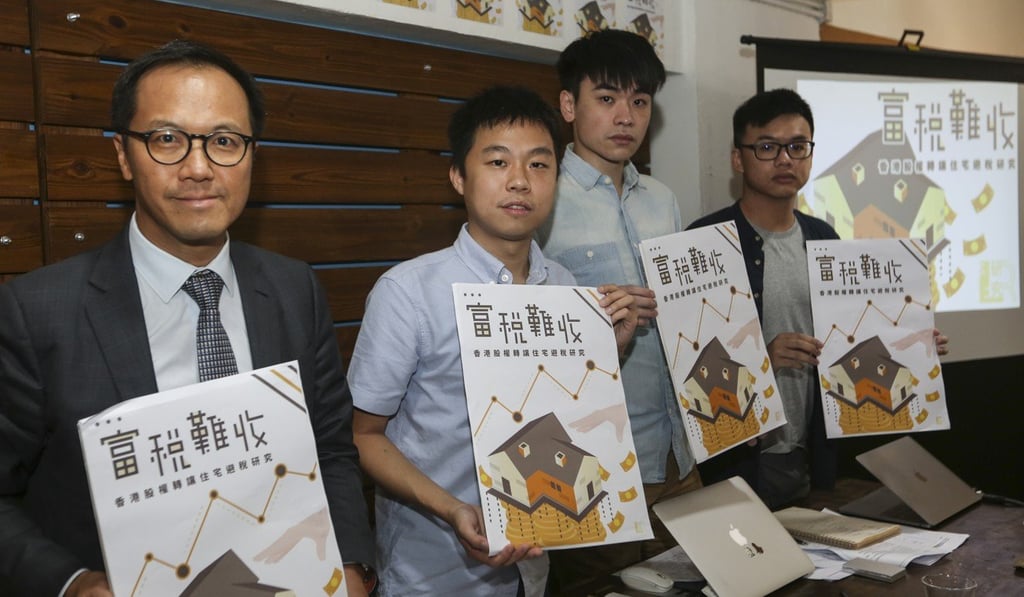

Stamp duty loophole cost Hong Kong purse HK$9.4 billion in 8 years, study finds

Local property developers, mainland Chinese and firms registered in Bermuda or the British Virgin Islands are taking advantage of the system, Liber Research Community says

A loophole in Hong Kong’s stamp duty system has cost the public purse at least HK$9.4 billion (US$1.2 billion) in the past eight years by allowing buyers to acquire properties almost tax-free via the purchase of companies, a study published on Tuesday has found.

Research by land concern group Liber Research Community identified at least 126 cases between November 2010 and May this year in which buyers were suspected of acquiring property-owning firms to avoid the levy.

The findings have reignited public discussion about the long-standing tax loophole, which critics say encourages market speculators.

About 60 per cent of the cases unearthed by Liber involved non-local buyers, mostly mainland Chinese. Other overseas buyers included companies registered in Bermuda or the British Virgin Islands, as well as new migrants to the city who had not been resident for the requisite seven years to secure permanent residency.

But some cases involved prominent local property developers, as well as managers of well-known companies on the mainland, popular entertainers and even members of the Chinese People’s Political Consultative Conference, the nation’s top political advisory body.