Coronavirus: Hong Kong bankruptcies for May the worst since 2003 Sars epidemic, as experts paint dour picture of road ahead

- With courts closed or barely working from February to April, the first five months of the year still saw personal bankruptcies climb 12.5 per cent from 2019

- Liquidation expert says residents will try to solve cash-flow issues as long as they can, but ultimately it will be ‘much worse’ than during Sars epidemic

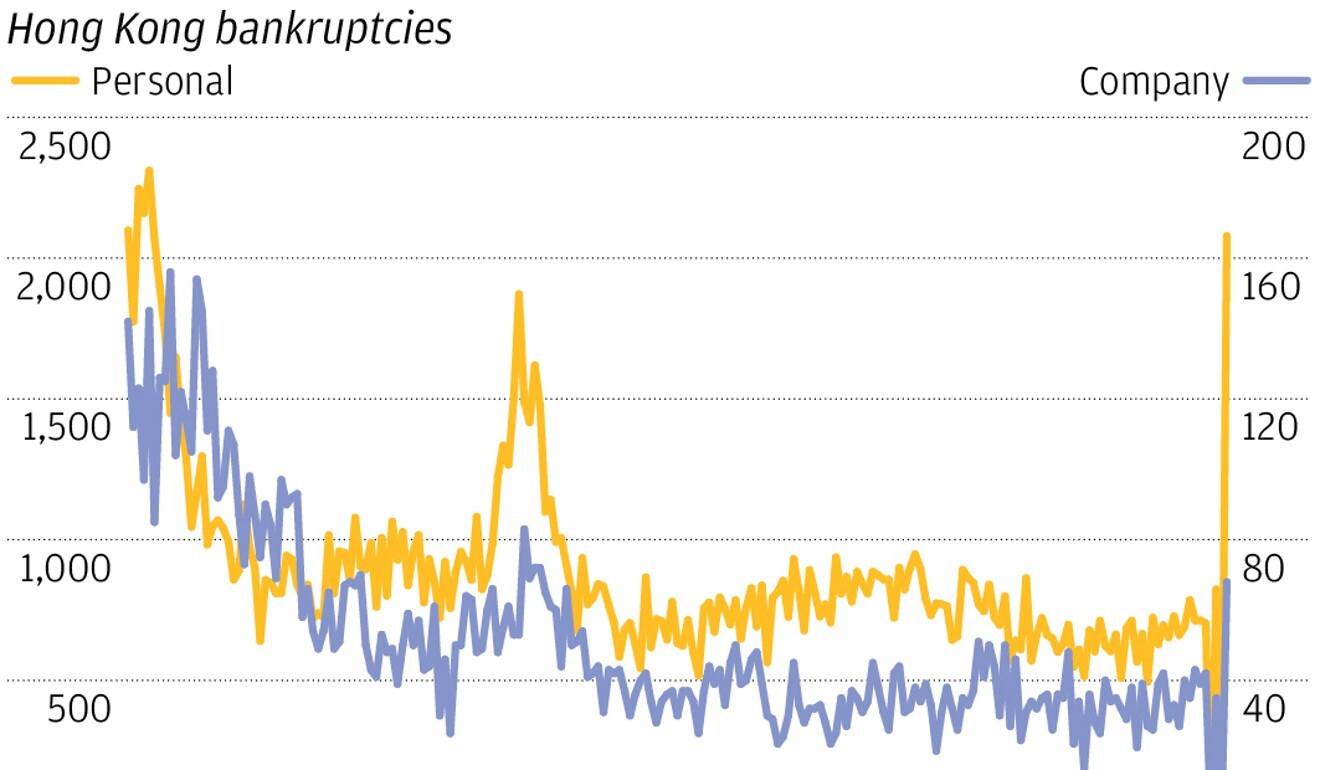

Personal bankruptcies in the city shot up from just six in April to 2,079 the following month, while companies’ winding-up petitions jumped from one to 68 in the same period, according to data released by the government’s Official Receiver’s Office on Friday.

With courts closed or operating on a minimal basis between February and April, personal bankruptcies for May surged threefold year on year as they fully reopened, while petitions to wind up non-limited companies increased 62 per cent.

But even with filings largely on hold for those three months, Hong Kong registered 3,611 personal bankruptcies in the first five months of the year, up 12.5 per cent from the same period in 2019. The 146 winding-up petitions for companies in the first five months of the year, meanwhile, represented a 25 per cent jump from last year.

It will be much worse than Sars in 2003, as that epidemic was regionalised, affecting a few countries. This pandemic is affecting the whole world.

Derek Lai Kar-yan, vice-chairman of Deloitte China and a veteran liquidation expert, said this was just the beginning, as people would attempt to solve their cash-flow issues for as long as they could. He expected the bankruptcy trend to continue to rise over the next few months.

“It will be much worse than Sars (severe acute respiratory syndrome) in 2003, as that epidemic was regionalised, affecting a few countries. This pandemic is affecting the whole world. You can see Africa and Brazil are just now getting very serious, for example,” said Lai, adding that manufacturing, retail, hospitality and restaurant businesses were particularly affected.

Felix Chung Kwok-pan, leader of the pro-business Liberal Party, said he was not surprised by the new bankruptcy figures as “every industry is hurting”.

The export sector, in particular, had been affected, with such destinations for goods as the United States and the European Union still under varying degrees of lockdown, he explained.

“Some businesses have even been asked to put their international shipments on hold. So there is no revenue coming in at all,” he said.

Hong Kong unemployment hits 15-year high, with 5.9 per cent out of work

“I would predict the unemployment rate will rise, the bankruptcy rate will increase, and the number of businesses closing down ... will also go up.”

The Sars epidemic saw company winding-up petitions rise 1.4 per cent to a record 1,451 from 2002. And while personal bankruptcies for that year dropped 18 per cent to 22,092 when compared with the record 26,922 filed in 2002, they remained at historically high levels.

The travel ban from the global pandemic has had a huge impact on companies both locally and across the globe, with more than 8.4 million Covid-19 cases worldwide and more than 453,800 deaths.

“A lot of cross-border transactions have been blocked or knocked down, with many countries still adopting work-from-home practices. All this will affect the economy,” Lai added.

Foreclosures set to surge as Hong Kong homeowners struggle with finances due to recession, rising unemployment

The sharp rise in failing businesses would also inevitably push the city’s unemployment rate higher. The overall unemployment rate from March to May reached its highest level in 15 years, hitting 5.9 per cent and surpassing the figure recorded in the wake of the global financial crisis in 2008.

Overall, the number of unemployed in Hong Kong increased by about 27,900 – from 202,500 between February and March, to 230,400 from April to May.

Secretary for Labour and Welfare Law Chi-kwong on Tuesday warned the rate was likely to continue to rise next month.

Battered by anti-government protests, the US-China trade war and the global economic slowdown, the city officially entered recession last autumn.

The teetering local economy was dealt its sharpest blow yet after the coronavirus reached Hong Kong in late January.