‘Mission impossible’ for China’s Greater Bay Area without flow of people, Hong Kong bourse chief Charles Li warns, saying facial recognition way forward

HKEX chief also calls for relaxation of tax rule for Hong Kong residents who work across border

Artificial intelligence technology could be used to boost the number of Hongkongers crossing the border to work in mainland China by calculating to the minute how long they spent there for tax purposes, the boss of the city’s stock exchange operator said on Wednesday.

Hong Kong Exchanges and Clearing chief executive Charles Li Xiaojia also called for a relaxation of a tax rule for Hong Kong residents who work across the border for more than 183 days a year.

Tax differences are seen as a factor that discourage Hongkongers from working across the border.

Currently, even a quick trip across the border is counted as one day for residents, and those who spend 183 days a year for work are required to pay the mainland’s heavy tax rate on income generated there.

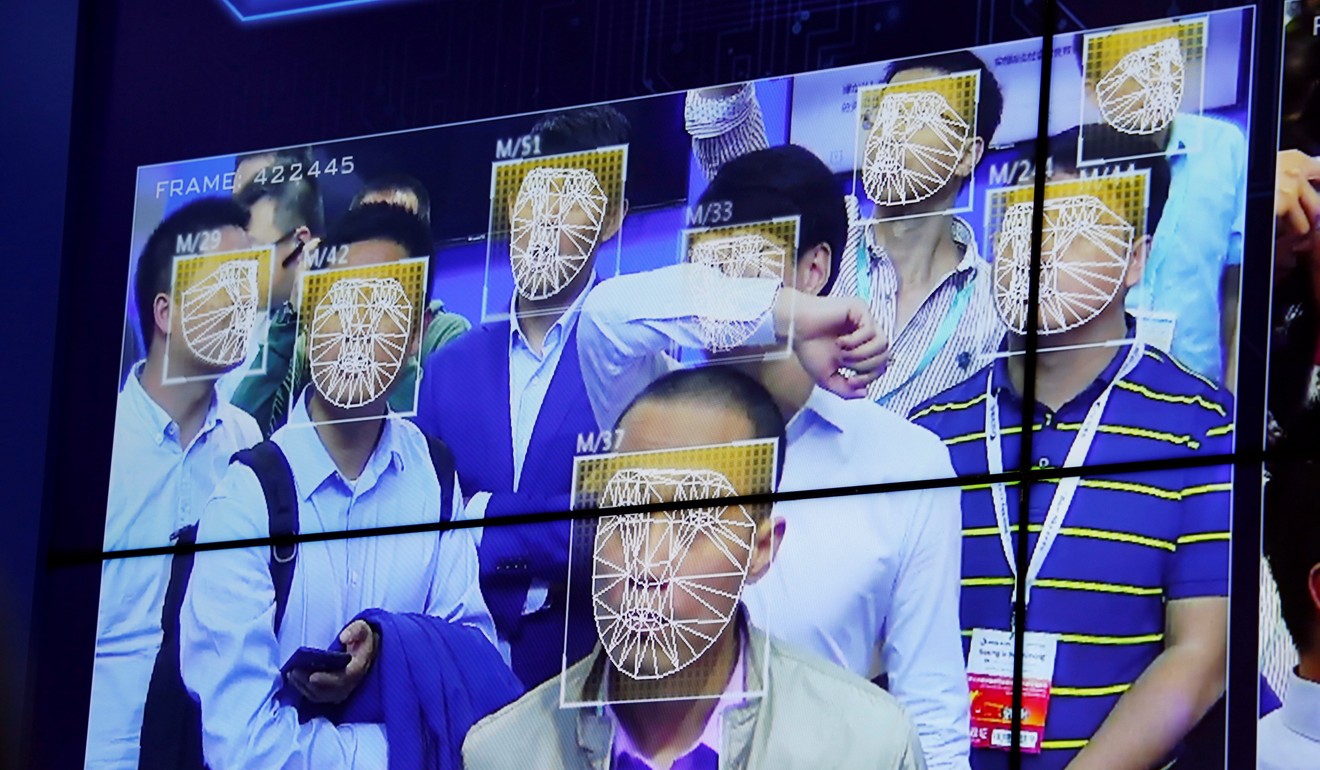

Facial recognition tech comes to Hong Kong-Shenzhen border

“The mission impossible, the most difficult part of the Greater Bay Area plan, is the flow of people,” Li said, adding that with people came capital and information.

“If the flow of people cannot be enhanced, [development of] our bay area would be more difficult than the other bay areas.”

He hoped that in five to 10 years, the process of passing through immigration and customs controls would be eased by facial recognition systems, particular for those people the bay area needed most.

In Li’s thinking, these workers would not require visas or even have to undergo any procedures to cross the border, as artificial intelligence in facial recognition systems built in cities would do the job, and at the same time, calculate their hours spent across the border.

“How could [the flow of people] work under the current 183 days?” he said, highlighting the rule’s harshness by raising the situation of a person crossing the border for just an hour in the morning.

“Let’s calculate according to hours and minutes. We don’t need a large number of tax officials to monitor [this] … as everything could be resolved in the era of artificial intelligence.”

Chinese consumers demand bigger tax cut as living costs skyrocket

On the mainland, individual income tax is collected on a monthly basis with workers’ personal allowance at 3,500 yuan (US$512), which is set to be raised to 5,000 yuan in October.

Under progressive rates, the tax could take up 30 per cent of one’s monthly salary, according to Peter Kung, a senior adviser at KPMG China who specialises in mainland tax.

In Hong Kong, tax on the first HK$200,000 (US$25,480) of annual income is HK$16,000 with a rate of 17 per cent applied to the remainder. Meanwhile, tax payers enjoy a reduction rebate of 75 per cent with a cap at HK$30,000 (US$3,822) this year under government relief measures.

Under the amendments, Hongkongers who stay on the mainland for more than 183 days will not only be required to pay tax on mainland income, but also on other earnings round the world.

Future of travel: new Beijing airport embraces facial recognition tech

“Although the Greater Bay Area is within one country, there are two systems, three customs zones, three currencies and three sets of legal systems,” she said, adding more work would be done to remove barriers for residents to live, work, study and run businesses across the region.

Additional reporting by Su Xinqi