US Congress hurries to approve bill tightening scrutiny of offshore deals

Lawmakers are pushing for a hearing on the legislation this year and a vote in both chambers by next January, an expert told the South China Morning Post

The US Congress is moving quickly to approve proposed bipartisan legislation that would tighten national security reviews of foreign investment, particularly Chinese acquisitions of US assets, by pushing for a hearing on the bill this year and a vote in both chambers by next January, an expert with direct knowledge of the bill told the South China Morning Post.

Derek Scissors, a China analyst at the Washington-based American Enterprise Institute think tank, said on Tuesday that there would be few reasons for a fast-moving Congress to block the proposed legislation introduced last week. Scissors began working on the bill with Congress as an outside consultant in March 2016, while Barack Obama was still US president.

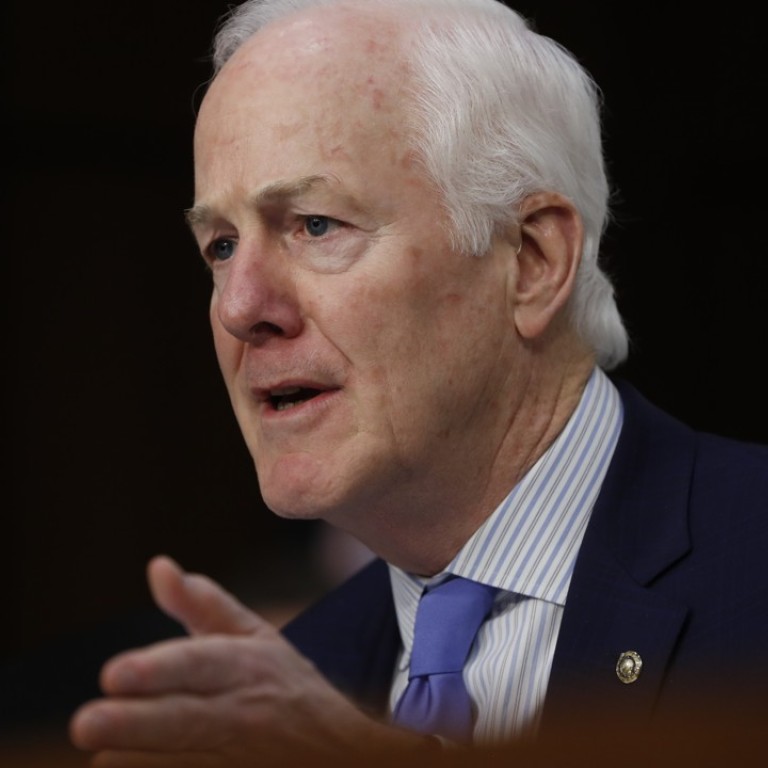

The bill’s proposed text does not name China as its main target, although its author, John Cornyn, a Republican Senator from Texas and the Senate Majority Whip, accused China in a release when he unveiled the legislation of “exploiting gaps” in the existing review process to degrade the US’s military technological edge by acquiring and investing in US companies.

“Treasury does not want to name specific countries and they want as much flexibility as possible,” Scissors told a Heritage Foundation event in Washington. “They don’t want direct confrontations with the Chinese.”

The bill, called the Foreign Investment Risk Review Modernisation Act, won Democrats’ support in both the Senate and House last Wednesday.

It would expand foreign investment review procedures overseen by the Committee on Foreign Investment in the United States (CFIUS), which is chaired by the Treasury Secretary along with eight other heads of government agencies, including defence and homeland security.

Cornyn said at a Council on Foreign Relations event in Washington in June that the legislation would keep China, an “economic rival”, from exploiting a loophole to modernise its weapons system via acquisitions of US intellectual property while undermining the US’s “competitiveness or defence industrial base”.

He said the bill would cover foreign transactions such as joint ventures or minority investments that would lead to the acquisition of equity stakes in companies with advanced technologies used in rockets, sensors, autonomous vehicles application in the military space and other projects.

Scissors warned that the bill’s lack of specifics about the sectors it would cover could allow its intention to be co-opted by people who favoured shielding the country’s domestic industries from foreign competition.

“The Cornyn bill does provide CFIUS more resources, and I don’t see obvious harm in the bill,” Scissors said. “But we also need to watch out [if] it becomes a vehicle of protectionism.”

Matthew Goodman of the Centre for Strategic and International Studies also told the Heritage Foundation event that while the US Treasury has “a powerful voice in the CFIUS debate” through the review process of foreign investment, “the voice has been diminished”.

The Cornyn bill “seems to reinforce the trend towards making Treasury more of a secretariat”, said Goodman, who worked as an international economist at the Treasury from 1988 to 1997.

“The US Treasury is still a voice for an open US economy, basically, except where there is a national security threat.”