Chinese companies in the US are repatriating profits as trade tensions rise, survey shows

A business environment ‘increasingly strewn with fresh challenges’ is frustrating Chinese firms in the US, according to the 2018 business survey by the China General Chamber of Commerce - USA

More Chinese companies in the US are transferring their profits back home as tensions between Washington and Beijing escalate to the threshold of an all-out trade war, according to a recent survey by a non-profit organisation representing Chinese enterprises in America.

Citing the probability of higher tariff walls and more rigorous government reviews of investments, Chinese companies operating in the US are frustrated about a business environment “increasingly strewn with fresh challenges”, according to the results of the 2018 business survey by the China General Chamber of Commerce - USA.

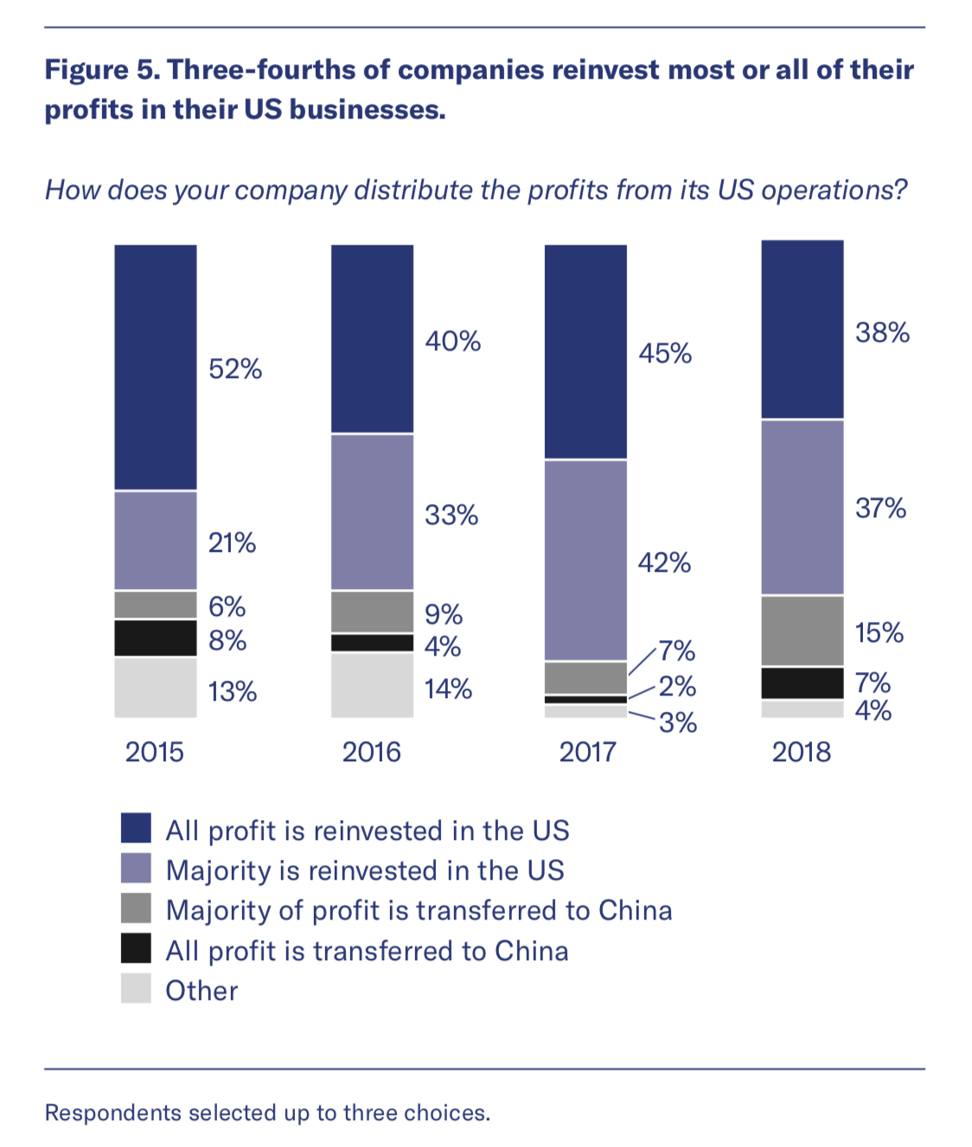

For example, 75 per cent of the business association’s members – mostly Chinese companies including Fosun International, PetroChina and embattled telecommunications equipment maker ZTE – said they reinvest all or “a majority” of their profits in the US, down from 87 per cent in the 2017 poll.

Twenty-two per cent said this year that all or most of their profits go back to China, up from nine per cent in 2017.

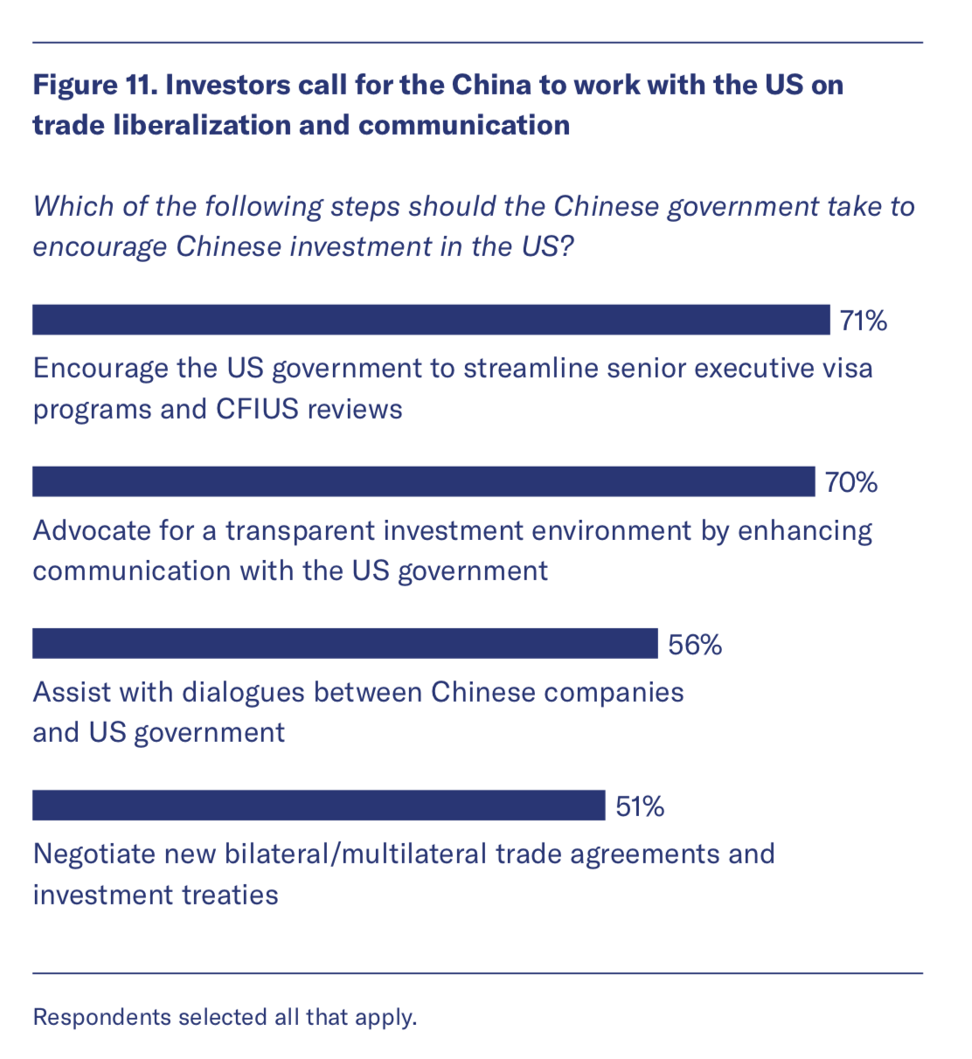

“The current administration has employed a new level of scrutiny and gamesmanship to” national security reviews conducted by the Committee on Foreign Investment in the United States (CFIUS), the survey report said.

Blog on US-China trade war by ‘US professor’ goes viral in China

“Chinese investors in the US seem especially likely to struggle under regulatory burdens.”

The CGCC-USA results dovetail with new data released by Rhodium Group, a consultancy that tracks investment flows between China and the US. The value of Chinese investments in the US in the first five months of 2018 dropped by 92 per cent, year-on-year, to US$1.8 billion, according to a Rhodium report published on Wednesday.

Factoring into the calculation asset divestitures in the US by Chinese firms brings the five-month figure to negative US$7.8 billion, the report said.

Many of CGCC-USA’s approximately 1,500 members, particularly those looking to acquire US technology, are facing fallout from US President Donald Trump’s tough stand aimed at changing Beijing’s trade and investment policies.

Beyond measure or a dent to GDP growth? How a trade war could hit China

Trump recently announced that a 25 per cent tariff on US$50 billion worth of Chinese imports would go into effect next month, prompting Beijing to take equivalent action on its imports from the US. The US president has threatened to widen the scope of his punitive moves to as much as US$450 billion of targeted Chinese products.

China’s US embassy warned that investment by Chinese companies would continue to evaporate.

“We are faced with uncertainties and severe challenges in trade relations,” Zhu Hong, the embassy’s minister for commercial affairs, said at a CGCC-USA reception in Washington on Wednesday.

“The macro US policy environment has become a major consideration for Chinese entrepreneurs when they transform their enthusiasm for investment into real investment practice ... when they consider their investment practices.

“However, if the US on one hand tries to attract foreign investors ... and on the other hand tries to tighten investment restrictions, this chaotic situation will make Chinese investors feel at a loss.”

While the specific details of Trump’s tariff plan came out after the CGCC-USA had obtained its survey results, the rhetoric had already begun to heat up, and that tension is reflected in the survey report.

Many of the responses in this year’s survey are phrased differently from those in the previous edition as the inquiry’s focus and scope evolve; this year’s survey is only the fifth edition. Some responses from year to year, however, are sufficiently consistent to suggest that overall business expectations have dropped noticeably.

For example, this year’s survey said: “Forty-eight per cent of respondents are optimistic about the US commercial environment over the next three years.” The most analogous data point a year earlier: “Sixty per cent express confidence and optimism about their investments in the United States.”

The survey report devoted much space to the impact of proposed legislation meant to strengthen CFIUS reviews; the bill was making the rounds in Congress when CGCC-USA’s respondents completed their surveys.

Co-sponsored by Republican Senator John Cornyn and Democratic Senator Dianne Feinstein, and with the backing of many senior senators, the Foreign Investment Risk Review Modernisation Act (FIRRMA), has wide bipartisan support.

FIRRMA would require Chinese entities investing in, or forming joint ventures with, certain US companies not only to submit to a review by CFIUS, but to pay the agency US$300,000 for the work.

China’s proposed tariffs on US energy worry shale producers

CFIUS reviews, and changes FIRRMA would mandate, do not differentiate between foreign investors. Cornyn, however, has argued that FIRRMA is needed to counter China’s attempts to acquire US technology.

“Some of our adversaries, most notably China, have altered the strategic landscape and [are] not playing by the same set of rules,” Cornyn, the second-most senior Republican, said on the Senate floor in February, shortly before the CGCC-USA survey went out to members.

“China has weaponised investment in an attempt to vacuum up our advanced technologies and simultaneously undermine our defence industrial base,” he said.

And CGCC-USA members have listened.

“A majority of survey respondents familiar with FIRRMA say that the new legislation is likely to affect their plans to further invest in the US,” according to the survey report.

The latest developments around FIRRMA may reinforce that trend. The bill passed the US Senate as an amendment to the National Defence Authorisation Act, and will become law once the Act is reconciled with the version of the bill produced by the US House of Representatives.

“If FIRRMA becomes law, our members will always abide by the laws and regulations of the US, but many will likely be forced into foregoing business opportunities that might otherwise lead to successful cooperation and maximising the synergies and economies of scale between both our economies,” CGCC-USA President Xu Chen told the South China Morning Post.

“No one wants to see a trade war, not American companies and not Chinese companies.

“It is our hope that this survey will continue to act as a valuable tool for both the business community and policymakers in the US and China as they map out their corporate strategies and revise government policies that will encourage and incentivise mutually beneficial cooperation and collaboration,” Xu said.