Hong Kong finance minister plays down fears about impact of China-US trade war, saying cost to city will be limited

Paul Chan Mo-po forecasts drop in growth of only 0.1 or 0.2 of a percentage point in 2018 as US President Donald Trump follows through on tariff threats

Hong Kong’s finance minister on Saturday said the short-term impact on the city of China’s escalating trade war with the United States would be limited to a dip in growth of just 0.1 or 0.2 of a percentage point, but the government nevertheless stood ready to help local businesses if necessary.

Paul Chan Mo-po told the Post that trade in goods between the US and China moving through Hong Kong accounted for only 1 per cent of the city’s re-exports, so the effect of tariffs would be small.

But he conceded the investment climate in the city had been affected, citing a plunge in the local stock market. However, he said share trading volumes had been stable and he also expected the government’s income from stamp duty to remain level.

“As a small and open economy, there is not much we can proactively do. But we can monitor the situation very closely and make sure our financial and banking systems are operated in order without systematic risks,” Chan said.

“We stand ready to roll out support measures to enterprises if affected, especially for small and medium-sized businesses.”

US-China trade war: how will Hong Kong companies be affected as tariffs imposed on US$34 billion worth of Chinese goods?

The medium- to long-term impact on the city would hinge on how the mainland economy was performing, Chan said.

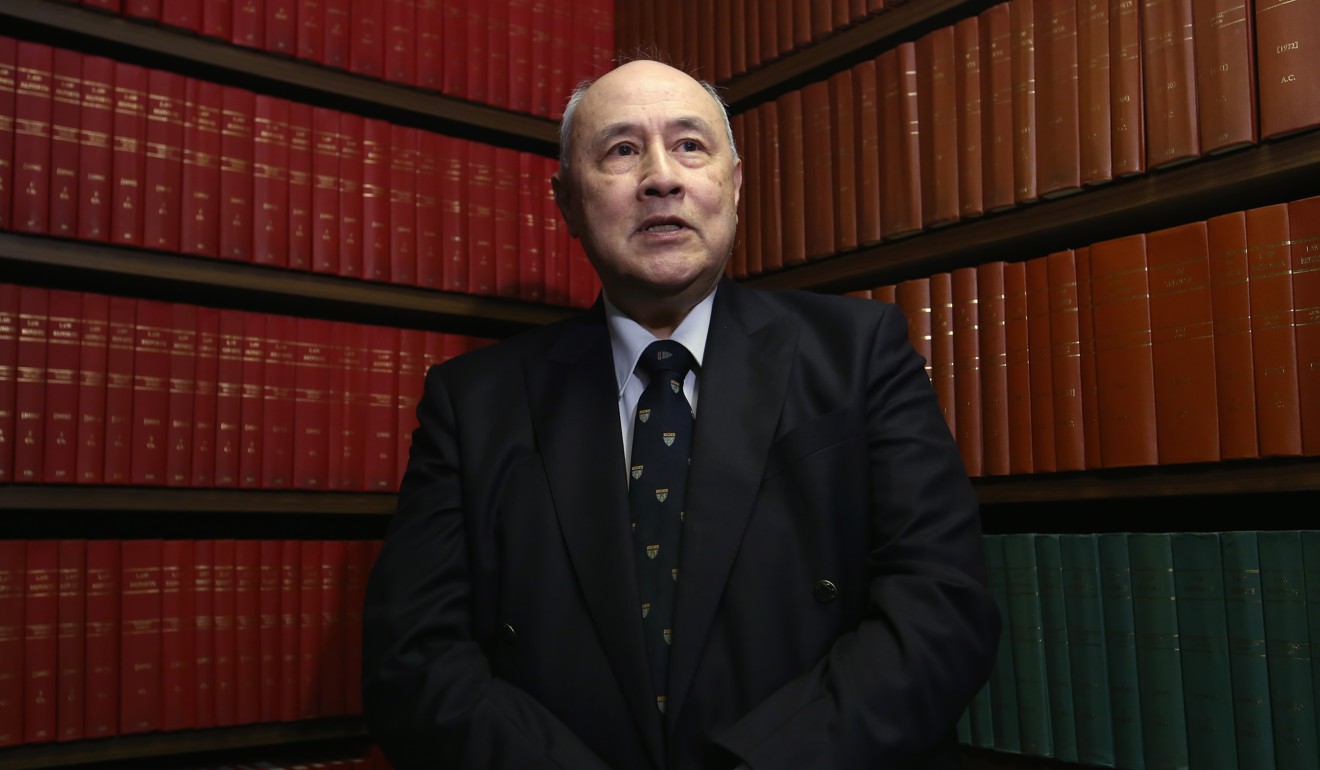

Anthony Neoh, a former top adviser to ex-Chinese premier Zhu Rongji, said Hong Kong’s economy would take a smaller hit than the mainland’s, and the dispute was a good opportunity to diversify the city’s trading network.

The former chief adviser to the China Securities Regulatory Commission also said the US risked becoming the “odd man out” in a realigned international trade order.

“Our gross domestic product will go down a bit – I don’t think we can avoid a hit,” Neoh said on Saturday after chairing a forum at the Asian Academy of International Law.

“But I don’t think it will be a big hit. The hit on China will be bigger as the mainland has more direct exports to the US.”

US, China deliver on threats as ‘biggest trade war in economic history’ starts at high noon

Neoh said Hong Kong companies on the mainland would suffer under the tariffs but would benefit from compensating factors such as lower operating costs north of the border and a weakening yuan.

The former chairman of Hong Kong’s Securities and Futures Commission anticipated a slighter greater drop than Chan in GDP growth, at 0.2 of a percentage point or more, and said expansion in 2018 would likely end up in the lower range of the government’s 3 to 4 per cent forecast.

But he cautioned that the full impact on company balance sheets may not be known until the first quarter of next year.

Hong Kong leader Carrie Lam Cheng Yuet-ngor said her government would stay alert to the impact of the trade war.

US and China: who tried to avert a trade war and who forced it?

She also took aim at the US, saying the international trading order had been “disrupted by a single country” overnight. She cited a metaphor used by Chinese President Xi Jinping at the World Economic Forum in Davos last year which described protectionism as “locking oneself in a dark room”.

The US imposed 25 per cent tariffs on US$34 billion worth of Chinese goods on Friday. China’s Ministry of Commerce quickly struck back by announcing the same level of tax on an array of American goods.

There is no consensus among analysts on where the trade war is headed. US President Donald Trump has indicated similar duties on a further US$16 billion worth of Chinese products could come in less than two weeks.

Trump’s trade war on China: phoney or real, world will be the loser

Neoh predicted further tariffs as Trump had a “political objective” ahead of US congressional elections in November, and Beijing would have little choice but to hit back. Therefore a spillover effect on Hong Kong’s financial and property markets may be seen before the end of the year, Neoh said.

“It is difficult to see Trump backing away from his stance in light of the impending election,” he said.

But Neoh warned America that the higher cost of Chinese goods for US businesses, coupled with a stronger dollar, could come back to haunt them, and Chinese and European manufacturers would look for substitutes to the US when sourcing raw materials.

“A realignment of trade is happening and the Americans will be the odd man out. But Trump seems to want that to happen,” Neoh said.

US-China trade war: who wins, who loses?

As for Hong Kong, opportunities lay ahead despite a time of uncertainty, he said.

“At the moment everyone is thinking of dark clouds, but what is the silver lining? If the international law-abiding countries bind together and trade more, Hong Kong will be able to substitute the losses with exports to other countries, and gain from that.”

Sarah Grimmer, secretary general of the Hong Kong International Arbitration Centre, said increased duties and scrutiny of trading licences for foreign firms would lead to more commercial disputes among businesses.

“With the changes in tariffs, there could be changes to profit margins and sale prices, so some contracts may not be as appealing as when first concluded. Some may be breached,” Grimmer said.

Nils Eliasson, a partner in law firm Shearman & Sterling, said businesses “could only live with” the increased duties.