Exclusive | Dragon’s gold: Hong Kong’s Cathay Pacific likely to retain axed subsidiary’s routes, sources say, but push for transparency ongoing behind scenes

- Multiple sources tell Post city’s de facto flag carrier secured deal in principle to keep valuable traffic rights before pulling plug on regional airline

- And as pro-Beijing lawmakers lobby for fair play, upstarts like Bill Wong’s Greater Bay Airlines hope to grab their own piece of the pie

Cathay Pacific Airways is likely to absorb most of the traffic rights of its axed regional subsidiary Cathay Dragon, multiple sources have told the Post, but players within the city’s pro-Beijing camp have been lobbying the Hong Kong government for transparency in such arrangements.

In the balance are valuable routes, including a number in mainland China, that would likely draw attention from other contenders.

Bill Wong Cho-bau, founder of start-up Greater Bay Airlines, which hopes to challenge Cathay Pacific’s long-standing dominance of Hong Kong’s aviation sector, told the Post on Thursday that the fledgling carrier hoped to vie for some of the routes previously operated by Cathay Dragon, though he expected most would be taken over by its parent.

You can see all the preparation work that had to be done so they could make sure [the rights] could be obtained

“We expect our application for an operator’s certificate to be approved in February or March next year, and hope the government will expedite the vetting process,” he said.

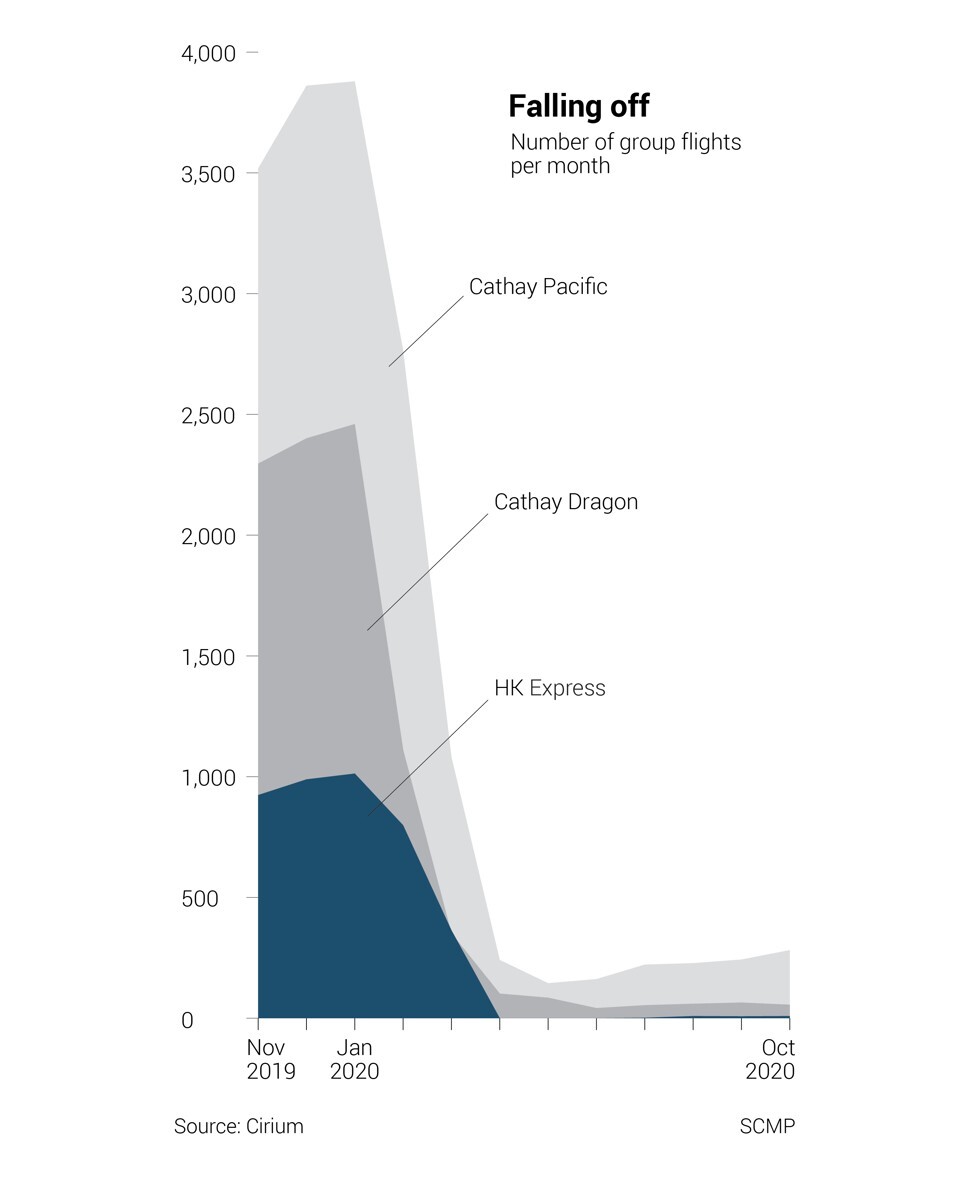

On Wednesday, Cathay Pacific closed its 35-year-old subsidiary, acquired in 2006, as part of a do-or-die restructuring. Cathay Dragon, with 48 planes in its fleet, flew to 51 destinations, including 23 routes on the mainland.

But its parent company received assurances from the Hong Kong government and other stakeholders that it would hold on to most of the regional carrier’s traffic rights before making the move to shut it down, multiple sources told the Post.

“It’s not that difficult. Of course, it would be done after completing due process,” one government source said.

Under the Basic Law, the city’s mini-constitution, Hong Kong is authorised by the central government to issue traffic rights to airlines that are incorporated in the city and make it their principle place of business.

A source familiar with the government’s distribution of those rights said their availability was publicised ahead of time and qualified airlines were invited to apply.

Airlines must then demonstrate they are capable of utilising the rights and show how the market and consumers would benefit. But, the source added: “It’s not really a bidding process.”

Making sure they were in position to retain those rights was a key priority for Cathay in the lead-up to Wednesday’s moves.

“The management has done a lot of reaching out and engagement. They had to sound out the stakeholders, and the board and shareholders had to approve it. You can see all the preparation work that had to be done so they could make sure [the rights] could be obtained,” a source close to the Cathay Pacific Airways board said.

“But obviously, at the end of the day, you still have to go through the process.”

State-owned Air China, the nation’s flag carrier, is one of the key shareholders – with a 29.9 per cent stake – whose approval was needed before the recent shake-up.

Can slimmed-down Cathay Pacific still protect Hong Kong’s status as global aviation hub?

A source in Cathay’s senior management ranks who spoke to the Post on Thursday described the decision to close the airline then go through the traffic rights application process as a “big risk”, further suggesting it was inappropriate for the government to promise Cathay it could keep the Dragon routes.

A source from the city’s pro-establishment camp said some political figures were also concerned about the optics of the rights distribution process.

“They are lobbying the government to handle it in a fair and transparent manner,” the source said.

While Air Transport Licensing Authority (ATLA) is responsible for licensing air services between Hong Kong and the rest of the world, the Transport and Housing Bureau reviews airlines’ commercial bids to operate routes and awards the traffic rights.

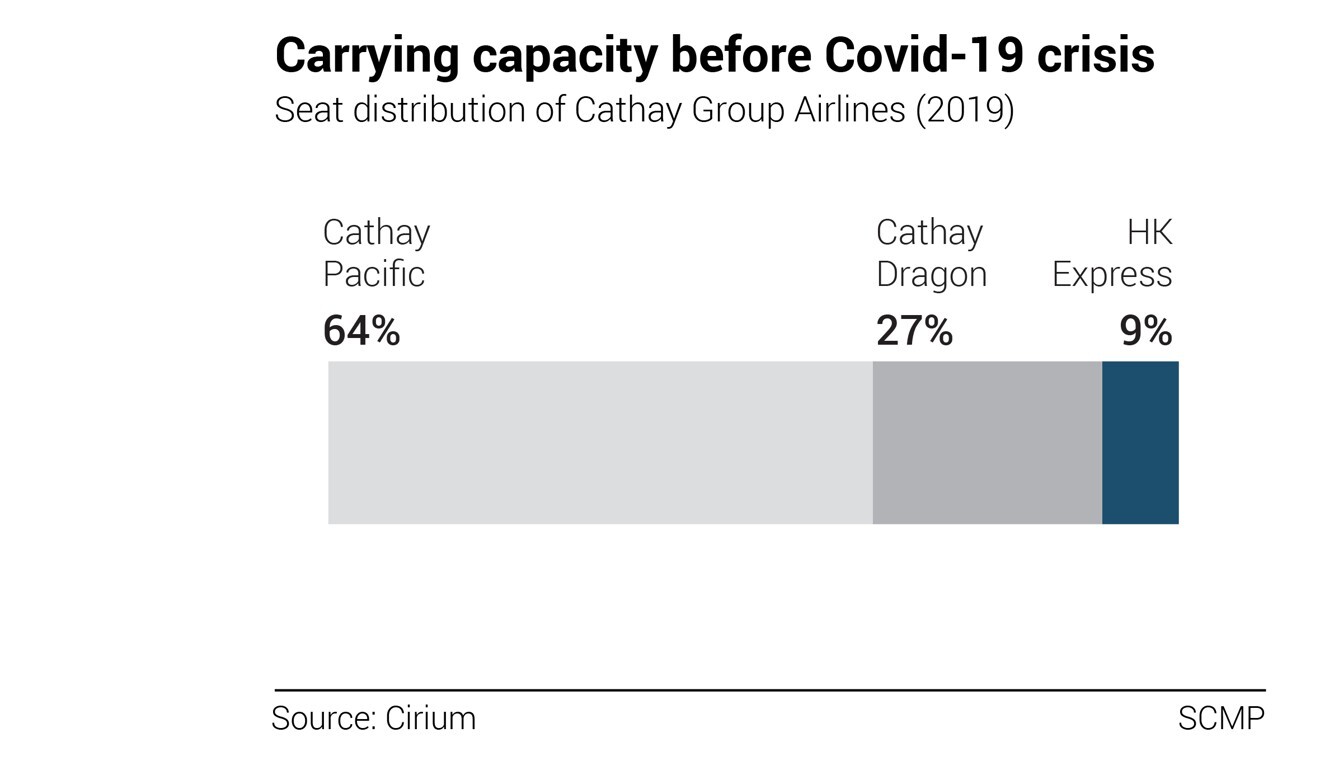

Cathay Pacific chairman Patrick Healy on Wednesday said the airline “expected” that “most of the destinations” served by Dragon would be shared between its two remaining carriers.

“It is intended that regulatory approval will be sought for a majority of Cathay Dragon’s routes to be operated” by Cathay Pacific or HK Express, the airline said in a stock exchange filing.

The Transport and Housing Bureau (THB), under which the ATLA sits, on Thursday said its department would handle bids for the traffic rights without mentioning the licensing body.

“The primary principle of traffic rights allocation is to ensure that public resources can be fully utilised with a view to upholding and strengthening the competitiveness of the aviation industry in Hong Kong,” a government spokeswoman said.

“The bureau noted that Cathay Pacific Group has the intention to apply for the traffic rights to be returned by Cathay Dragon … The situation and complexity of each and every application varies, which affects the processing time required,” the spokeswoman added.

The bureau said traffic rights would only be allocated to designated local airlines that hold valid licences in accordance with established procedures.

Cathay Pacific’s share price closed at HK$5.65 on Thursday, down 3.42 per cent from the day before.

Wong, the man behind Greater Bay Airlines, is a Hong Kong property tycoon and delegate to the Chinese People’s Political Consultative Conference, the nation’s top advisory body.

Dubbed “Shenzhen’s Li Ka-shing” after one of Hong Kong’s richest men, Wong already owns Shenzhen-based Donghai Airlines.

While hoping to bid for the traffic rights previously held by Cathay Dragon, Wong said he expected the lion’s share would be granted to Cathay Pacific.

Cathay job cuts likely to hit home prices, rents as axed staff sell up

“Cathay Pacific is a giant, while we are just a little kid. How can we match it?” Wong said. “Of course, as a Hong Kong-based airline, we will try our best to vie for some routes.”

He said he believed the government would make a “proper arrangement” in the near future.

But a government insider who spoke to the Post did not think Wong’s airline stood much of a chance.

“I don’t see anyone, including the central government, that would really favour Bill Wong,” the source said.

The ambitious start-up said last week it had applied for the right to launch flights to mainland China and the wider Asia-Pacific region.

In a recent job advert for managerial positions, Greater Bay Airlines revealed it had applied for an Air Operating Certificate from the ATLA in June. But rival airlines will have the ability to oppose and potentially delay its launch, which could determine what routes the carrier could fly.

The new carrier is seeking to hire for eight top-level roles, which are critical to its ATLA license application.

Cathay has take-it-or-leave-it deal for pilots: salary and benefit cuts, or the door

Wong said the airline also planned to recruit several hundred staff members in the near term.

Jae Woon Lee, an international aviation law and policy expert and assistant professor of law at Chinese University, said he believed Cathay was well-positioned to hold onto the Cathay Dragon rights.

“Given that there is only one competitor in Hong Kong (Hong Kong Airlines) and low demand due to Covid-19, Cathay Pacific and/or HK Express have a good chance to receive the traffic rights,” he said, acknowledging both HKA and Wong’s start-up would likely apply.