How tiny satellites are helping China in the space race

- Millennial’s start-up, Spacety, is one of the firms jumping in as Beijing opens its ambitious programme to private enterprise

A space race known for giant rockets and billion-dollar exploration vehicles is shrinking to the size of a Cheerios box, and that is opening a launch window for entrepreneurs like Chinese millennial Yang Feng.

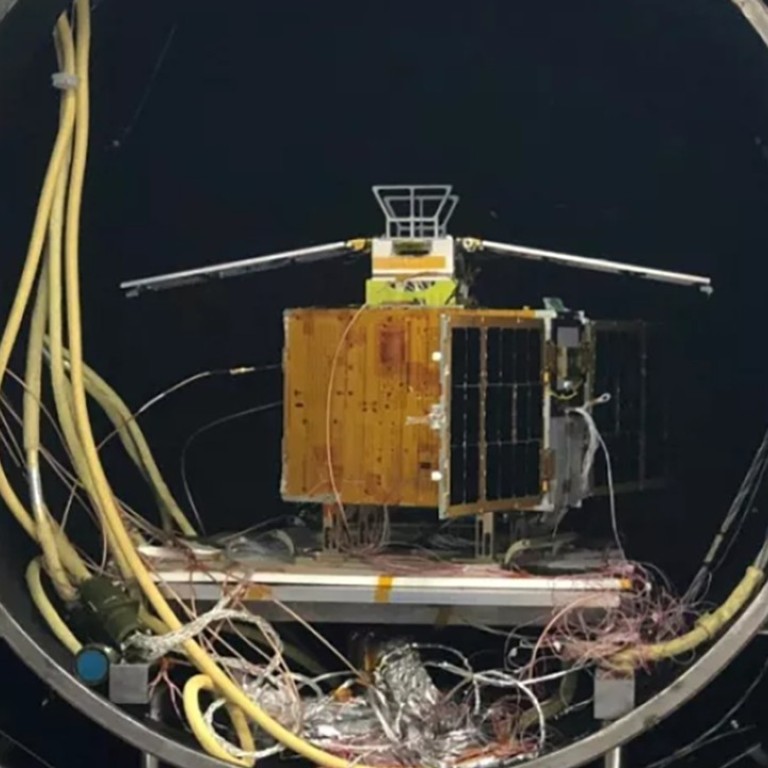

Yang’s start-up, Spacety, builds microsatellites and then has them shot into orbit, offering to provide Wi-fi service on planes or eyes into the furthest reaches of space – at prices starting around US$16,000.

“There are so many niche markets for satellites,” Yang, the 36-year-old chief executive officer, said in his office at a Chinese Academy of Sciences complex in Beijing, with one of his machines sitting on the table in front of him. “I want to do low Earth orbit satellites in the areas that state-owned enterprises are too big to reach.”

China is deliberately opening its ambitious and secretive space programme to private enterprise, spawning home-grown rocketeers One Space Technology and Landspace Technology to compete with similar efforts by billionaires Elon Musk and Jeff Bezos.

There is also a blossoming of lesser-known businesses that make small satellites – some weighing less than 1.4kg (3 pounds) – to put atop those rockets. Spacety, Zhuhai Orbita Aerospace Science and Technology and Beijing Galaxy Space Internet Technology routinely send imaging and data-collecting machines into orbit as they compete for pieces of a global satellite industry worth US$269 billion.

Those efforts are attracting seed money from venture-capital funds associated with technology titan Lenovo Group and the founder of Xiaomi as China starts challenging microsatellite makers in the US, Japan and Germany.

“If China can put its industrial capacity into small satellites as it does with global consumer electronics, then it could be the dominant small satellite manufacturer in a few years,” said John Holst, a senior analyst with the non-profit Space Foundation in Colorado Springs, Colorado.

Chang’e 4 launches China’s bid to be first on dark side of the moon

As the Chinese government frees up more space, some of the biggest national champions are jumping in.

Alibaba Group Holding had a small satellite powered by Beijing-based Commsat Technology Development launched to help its multibillion-dollar Singles’ Day sales promotion, and Tencent Holdings invested in Satellogic, a start-up with offices in San Francisco that wants to build a constellation providing high-resolution imagery and analytics. Alibaba owns the South China Morning Post.

The military and government still dominate China’s space programme, which has an US$8 billion annual budget that is second only to Nasa’s, according to the Space Foundation. The nation plans to explore the moon and Mars, and build its own orbiting station for astronauts, according to state media.

President Xi Jinping allowed private enterprise into the space business in 2014 to nurture the development of hi-tech industries that could produce sophisticated semiconductors, artificial intelligence and small satellites, sometimes called cubesats.

There are about 60 Chinese companies in the commercial space industry, said Blaine Curcio, founder of Hong Kong-based Orbital Gateway Consulting.

“In terms of satellite design and manufacture, China still lags behind the US and EU,” Curcio said. “However, this also is changing fairly quickly.”

Manufacturing satellites generated US$15.5 billion in global revenue last year – a 10 per cent increase from the year before, according to the Washington-based Satellite Industry Association. Satellite services such as telecommunications, Earth observation and science generated US$128.7 billion.

Those services are essential in the biggest market for internet users, smartphone buyers and electric-car drivers, and what is expected to be the leading air-travel market within five years.

China has strongest fibre that can haul 160 elephants – and a space elevator?

To be sure, the government will maintain control of what it considers the most sensitive aspects of its space programme, and that may squelch future growth for these start-ups, Curcio said. Yet there is opportunity in low Earth orbit, defined as between 80km and 2,000km (1,243 miles) in the air.

Yang, who studied engineering at Beihang University, renowned for its aeronautics programme, worked in the energy and information technology industries before founding Spacety in 2016.

He was inspired by US-based disrupters such as Musk’s Space Exploration Technologies and satellite makers like Planet Labs, and now he wants to disrupt them.

Spacety’s investors include Lenovo’s venture-capital arm Legend Capital, Matrix Partners China and SAIF Partners, according to its website. The company, which has a factory in Hunan province, is valued at about US$100 million, Yang said.

“The US may have better companies than us, but I’ve only been here for three years,” said Yang, whose team sometimes dons flight jackets with patches commemorating each launch.

Spacety has paid to launch more than 10 satellites since 2016 for clients including company-backed in-flight Wi-fi provider LaserFleet, Chengdu-based AI satellite maker ADA-Space, Tsinghua University and the Chinese Academy of Sciences. Its services include carrying instruments so Tsinghua scientists can study gamma ray bursts and potentially providing Earth imaging for insurance companies to analyse losses from natural disasters.

“I don’t want to just be a manufacturer,” Yang said. “I want to build my own network for others to use. I want to be the platform.”

How a Chinese rocket scientist’s resignation started a nation talking about its poorly paid talent

He has plenty of competition in the cosmos. Shenzhen-listed Zhuhai Orbita, with a market capitalisation of about US$1 billion, launched five remote-sensing satellites in April as it tries to build a constellation providing data for agriculture, transport and environmental protection.

The company, founded in 2000 to make semiconductors for the aerospace industry, did not reply to a request for comment.

Galaxy Space, founded in 2016, wants to put hundreds of its satellites into low Earth orbit to provide global 5G coverage, according to state media. Investors include Shunwei Capital Partners, the firm backed by Xiaomi billionaire founder Lei Jun; Morningside Venture Capital; and IDG Capital, state-run Global Times reported last month.

Beijing-based China Head Aerospace Technology plans to create a 48-satellite constellation called Skywalker with applications for shipping, earthquake monitoring and imagery. The company, which built a 45kg satellite launched last year, has partners in several countries taking part in China’s “Belt and Road Initiative”, including South Africa.

“The China market is opening much more now than versus five years ago,” said Kammy Brun, who oversees global business development at Head. “We’re looking for ambitious plans and international partnerships.”