Questions mount over Chinese billionaire hedge fund manager's big stock picks

Company reports show Xu Xiang's hedge funds had big holdings in A-share rescue targets

The uncanny parallels between billionaire Xu Xiang's stock picks and the targets of government rescue funds have added weight to suspicions about widespread collusion linked to the A-share market's roller-coaster ride over the summer.

Xu was arrested on Sunday over suspected insider trading and market manipulation. His hedge funds had several large holdings of stocks that were chased by an institution distributing government rescue funds, according to data in the listed firms' quarterly reports.

Xu, 37, founder and general manager of Zexi Investment, has been lauded on the mainland for his investment decisions.

As the benchmark indicator sank 35 per cent in three weeks from mid-June, five of Zexi's funds reported at least 20 per cent growth in net asset value. At least three of Zexi's heavily held stocks - real estate developer Deluxe Family, Shanghai Metersbonwe Fashion & Accessories and Eastern Gold Jade - became darlings of China Securities Finance Corporation, the platform the government used to stem a sharp fall to bolster investor confidence.

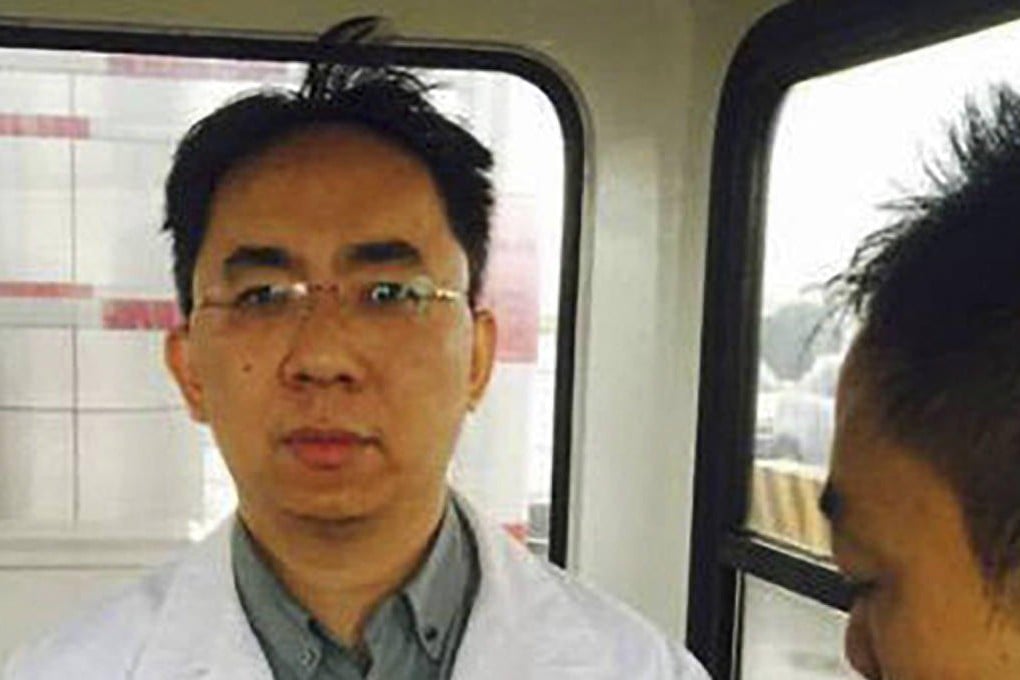

Read more: ‘China’s Warren Buffett’ mocked by internet users after he is arrested in ‘doctor's jacket’

Xu's arrest comes as investigations continue into the activities of more than 10 Citic Securities officials, including president Cheng Boming.

"Xu's detention has fuelled speculation that Zexi colluded with some of those who managed the rescue funds to make illegal profits," hedge fund manager Dong Jun said. "It would be naive for people to believe the [market] synergy was only a coincidence."