Drone tech gives China an edge in Middle East arms sales, but Israel-Gaza war brings risks: analysts

- China’s hi-tech, low-cost UAVs have proven to be popular among countries from the Middle East to North Africa and Pakistan

- But aligning systems with dominant Western weaponry and balancing regional ties presents challenge, observers say

More than 30 Chinese commercial and defence contractors showcased their products at last week’s Dubai Airshow. These included their latest aerial vehicles and weapons systems, with arms producers focusing on unmanned aerial vehicles (UAV) technology.

State-owned China National Aero-Technology Import & Export Corporation displayed its AR-2000 uncrewed aircraft system (UAS) internationally for the first time during the November 13-17 event.

The version displayed in the air show is said to be developed for ship-based operations, featuring short, folding wings and a large surveillance radar pod mounted under the nose. A VIP event before the air show opened to the public reportedly featured a vehicle armed with short-range guided missiles.

It comes as China increases its global defence industry foothold, including in the Middle East, with drones as a major export.

President Xi Jinping has pledged that China will “continue integrated development of the military through mechanisation, informatisation, and the application of smart technologies”.

“We will … speed up the development of unmanned, intelligent combat capabilities, and promote coordinated development and application of network information systems,” Xi, also leader of China’s ruling Communist Party, told its 20th congress last year.

According to a Stockholm International Peace Research Institute (SIPRI) arms transfer database, China has exported more than 280 combat UAVs in the past decade.

At least eight countries from the Middle East to North Africa and South Asia have been the major buyers of Chinese drones such as the Wing-Loong I and II, and the CH-3 and CH-4.

They include Algeria, Egypt, Iraq, Jordan, Saudi Arabia and the United Arab Emirates, as well as Pakistan.

Pakistan, in particular, is the top client for Chinese arms contractors. The SIPRI report suggests that it accounted for more than 54 per cent of China’s total weapons exports between 2018 and 2022.

Algeria, Egypt and Iraq have also reportedly bought or plan to buy China’s CH-5 advanced UAV, manufactured by the state-owned China Aerospace Science and Technology Corporation. It is known to be the world’s largest strike-capable drone – with 60-hour endurance and a 1,000kg (2,204lbs) payload.

Kostas Tigkos, head of mission systems and intelligence at global military intelligence company Janes, said while the US was still the leading weapons supplier in the region, China had had considerable success in entering the Middle East and North Africa markets, with increasing sales of advanced UAVs.

“The US remains the largest supplier of defence articles across the region in both numbers of deals and value, especially in areas such as combat and mission aircraft, air and missile defence, combat vehicles and C4I [command, control, communications, computers, and intelligence systems],” Tigkos said.

“However, as countries in the region are diversifying their import sources and developing local manufacturing capability, competition to traditional US [primacy] will impact the overall market outlook.”

Timothy Heath, a senior international defence researcher at US-based think tank Rand Corporation, said drones had proved extremely valuable on the modern battlefield. This had been seen in the Russia-Ukraine war, and Chinese UAVs could be valuable to Middle Eastern countries for their flexibility in carrying out a broad range of missions at relatively low cost, he said.

“Chinese drones are among the most sophisticated in the world and probably only slightly behind US military drones, which are generally not available for sale,” Heath said. “Given their proven value on the battlefield, the combination of high quality and lower cost make Chinese drones very attractive for militaries in the region.”

Advanced drones have been playing a more crucial role in the Middle East as the region contends with security uncertainties amid the Israel-Gaza war, which followed a deadly raid on Israeli border towns by Palestinian militant group Hamas on October 7.

Hamas launched drone strikes on two Israeli military bases in southern Israel last month, while Israel’s drone strikes in southern Lebanon on Tuesday reportedly killed four Hamas members.

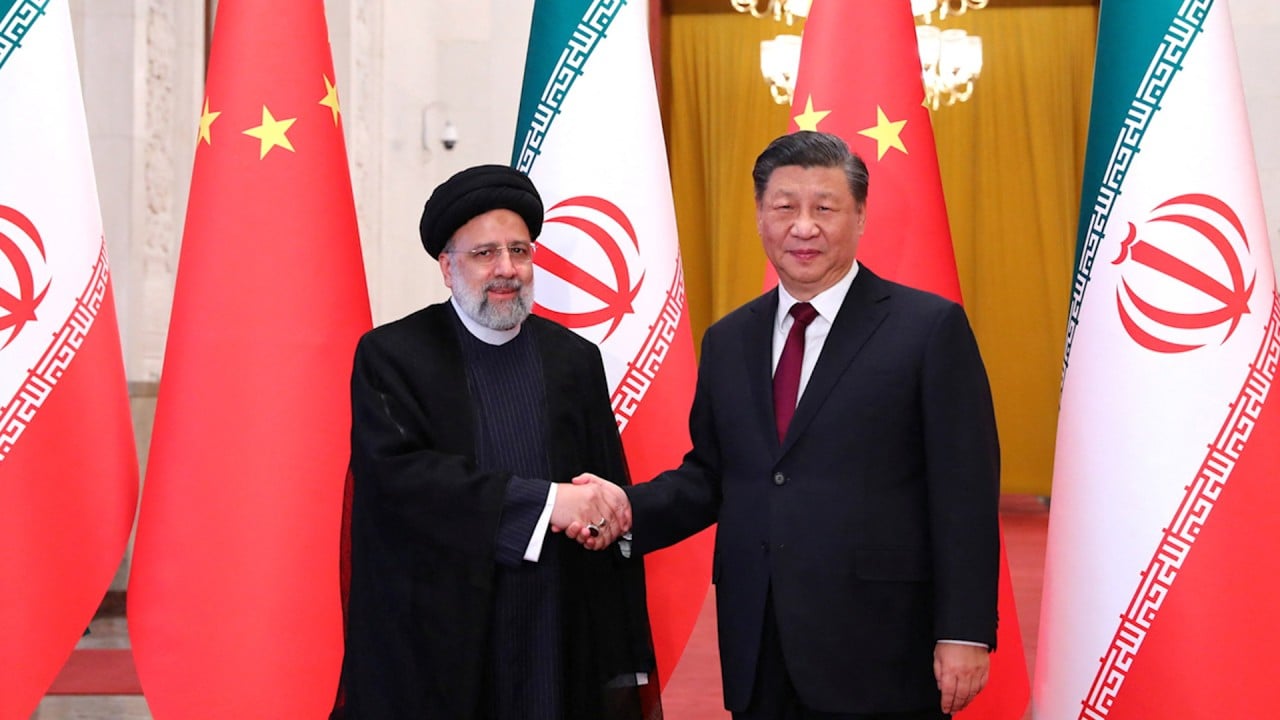

The United States, Israel’s top ally, believes Iran is a major sponsor for multiple Islamist militant groups supplying them with training and weapons, including combat drones developed from parts imported from China and elsewhere.

In September, the US Department of Treasury imposed sanctions on Iranian, Chinese, Russian, and Turkish companies and individuals for their connections with Iran’s UAV development.

“The most advanced drones come from the US, but they are large, expensive and too regulated. The drones being used in war are usually smaller and expendable,” Lewis said.

“Drones for the commercial market are weaponised and … China’s lead in the commercial drone market gives it an advantage. The thing to watch is what drones use [artificial intelligence] for guidance – they are on the market and are preferred.”

Tigkos said while China was likely to find opportunities to supply military equipment or systems in the Middle East, it would face more challenges in broader systems integration requirements, as Western weapons systems are widespread across the region.

“With increasing US restrictions on export of certain advanced defence systems, countries are turning to European, Turkish, Chinese, South Korean and as well as local suppliers to develop and deploy systems as part of their modernisation plans,” Tigkos said.

“However, despite that diversification, Chinese systems remain harder to integrate with Western/Nato-origin systems.”

Heath warned that China’s focus on drones in its arms sales was likely to only help to expand its relatively low-cost weapons systems exports. Its smaller share in supplying “high-end sophisticated weapons and equipment”, such as advanced aircraft and integrated missile defence systems, where the US was the largest stakeholder, could potentially pose a challenge, he said.

“The US has warned Middle Eastern countries that their access to advanced US weapons systems such as integrated air defence could be in danger if they integrate too many Chinese weapons and equipment into their militaries,” Heath added.

Beijing must be also careful with developing defence ties in the region, so as not to upset the country’s major energy suppliers including Saudi Arabia and the UAE, Heath said.

Both neighbours have a difficult relationship with Iran, for instance, and vie with it for regional influence.