Taxing times in China’s online retail grey zone as new rules set to overhaul cross-border e-commerce industry

New duties and restrictions on saleable goods herald a shake-up for the industry rife with tax evasion; tough crackdown on 'overseas personal shoppers' expected

It didn’t take long for the deluge of orders come in. Thirty-something Sydney-based personal shopper Michael Sun was so overwhelmed that he had to send out a plea to his clients in a post on WeChat.

“Taxes [in China] will be raised soon, so I had too many orders for baby formula recently. Could my dear friends alert me who asked for Aptamil Stage 3? ” Sun asked.

It was a week after mainland authorities announced a new tax regime on the loosely regulated cross-border e-commerce industry, a sector that by some estimates is growing at 40 per cent a year.

Also looming on the horizon are limits on the types of goods the platforms can sell, changes that will raise prices for consumers and threaten the survival of many small businesses, industry observers say.

But while that’s bad news for corporate business-to-consumer (B2C) e-tailers, it could give an extra bump to offshore, one-man personal shopping agents – or daigou – like Sun who can undercut bigger players by smuggling goods into the mainland.

Many friends, and friends’ friends, who used to buy Australian baby formula on B2C platforms are now asking me to buy it for them

“Many friends, and friends’ friends, who used to buy Australian baby formula on B2C platforms are now asking me to buy it for them,” Sun said.

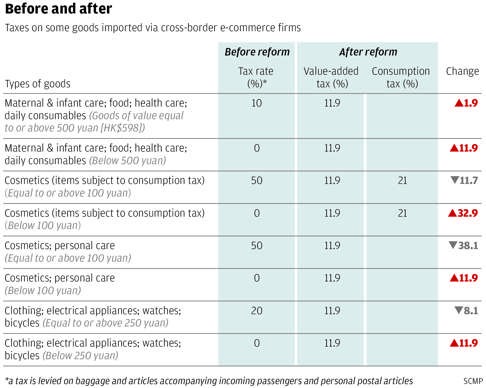

Until now, goods bought through cross-border e-commerce businesses – big and small – have been subject to postal taxes. These kinds of purchases were regarded as personal items or passenger baggage, attracting a postal tax of between 10 and 50 per cent when the tax to be paid was at least 50 yuan (HK$60).

Often goods bought through daigou slipped through this tax net because customs authorities lacked the staff to make the checks. It was harder for corporate e-tailers to escape as their imports were bigger and some platforms were connected to the customs system. But even when they paid, the online vendors were still much more competitive on price than traditional importers.

Then the central government said late last month that this was all changing. From Friday, e-commerce imports will no longer be subject postal tax but a new, more complex regime that imposes duties equivalent to 70 per cent of those on traditional imports.

Is the end nigh for China’s overseas luxury personal shoppers?

Under the new system, consumers will be allowed spend up to 2,000 yuan tax-free on a single purchase and up to 20,000 yuan per year without attracting tax. Anything beyond that will be regarded as a commercial import and subject to the duties.

Some players are embracing the changes, seeing them as a chance for respectability and as beneficial to the industry’s long-term development.

Zeng Bibo, chief executive of major e-commerce platform Ymatou, said that in the past, traditional vendors saw cross-border e-commerce as a grey industry rife with tax evasion.

“The new policy will lead the industry from disorder to a well-regulated one,” Zeng said.

Ymatou said it expected the authorities to follow up with tough crackdowns on “smugglers” – or the daigou business – at ports across the country.

“Some said the new policy would benefit smugglers, but the government must have been prepared for this,” the company said.

Observers say that one of the big motivations for bringing in the new system was to cut tax losses for the government.

According to official estimates, there are more than 5,000 businesses specialising in cross-border e-commerce.

Beijing-based internet consultancy Analysys International estimated these businesses imported 476 billion yuan worth of goods in 2014. On top of that, purchases through daigou came to about 248 billion yuan last year, according to the Hangzhou-based China E-CommerceResearch Centre (CECRC).

This means that mainlanders are spending at least 700 billion yuan a year on foreign goods online, about as much as Amazon registered in global sales last year.

But CECRC director Cao Lei said that less than 1 billion yuan in postal tax was collected from incoming parcels and luggage in 2014, suggesting a big loss in tax revenue given the huge spending on overseas goods.

Cao said the new tax system was also aimed at narrowing the price gap between online and offline products and protecting the interests of traditional importers.

He said the postal tax was lower than regular import duties because it was originally meant for items that would not be traded.

“The tax burden on e-tailers was therefore lower than that on traditional importers and domestic retailers, which led to inequality,” Cao said.

China’s professional shoppers face renewed scrutiny as government cracks down on agents purchasing goods overseas

This advantage also allowed the e-tailers to beat brick-and-mortar stores on price.

CECRC analyst Mo Daiqing said the biggest impact from the new rules would be in food, health care and maternal and baby care products, which made the bulk of mainland consumers’ overseas shopping lists.

“These goods were basically tax-free previously, and now they will have an 11.9 per cent tax, so price rises are inevitable. Consumers should be prepared for higher prices,” Mo said.

Frequent online shopper Maggie Chen said she would be more selective about her purchases once the changes came in.

“I might opt for shopping agents for health care products and start buying luxury bags directly from domestic stores as many brands are narrowing the price gap between China and Western markets,” Chen said. “Not everything on cross-border e-commerce platforms is getting more expensive, though. Taxes on cosmetics, for example, have actually dropped.”

No matter whether the websites are doing good or bad, there will always be a market for personal agents

But for people like Sun, things are not expected to change much – the postal tax will rise to 15-60 per cent, but the exemption and the lack of customs scrutiny in the short term would work in their favour, he said.

An official from a major industrial park specialising in cross-border e-commerce in Hangzhou agreed.

“No matter whether the websites are doing good or bad, there will always be a market for personal agents,” the official said.

The official said daigou offered a bigger range of goods than e-commerce websites, and complemented the mainstream selections of major e-tailers. “For example, daigou allow us to buy niche goods and the latest products,” he said.

The official said that under the new rules, personal shopping agents stood to benefit most from the demand for products priced above 2,000 yuan, such as electric appliances like air purifiers.

But some smaller businesses do not know what the future holds. Xiaohongshu – an e-commerce start-up that began as an overseas shopping tip app and boomed over the past year by enabling overseas purchases – said it was uncertain about its fate.

That’s because an even bigger change than the tax revamp is in the wind – authorities will soon issue a “white list” of products that cross-border e-tailers will be allowed to import.

Mainland media reported that the list would comprise daily consumables that did not require import licences, and a number of popular licensed items.

Many platforms, including Xiaohongshu and Ymatou, have launched sales since the announcement of the revamp, fearing that much of their stock will not make it onto the white list.

“It’s a regular way to tackle risks – if they don’t sell the goods as soon as possible, they might be categorised as off-limits and have to be sent back to the supplier,” the Hangzhou official said.

He said the industry feared that this shift would result in a homogeneous market, with vendors limited to selling the same things, killing off smaller platforms.

“There would be no room for imagination for the sector anymore,” he said.

The official added that major platforms such as JD Worldwide and Mia, which had a big user base and a wider range of goods, would benefit from the new rules in the long run.

After all, the government will still be giving e-commerce a break – the new tax for e-tailers is still only 70 per cent of the burden imposed on traditional retailers.