Chinese using a mobile phone in Beijing effectively manage cobalt mines in Africa by remote control: study

- Driven to secure cobalt supplies for EV production, China uses smart sensors, high-speed communication tech and live streams to control DRC mines

- Real-time monitoring sends data to Beijing, with an alert sounded if any unauthorised person approaches or tampers with it

The Democratic Republic of Congo (DRC) produces 70 per cent of the world’s cobalt. More than 80 per cent of the DRC’s cobalt mines are now owned by Chinese companies, according to industrial estimates.

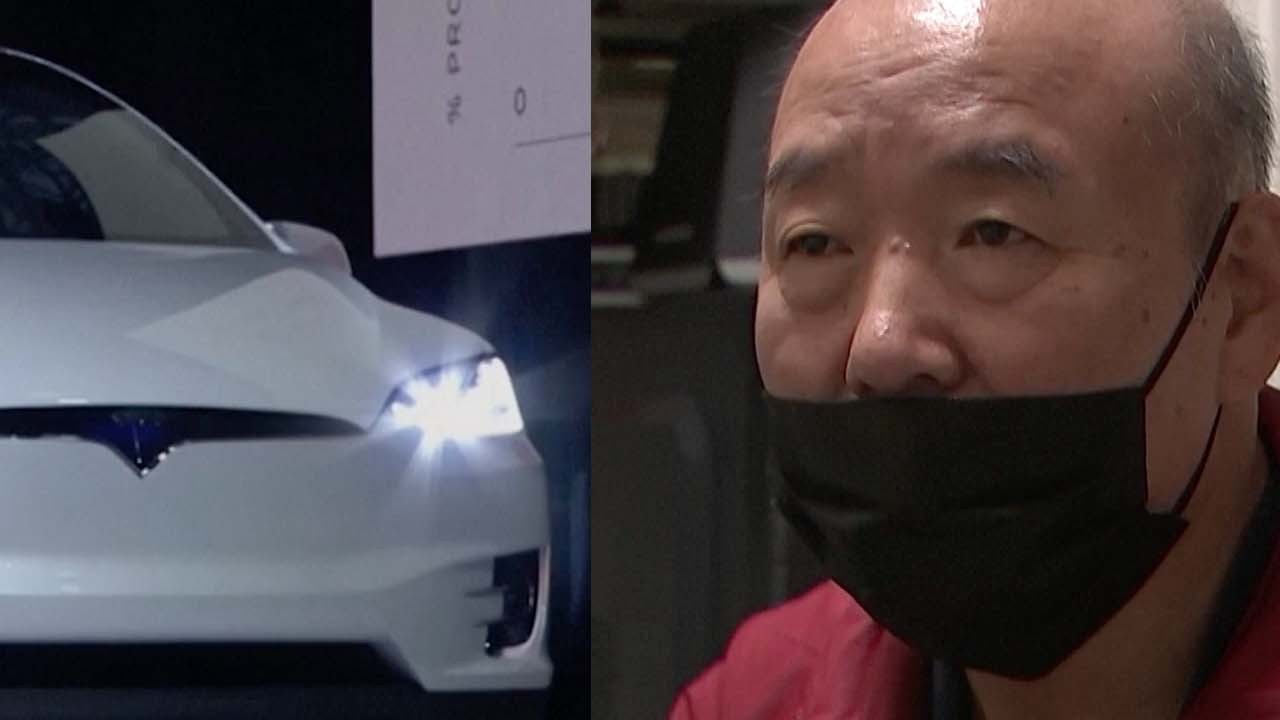

In recent years, China has had immediate access to the operational data from almost all the equipment on site in these mines, which are mostly in remote areas, thanks to the large-scale application of smart sensors and high-speed communication technology. A manager in Beijing, for instance, can learn the position, speed and load of each truck while sitting in a cafe in Beijing with a smartphone in hand.

Cui Bing, a senior engineer overseeing the construction of digital mining infrastructure with the North Mining (also known as Norine) Limited company, said in a paper published in the domestic peer-reviewed journal Mining Technology last month that the system “also streams live video feeds collected by cameras at critical locations back to headquarters”, and that management in Beijing could give direct orders to local executives based on what happened on site.

The company, with headquarters near the Forbidden City, is a subsidiary of Norinco, China’s largest arms exporter, and has made one of the largest investments in DRC’s cobalt mines.

“We have maintained distance-free contact with the mines overseas,” Cui and his colleagues said.

China, the world’s largest producer of lithium batteries, feels “deeply insecure” about the cobalt supply, according to a government study.

Driven by the electric car boom, the international trade volume of cobalt-related minerals between China and the DRC had already reached 95 per cent of the world’s total by 2020, according to the study conducted by China’s natural resources ministry. China has almost no cobalt reserves at home.

“If the overseas supply of upstream raw material is cut off, the advantages of mid-and-downstream products will no longer exist. Under the background of increasing tension between major powers and the West’s attempt to ‘de-Sinicise’ the global industrial chain, it can severely restrict the development of strategic emerging industries in our country,” according to the study published in Acta Geoscientica Sinica journal on December 2.

In the DRC, some critics have said Chinese companies are overexploiting its natural resources. The government in Kinshasa has imposed new taxes on foreign mining companies and lawmakers are mulling new laws to regulate their activities. Beijing worries that more restrictions will increase the cost of the cobalt and affect the mass production of lithium batteries.

Why Africa is critical to China’s electric vehicle race with the West

The central African country has been damaged by decades of war between the government and resistant forces, with armed robberies happening regularly. Increasing productivity in a highly unstable environment poses a severe challenge for the Chinese companies, according to the ministry’s study.

In the past, the information system in the African mines was largely separated from Chinese headquarters. Most data was collected by local employees and processed manually before being sent to Beijing, according to Cui’s team.

“Each mine operates like an isolated island,” they said in a paper.

This is unlike China, where many mines have already employed new technology such as AI and 5G to automate operation.

In a cobalt mine, the diverse equipment includes ore excavators and automated machines for selection and fine processing. Chinese engineers have installed about 1,000 monitoring and data collection terminals in each of its mines in the DRC.

These terminals report the work status data to Beijing as frequently as 10 times a second.

“The data only makes a one-stop journey,” the engineers said. Local employees were not allowed to modify the raw production data and if anyone approached or tampered with the monitoring devices without authorisation, an alert would pop up on a screen in Beijing, they said.

The mining system in Africa can be accessed via a wide variety of platforms from China, including computer, smartphone and tablet, according to the engineers.

The real-time monitoring system had significantly improved work efficiency and increased the mines’ output, said the researchers without giving specific data.

DRC’s total cobalt output recorded a more than 20 per cent annual increase to more than 120,000 tonnes last year, according to the US Geological Survey.

China’s mining rights in DRC were mostly bought from Western companies over the last decade.

The DRC had supplied cobalt to countries such as Finland and Zambia but China became the sole buyer as diplomatic ties between Beijing and Kinshasa strengthened.

Meanwhile in China, some battery companies are mass producing cobalt-free cells to reduce dependence on Congolese minerals.

‘My country did not get anything’: ex-DRC leader slams China mining deal

Electric car batteries using cobalt still dominate the international market but in China, home to the world’s largest number of electric cars, the market share of cobalt-free products such as lithium iron phosphate batteries has surpassed those using cobalt this year, according to government data.

New technologies, such as BYD’s blade battery pack, have significantly increased the performance of cobalt-free batteries.