Coronavirus: Cathay Pacific overhaul set to begin as shareholders overwhelmingly back HK$39 billion Hong Kong government-led bailout package

- Cathay chairman Patrick Healy says overhaul of the business will take ‘a couple of months’

- Bailout package wins support of 99 per cent of shareholders

After the meeting, which lasted little more than 15 minutes, Cathay chairman Patrick Healy told the Post the overhaul of the business would take “a couple of months”, offering a more specific time frame on how soon the airline could decide on its cost-saving measures.

“The first priority was to get the recapitalisation done and it’s great to get this far and we hope to get shareholder support and then we’ll move onto the deliberations of the restructuring,” he said, before the results of the vote.

01:27

HK$30 billion bailout for Cathay Pacific is necessary, Hong Kong government says

Healy said Cathay would evaluate the company’s structure, network, fleet and the impact on “the team and organisation”.

It had yet to come to “any final conclusion” on a broad restructuring that would conclude in the fourth quarter of this year to determine its future size and shape in a post-pandemic world.

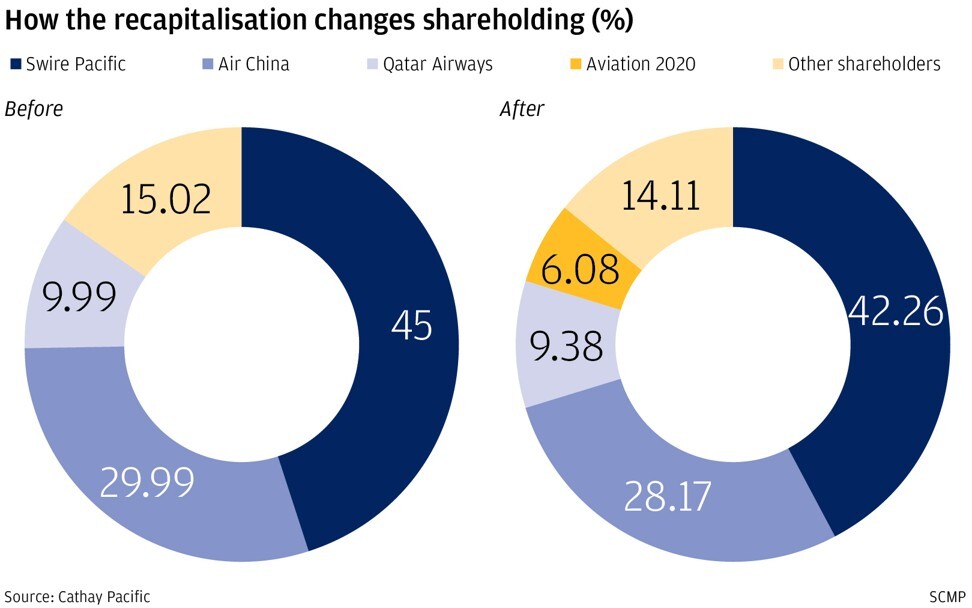

Key shareholders Swire Pacific, Air China and Qatar Airways control 84.98 per cent of the company, and the trio offered “irrevocable undertakings” to the issuance of new shares last month.

Hong Kong to tighten social-distancing rules after 52 new Covid-19 cases recorded

Shareholders overwhelmingly backed the government-led bailout package on Monday with 99 per cent voting in favour.

An elderly shareholder for “numerous years” who declined to be named was happy to back the proposals. “It will help Hong Kong and the company as well,” he said.

He shrugged off the investment losses, stating “it’s only a number”, and defended the company’s dwindling valuation. “Obviously the share price has not been good due to the coronavirus pandemic but Cathay is not to be blamed for that,” he added.

Analysts and experts said the airline gained enough breathing room to carry out its structural review but cautioned the need to keep costs under control with the coronavirus flaring up again in Hong Kong.

Kelvin Lau, head of auto, transport and industrial research at Daiwa Capital Markets, said: “They will need to have more cost control as cash flow will be under big pressure. The one-time support from the government will help but can they survive next year? Practically, there seems to be a need for ongoing support.”

Luya You, transport analyst at Bocom International, said the present package was definitely enough for the rest of the year and most of next.

“But we can’t rule out another resurgence that cripples air travel next year or the year after. It’s hard to say considering the effects of Covid-19 just on 2020 alone,” she warned.

Andrew Yuen Chi-lok, from Chinese University Business School’s Aviation Policy and Research Centre, said the shareholders’ blessing was necessary for Cathay to use the funds to maintain its operations with a long and slow recovery expected.

Cathay Pacific averts ruin with call to Hong Kong’s HK$4 trillion man

Asked about the third wave of Covid-19 infections in Hong Kong hurting the business, Healy described the situation as “extremely dynamic”. He also shrugged off the potential of a new local airline.

Shareholders were asked to back the recapitalisation plan, including issuing HK$19.5 billion (US$2.5 billion) worth of preference shares to the government and for existing shareholders to buy into an HK$11.7 billion rights issue.

Also, as part of its bailout, the government made available a HK$7.8 billion bridging loan, to help ease the airline’s immediate cash crunch.

Martin Murray, Cathay’s chief financial officer, said the airline had not yet drawn down the loan.

Cathay Pacific held HK$20 billion of unrestricted liquidity by the end of 2019 but was losing up to HK$3 billion a month since February. The airline anticipated a “substantial loss” in the first six months of this year, as most of its passenger planes were grounded with international borders closed.

Shares in the de facto flag carrier of Hong Kong have slumped by almost a quarter since the airline unveiled its massive capital restructuring proposal on June 9 and some two-fifths lower since Covid-19 emerged at the start of the year.