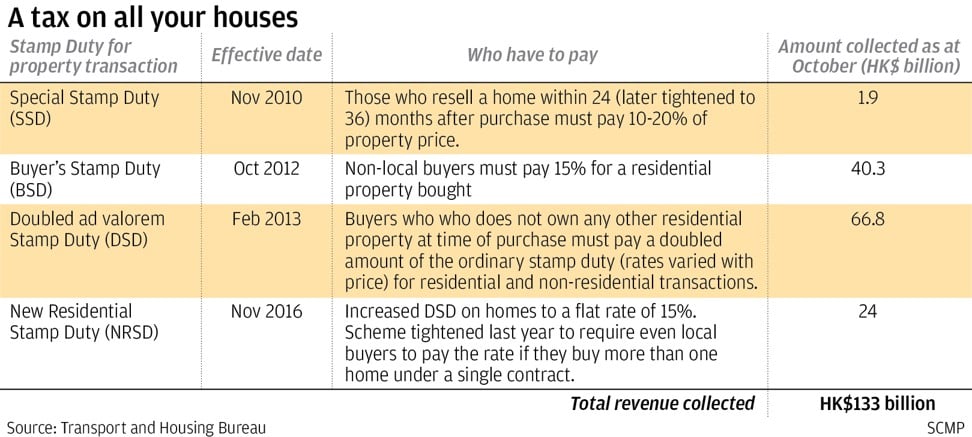

Homebuyers paid Hong Kong government HK$133 billion in tax over past eight years, and stamp duty is here to stay minister says

- Sum equivalent to a quarter of city’s 2017 expenditure and business sector wants officials to undo tax

- But housing minister Frank Chan said there was no plan to act while property prices remain high

Hong Kong’s public coffers have amassed almost HK$133 billion (US$17 billion) from stamp duty over the past eight years – and disclosure of the sum on Wednesday prompted calls to reduce the tax as the property market softens.

The city’s Transport and Housing Bureau revealed the figure in response to requests by lawmakers.

Enough to finance a quarter of the city’s HK$471 billion expenditure last year, the sum is the equivalent of 25 per cent of the estimated cost of the “Lantau Tomorrow Vision” – an ambitious and contentious HK$500 million government plan to create a huge artificial island for housing and offices.

Lawmakers representing the city’s business sector urged officials to undo extra stamp duties imposed in 2016 to slow runaway house prices.

But, housing minister Frank Chan Fan said there was no plan to act while prices remained high.

“The measures have proved effective and have deterred speculation,” Chan said in a meeting at the city’s legislature.

The latest levy, the New Residential Stamp Duty (NRSD), despite being aimed primarily at overseas buyers, had curbed speculation even among local investors after the rules governing the scheme were tightened in April last year, Chan said.

Non-local homebuyers must pay a flat rate of 15 per cent of the property price under the NRSD.

But, since April 2017, even local buyers have been subject to the tax if buying more than one home under a single contract.

Previously, locals could escape paying the duty if they put multiple transactions in one deal.

In recent months there had been no local buyers seeking to buy multiple properties in one go, Chan said.

Stamp duties have worked to stabilise the housing market, shielding us from speculative excess

The NRSD, together with three other stamp duty schemes introduced since 2010, had fetched HK$132.92 billion, according to a reply by Chan’s bureau to a written question submitted by a lawmaker.

A large part of the sum also came from the Buyer’s Stamp Duty levied on non-local buyers, which yielded HK$40.3 billion. These buyers must also pay 15 per cent of the property price.