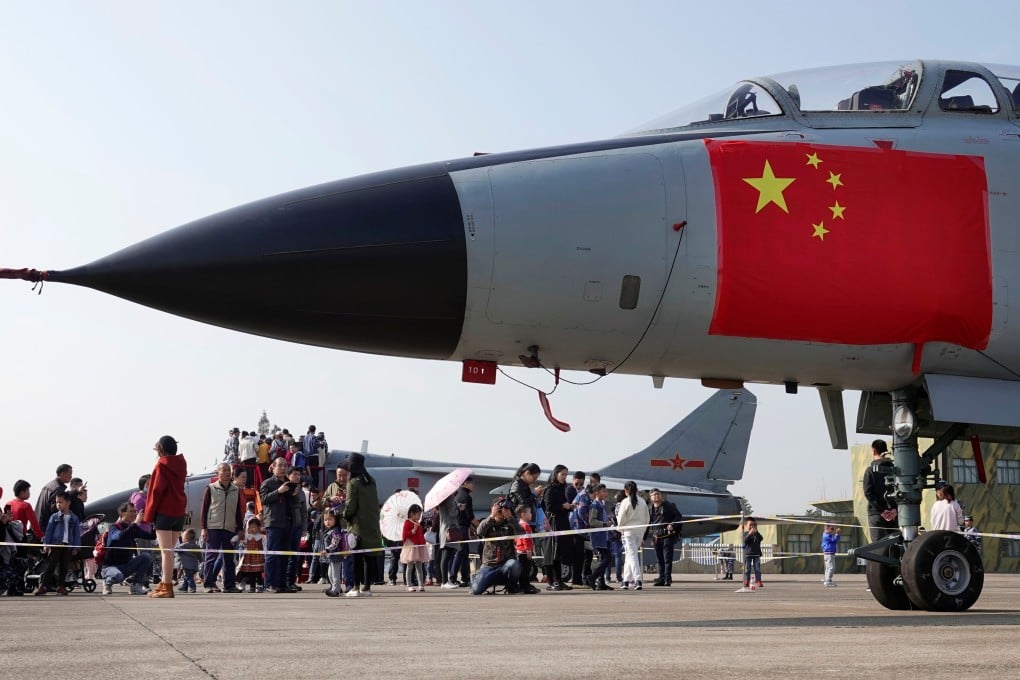

Is a fall in China’s military exports a sign of stockpiling at home?

- Chinese arms sales fell by nearly a quarter in 2018-2022, according to new report

- Geopolitical tensions, Covid-19 disruptions were main factors in the decline, analysts say

A drop in China’s arms exports could signal military stockpiling in the country amid surging geopolitical tensions and disruptions caused by the Covid-19 pandemic, according to analysts.

New figures from the Stockholm International Peace Research Institute (SIPRI) compared China’s arms exports over the two most recent five-year periods. The data showed arms exports from 2018-2022 dropped by 23 per cent compared with 2013-2017.

Still, in 2018-2022, China surpassed Germany to become the world’s fourth biggest exporter of major arms, following the United States, Russia and France.

The decline in arms exports from China could be a sign that Beijing was focusing more on domestic needs as geopolitical tensions rose, said Ni Lexiong, a professor at Shanghai University of Political Science and Law.