New types of indirect tax must be explored as the population ages

An ageing population will put pressures on Hong Kong's long-term fiscal sustainability

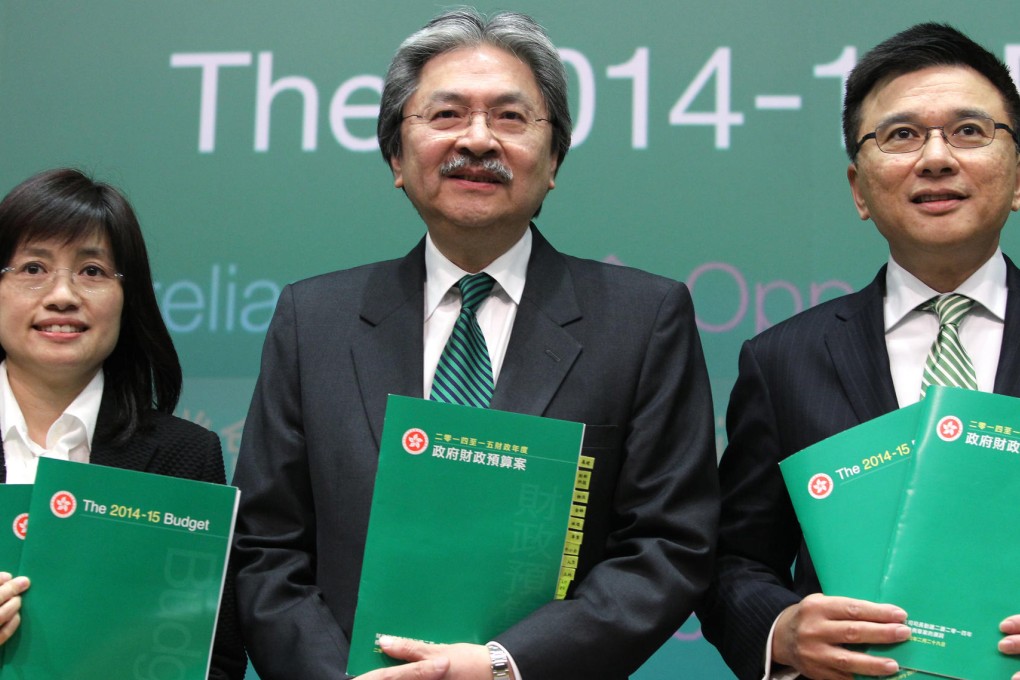

In his budget, Financial Secretary John Tsang Chun-wah announced an estimated surplus of HK$12 billion for 2013-14 and forecast surplus of HK$9 billion for 2014-15. This is a result of the government's efforts to adhere to the fiscal discipline of keeping expenditure within the limits of revenue. Indeed, the government has controlled public expenditure at about 20 per cent of gross domestic product since 1997-98.

However, Tsang also revealed that while growth in government revenue had largely been commensurate with economic growth, average annual growth of government expenditure in the past 17 years actually outpaced that of government revenue and nominal GDP.

Despite this trend, thanks to strict control of expenditure in the 10 years between 1998-99 2007-08, Hong Kong was able to achieve budget surpluses in the past 10 years. But in the longer term, to make the public finances sustainable, the government needs to align the growth of the economy, government revenue and expenditure, and to avoid allowing expenditure to persistently grow faster.

Looking ahead, with an ageing population, growth in the economy and government revenue will slow down while public expenditure on social welfare and health care will inevitably rise. This will cause further concern about Hong Kong's long-term fiscal sustainability. The working group on long-term fiscal planning warns that a structural deficit will occur within seven to 15 years according to projections based on economic growth trends and demographic changes under different expenditure-growth scenarios.

Tsang rightly pointed out this challenge and the need to contain expenditure growth and preserve the revenue base.

A narrow tax base has long been a notable problem of Hong Kong's tax system. Profits tax, salaries tax, stamp duty and land premiums account for more than 65 per cent of estimated government revenue in 2014-15. These sources are sensitive to economic change and tend to fluctuate more dramatically than the economy itself.