Hong Kong tobacco tax increase needed for city to cut smoking rate to 7.8% next year, health advisers say

- But concern group argues that higher tax could worsen illicit cigarette trade problem

- Hong Kong last raised tobacco duty by 31.5 per cent in February 2023

There are nearly 600,000 people who smoke every day in Hong Kong. Authorities hope to cut the smoking rate to 7.8 per cent by next year.

But Professor Kelvin Wang Man-ping, of the University of Hong Kong’s School of Nursing, said a more drastic increase in the tobacco tax would be needed to attain the goal.

“With just one year left, it would be very difficult [to bring down the rate],” he told a morning radio programme. “If we are not increasing the tobacco tax, I personally think it is almost impossible to [reach the goal].”

Hong Kong may raise tobacco tax again in bid to stub out smoking: health chief

Wang, also a member of the statutory Hong Kong Council on Smoking and Health (COSH), added there was no guarantee the government’s target could be reached even after an increase in tobacco duty.

“But if we are not doing it, we will never reach the goal,” he said.

Wong added that time would also be needed for people to quit smoking after the tax was raised.

Hong Kong raised its tobacco tax by 31.5 per cent in February last year.

Smokers had to fork out an extra HK$12 (US$1.50) for a pack of 20 cigarettes. A pack now costs about HK$78, with the tax about HK$50 of the price tag.

Although tax accounts for about 64 per cent of the retail price, the proportion is still below the 75 per cent of the over-the-counter price recommended by the World Health Organization.

Wang said that the measure would only become more effective if the tobacco tax was raised by a large amount.

A total ban on tobacco is unrealistic – and unnecessary

Henry Tong Sau-chai, the COSH chairman, told the Post on Thursday that the tax would need to be increased by about 70 per cent to meet the WHO standard, which would take the cost of a pack of cigarettes to about HK$112 to HK$115.

He said the city should not only raise the tax to the level suggested by the WHO, but also introduce an additional 10 per cent increase in tobacco duty every year to counter the effects of inflation.

“If the tobacco tax is frozen, its effect [in reducing smoking] could be lessened with inflation,” Tong said. “Manufacturers also increase prices of their products from time to time, and this would lower the proportion of tobacco tax in the retail price.”

But Joe Lo Kai-lut, convenor of the Long-term Tobacco Policy Concern Group, on Friday said a tax raise would not help reduce the smoking rate.

Lo, speaking on the same radio programme, questioned the effectiveness of the measure and argued that the number of smokers had fallen, even during a period when the tobacco tax was not increased.

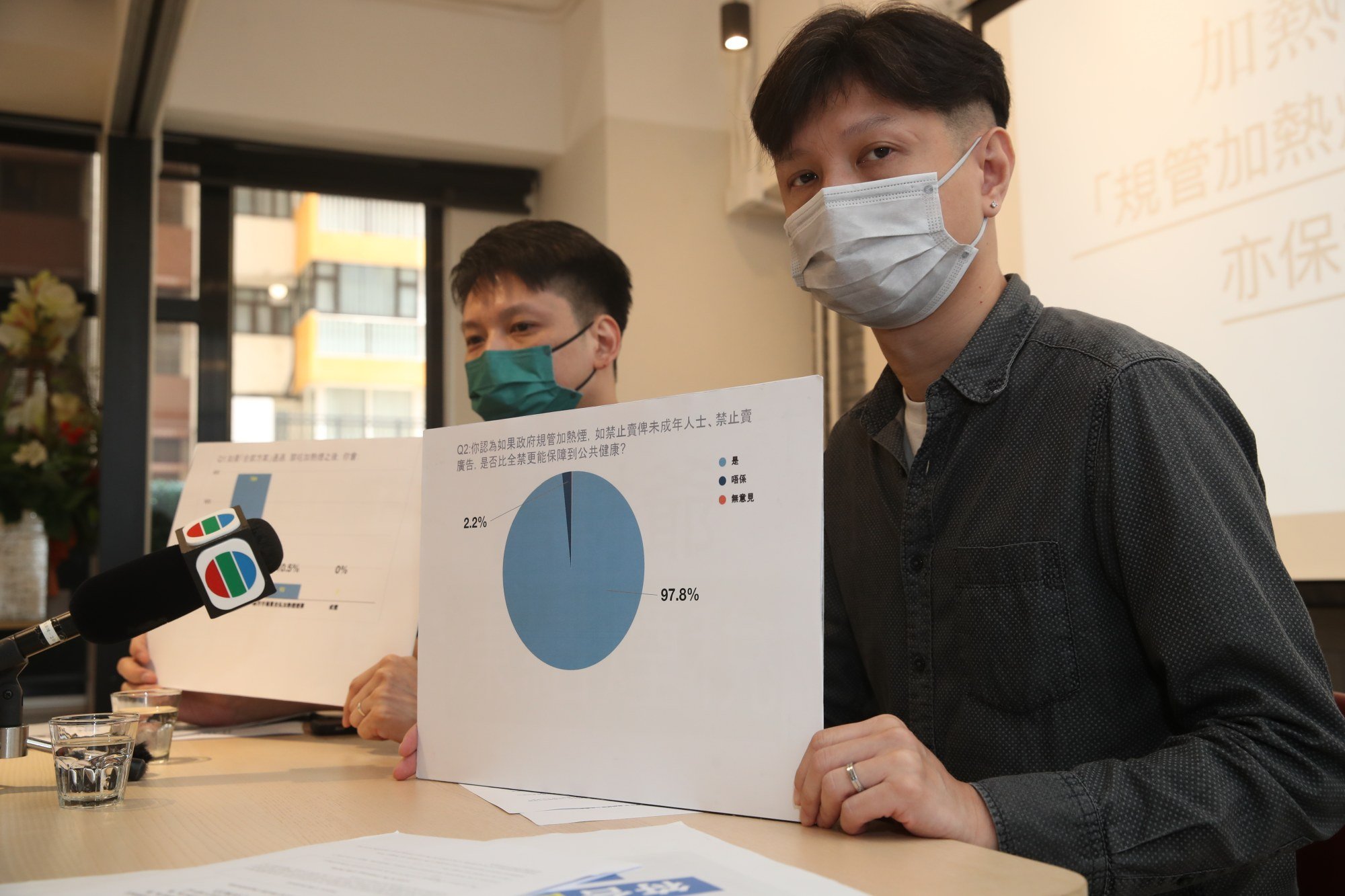

The city’s tobacco tax was frozen between 2015 and 2022, but the smoking rate continued to fall from 10.5 per cent in 2015 to 9.5 per cent in 2021. A similar decrease also happened between 2009 and 2014, when the tobacco tax was raised three times.

Hong Kong may raise tobacco tax again in bid to stub out smoking: health chief

The smoking rate went down by 1.5 percentage point, from 12 per cent in a 12-month period between 2009 and 2010 to 10.5 per cent in 2015.

Lo said he was also worried that a higher tobacco tax could encourage a black market trade in cigarettes.

After last year’s increase, his organisation noticed that more illicit cigarettes were being sold, some for as low as about HK$30 a pack, he added.

Tong said a government consultation process last year on the city’s tobacco control strategies had looked into ways to distinguish duty-paid tobacco products.

These included the possibility of requiring every cigarette to have a printed mark indicating tax had been paid.

Tong said a “tax paid” mark was already in use in Singapore and that he hoped Hong Kong would do the same soon.