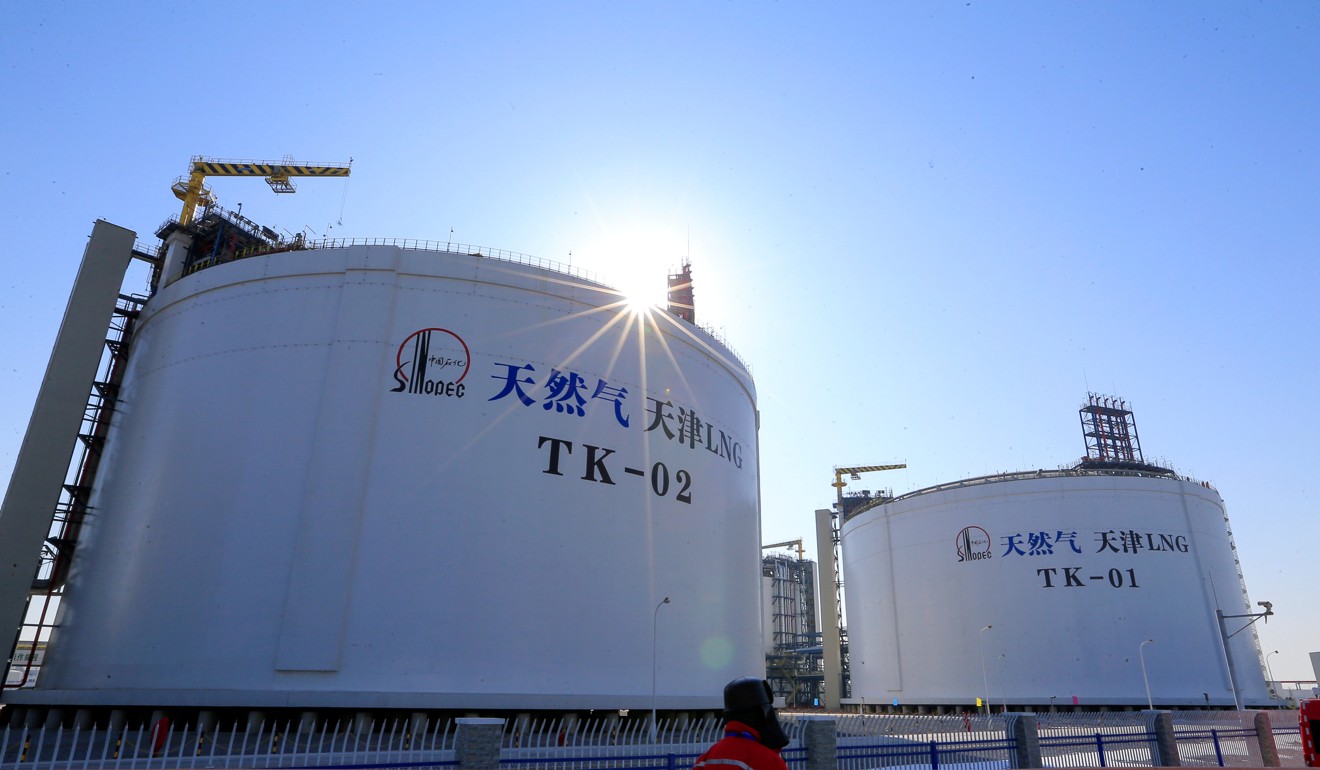

China snubs Trump on new trade front as biggest refiner halts US oil buys

China’s Sinopec will delay making any purchases of US oil for September while Beijing decides whether to slap new tariffs on American energy exports

China’s targeting of US liquefied natural gas and crude oil exports opens a new front in the trade war between the two countries, at a time when the White House is trumpeting growing US energy export prowess.

The rising tension could soon affect global oil flows.

China’s largest refiner, Sinopec, will delay making any purchases of US oil for September amid concern that Beijing will slap tariffs on American crude, making imports more expensive, according to a person familiar with the matter.

The state-run Sinopec is waiting until it is clear when or if China’s 25 per cent tariff threat on US crude imports might begin, the person said.

Beijing also declined to stop imports from Iran, dealing a blow to US efforts to isolate that nation, though it agreed not to increase shipments, according to officials familiar with the negotiations.

Petroleum was left off the list of products on which Beijing said on Friday it plans to levy duties of 5 per cent to 25 per cent if the US makes good on threats of a new wave of tariffs.

China, the world’s biggest oil importer, took a record volume from the US in June, increasing the potential hit to American producers if China does enact tariffs.

US President Donald Trump’s administration has warned that even US allies would face sanctions if they did not show “significant” progress in reducing Iranian oil purchases by November 4, ruling out broad exemptions or waivers.

Friday’s announcement of additional tariffs on liquefied natural gas and other products comes as Trump has directed US Trade Representative Robert Lighthizer to consider increasing proposed tariffs on $200 billion in Chinese goods to 25 per cent, from 10 per cent.

China included liquefied natural gas for the first time in its list of proposed tariffs.

That could cast a shadow over Trump’s ambitions for US energy dominance. The administration has repeatedly said it is eager to expand fossil fuel supplies to global allies, while Washington is rolling back domestic regulations to encourage more oil and gas production.

“The juxtaposition here is clear,” said Michael Cohen, head of energy markets research at Barclays. “It is hard to become an energy superpower when one of the biggest energy consumers in the world is raising barriers to consume that energy. It makes it very difficult.”

Sinopec had already been reducing its US oil purchases, mainly because the discount for West Texas Intermediate crude against the international marker Brent had narrowed.

In July, the company bought four supertankers’ worth, compared with six to seven in June. And Sinopec did not purchase any US crude for August loading for similar reasons, the person said. Unipec, the trading arm of Sinopec, buys oil for the refiner.

China took 15 million barrels of US crude in June, the most in data going back to 1996, according to US Census Bureau and Energy Information Administration. Sinopec officials in New York did not return an email or phone-call request for comment.

The drop-off in crude cargoes comes as the US has several large-scale liquefied natural gas export facilities under construction, and after Trump’s late 2017 trip to China that included executives from US gas companies.

“The US gas industry will be much harder hit by this as China imports only a small volume, whereas US suppliers see China as a major future market,” said Lin Boqiang, professor on energy studies at Xiamen University in China.

China became the world’s second biggest liquefied natural gas importer in 2017, buying more gas to wean the country off dirty coal to reduce pollution.

China, which bought almost 14 per cent of all US natural gas shipped between February 2016 and May 2018, has taken delivery from just one vessel that left the United States in June and none so far in July, compared with 17 during the first five months of the year.