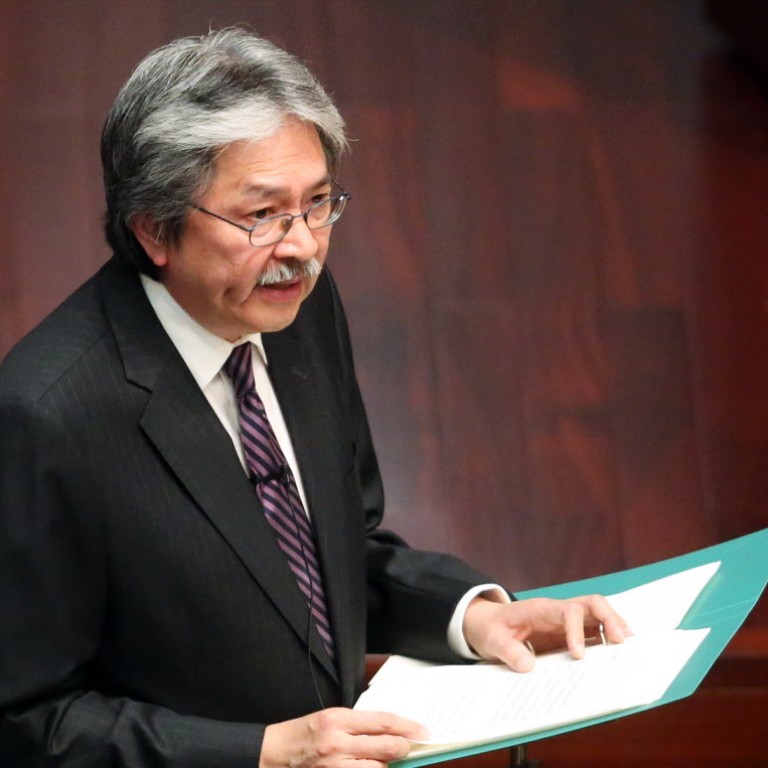

Hong Kong financial secretary says likely US interest rate rise is city's top economic concern

John Tsang also warns that a Fed move will affect the HK property market

Financial Secretary John Tsang Chun-wah warned that a potential interest-rate increase by the US Federal Reserve next week is becoming the biggest economic concern in Hong Kong.

Speaking to a Legislative Council panel yesterday, Tsang said the strong US payroll number released last Friday had prompted market expectations that the Fed would raise its near-zero interest rate for the first time in nine years.

READ MORE: Hong Kong facing capital outflows if US Fed raises interest rates, HKMA chief warns

"[It's] highly likely that the Fed will increase the interest rate at their next meeting" he said, but added that the first raise was likely to be moderate, such as 0.25 per cent.

Tsang also highlighted the risks from Fed action to Hong Kong's property market, with asset prices likely to fluctuate on higher borrowing costs.

When asked by a lawmaker whether the government would curb current purchase restrictions to support the property market, Tsang said only that the government would closely monitor trends like property prices and trade volumes.

Hong Kong's property market is especially vulnerable right now, with home sales hitting a record low for the year last month, and home prices dropping in October for the first time in three years.

However, the negative impact of a Fed tightening could extend beyond property markets.

"Hong Kong's gross-domestic-product growth would slow significantly," said Kevin Lai, a chief economist at Daiwa, predicting that a US interest-rate increase could lower full-year GDP growth to 1.6 per cent next year, much lower than the 2.4 per cent expected for this year.

"Labour markets would also be affected", Lai said, as investments in the city were expected to shrink when money flowed back to the US. "The retail sector [would be] under more pressure to cut staff," he said.

Swiss bank UBS also lowered its GDP growth estimate for 2016, to 1 per cent, in its latest Hong Kong strategy report.

However, Law Ka-chung, the chief economist at Bank of Communications, disagreed. "The impact of any rate hike has already been discounted."

Law also said property prices were not necessarily related to interest rates, and were more a function of the real economy.