Advertisement

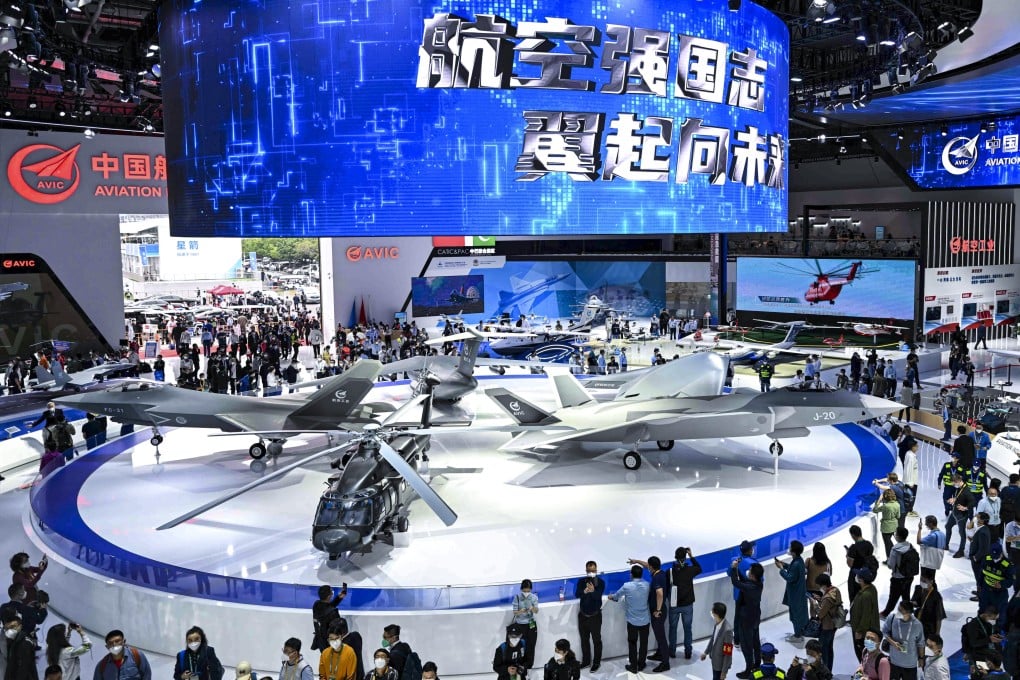

China’s top defence contractors saw income grow for fourth year in a row, SIPRI global top 100 list shows

- Six out of eight Chinese firms on SIPRI Top 100 list posted revenue hikes last year, unlike US peers, and three made it to the top 10, latest rankings show

- Analyst attributes scale of growth to ‘uninterrupted increase’ in military spending since 1995 as China pushes its modernisation drive

Reading Time:3 minutes

Why you can trust SCMP

12

Most of China’s top-tier defence contractors saw revenue grow for the fourth straight year in 2022, while their US counterparts suffered a sharp drop from 2021, a Swedish think tank report said.

Despite the dip in orders, US companies held on to their No 1 position overall, according to the Stockholm International Peace Research Institute’s annual report released on Monday.

Chinese companies retained their overall No 2 spot in combined arms sales with an 18 per cent share, but still trailed their US peers who captured 51 per cent.

Advertisement

The top eight Chinese arms producers were listed on the “SIPRI Top 100 Arms Producing and Military Services Companies, 2022” report.

Six of those posted an increase in revenue last year, and three made it to the top 10.

Advertisement

Combined revenue for the eight companies grew by 2.7 per cent to US$108 billion, a fourth consecutive annual increase.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x