Xi Jinping’s supply-side plan now the genuine article of economic reform for China

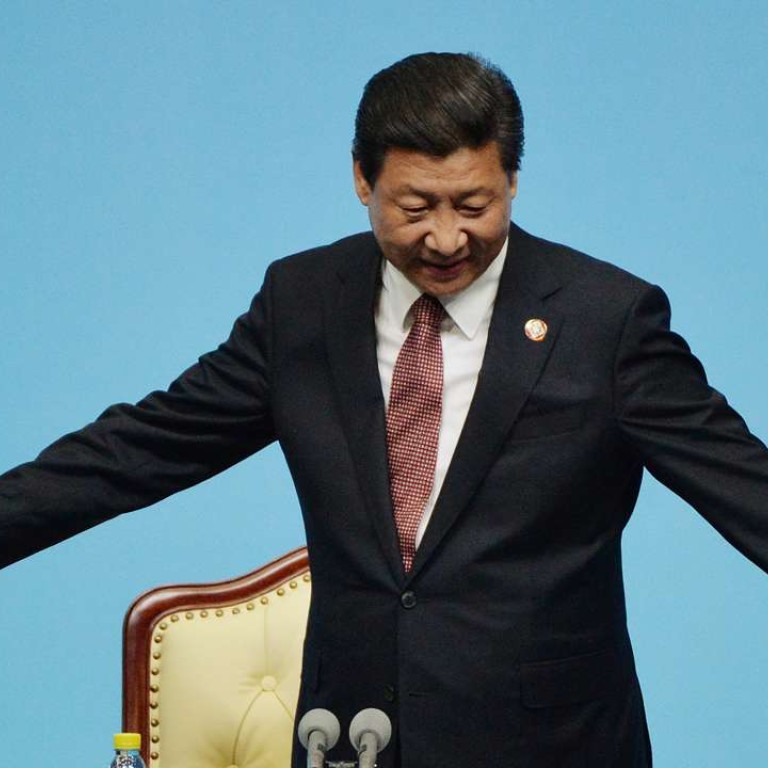

Two pointed items in People’s Daily last week sent the unmistakable message that the president is firmly in the economic driver’s seat

Who is in charge of the Chinese economy? If there were still any lingering doubts over this key question among overseas investors, they should have been removed after the publication of two significant long pieces in People’s Daily last week.

On Monday, the mouthpiece controlled by the Communist Party’s Central Committee carried a long question and answer “interview” with an unnamed “authoritative” source, repudiating the country’s debt-fuelled growth policies.

On Tuesday, it published the text of a long speech by President Xi Jinping expounding his hallmark economic policy which focused on supply-side structural reforms – 20,000 words in all that occupied two pages in the newspaper.

Xi gave the speech to top Chinese officials back in January, but the timing of the publication sent an unmistakable message.

Taken together, the articles signal that Xi has decided to take the driver’s seat to steer China’s economy at a time when there are intense internal debates among officials over its overall direction – namely whether to continue to resort to the old ways of deploying massive stimulus resulting in overproduction and high debt levels, or to undertake painful restructuring to reduce overcapacity and close down “zombie” enterprises.

Guessing game: who is mystery ‘authoritative figure’ claiming major shift in China’s economic policy?

The Monday interview was particularly pointed as it urged officials to dispense with the fantasy of stimulating the economy through monetary easing and warned that the country’s soaring debt levels could lead to “systemic financial risks” and negative growth.

This largely repudiated what Premier Li Keqiang and his cabinet have been doing over the past two years – using high leverage to boost the real estate and stock markets to support economic growth.

The article is thought to have been initiated by Liu He, one of Xi’s top economic advisors, and approved by the president himself.

The decision to publish it appeared to be prompted by first-quarter economic data which showed the country released a record 4.6 trillion yuan (HK$5.5 trillion) worth of bank credit, exceeding even the 4 trillion yuan released in early 2009 during the financial crisis. At that time, then-premier Wen Jiabao turned on the money tap to support economic growth but that greatly worsened China’s industrial overcapacity.

Although Li has repeatedly said his cabinet will not resort to a massive stimulus plan to support growth, the soaring bank lending and debt levels have heightened worries.

The dangerous cost of China’s debt-fuelled growth: delays to much-needed structural reforms

More importantly, the escalating lending threatens to derail Xi’s supply-side reforms which are aimed at forcing closures and mergers of enterprises in the steel, coal and metals industries with huge overcapacity. Indeed, recent reports have suggested that since the significant increase in money supply, many of the steel and iron enterprises targeted for closure have restarted production and some have even announced expansion plans following the rebound in steel and iron ore prices.

The two articles suggested that Xi appeared determined to bet on painful restructuring instead of seeking short but unsustainable growth, something that Chinese leaders have said repeatedly over the past few decades but have made little progress in achieving.

As some economists have pointed out, Xi’s emphasis on supply-side reforms is part of a global trend and also reflects his political aim to put more pressure on vested interest groups, including local officials and state-owned enterprises after his harsh crackdown on rampant official corruption.

Indeed, to push through Xi’s reforms means that many “zombie” enterprises will be forced to close down, which could contribute to unemployment and social instability.

The admission that the trajectory of China’s economic growth will continue to be “L-shaped” in the next few years validated the fears of many international investors including George Soros and will heighten international pessimism over the Chinese economy.

China’s debt-fuelled economy resembles situation in US ahead of financial crash, billionaire investor George Soros warns

All those factors mean that China’s economic growth could slow further and even fall below the government-set annual growth rate of 6.5 per cent.

The Monday interview seems to suggest Xi is not worried, as the “authoritative source” said the economy would not plunge even without stimulus as it still enjoyed huge potential, was highly resilient and had ample leeway. But it also means that he is prepared to accept lower growth in exchange for notable progress in restructuring, even if the risk of social instability rises significantly.

Despite the staggering odds, Xi’s strong leadership style displayed in his unprecedented anti-corruption campaign and rapid consolidation of power means he stands a good chance of succeeding.