August 14, 1998: ‘Billions spent to prop up shares’ - Hong Kong fights back amid financial crisis

- Tsang intervenes to defend dollar

By Ray Bashford and Enoch Yiu

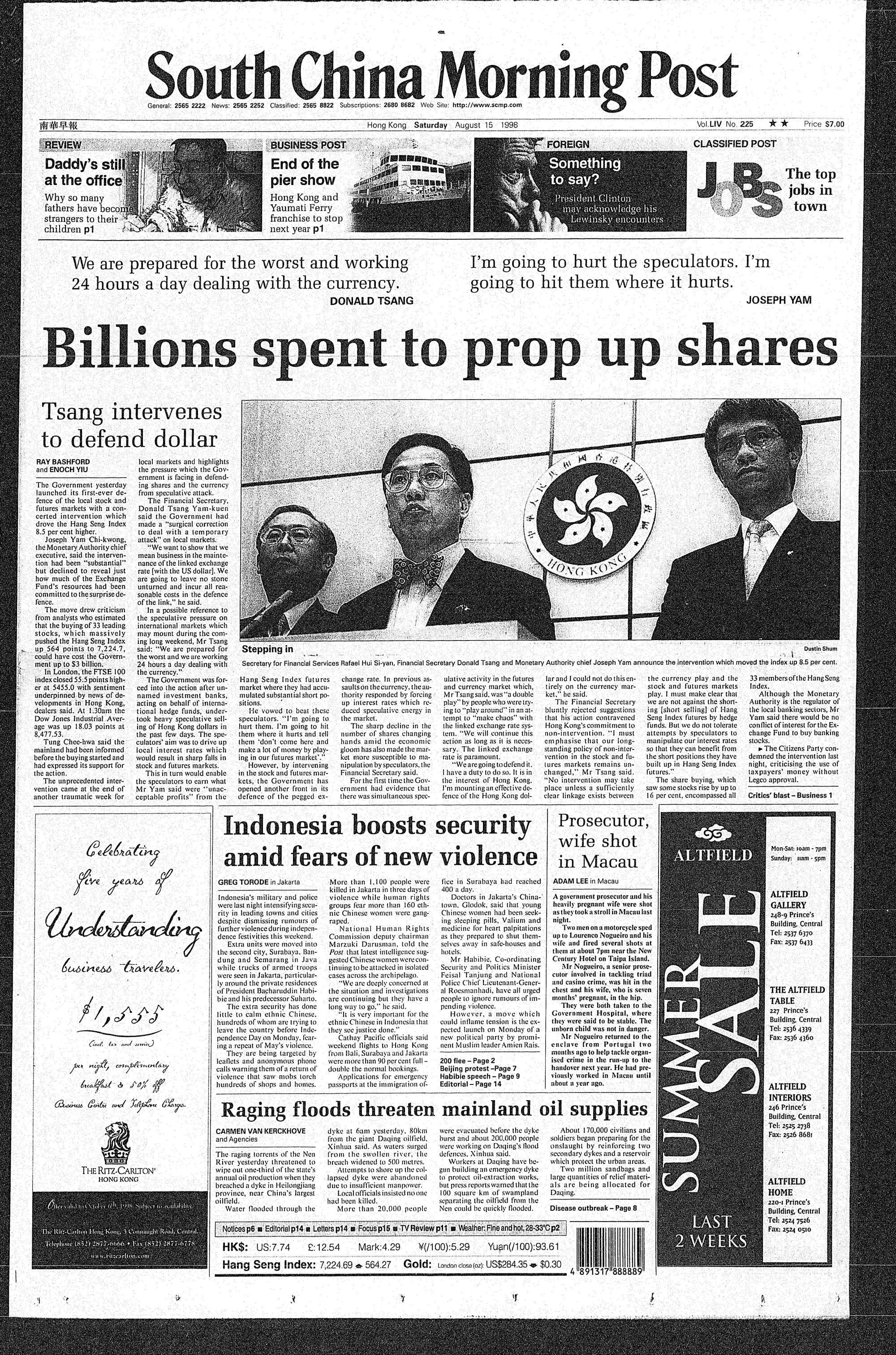

The Government yesterday launched its first-ever defence of the local stock and futures markets with a concerted intervention which drove the Hang Seng Index 8.5 per cent higher.

Joseph Yam Chi-kwong, the Monetary Authority chief executive, said the intervention had been “substantial” but declined to reveal just how much of the Exchange Fund’s resources had been committed to the surprise defence.

The move drew criticism from analysts who estimated that the buying of 33 leading stocks, which massively pushed the Hang Seng Index up 564 points to 7,224.7, could have cost the Government up to $3 billion.

In London, the FTSE 100 index closed 55.5 points higher at 5455.0 with sentiment underpinned by news of developments in Hong Kong, dealers said. At 1.30am the Dow Jones Industrial Average was up 18.03 points at 8,477.53.

Tung Chee-hwa said the mainland had been informed before the buying started and had expressed its support for the action.

The unprecedented intervention came at the end of another traumatic week for local markets and highlights the pressure which the Government is facing in defending shares and the currency from speculative attack.

We are prepared for the worst and working 24 hours a day dealing with the currency

We are prepared for the worst and working 24 hours a day dealing with the currency

The Financial Secretary, Donald Tsang Yam-kuen said the Government had made a “surgical correction to deal with a temporary attack” on local markets.

“We want to show that we mean business in the maintenance of the linked exchange rate [with the US dollar]. We are going to leave no stone unturned and incur all reasonable costs in the defence of the link,” he said.

In a possible reference to the speculative pressure on international markets which may mount during the coming long weekend, Mr Tsang said: “We are prepared for the worst and we are working 24 hours a day dealing with the currency.”

The Government was forced into the action after unnamed investment banks, acting on behalf of international hedge funds, undertook heavy speculative selling of Hong Kong dollars in the past few days. The speculators’ aim was to drive up local interest rates which would result in sharp falls in stock and futures markets.

This in turn would enable the speculators to earn what Mr Yam said were “unacceptable profits” from the Hang Seng Index futures market where they had accumulated substantial short positions.

He vowed to beat these speculators. “I’m going to hurt them. I’m going to hit them where it hurts and tell them ‘don’t come here and make a lot of money by playing in our futures market’.”

However, by intervening in the stock and futures markets, the Government has opened another front in its defence of the pegged exchange rate. In previous assaults on the currency, the authority responded by forcing up interest rates which reduced speculative energy in the market.

The sharp decline in the number of shares changing hands amid the economic gloom has also made the market more susceptible to manipulation by speculators, the Financial Secretary said.

I’m going to hurt the speculators. I’m going to hit them where it hurts

I’m going to hurt the speculators. I’m going to hit them where it hurts

For the first time the Government had evidence that there was simultaneous speculative activity in the futures and currency market which, Mr Tsang said, was “a double play” by people who were trying to “play around” in an attempt to “make chaos” with the linked exchange rate system. “We will continue this action as long as it is necessary. The linked exchange rate is paramount.

“We are going to defend it. I have a duty to do so. It is in the interest of Hong Kong. I’m mounting an effective defence of the Hong Kong dollar and I could not do this entirely on the currency market,” he said.

The Financial Secretary bluntly rejected suggestions that his action contravened Hong Kong’s commitment to non-intervention. “I must emphasise that our long-standing policy of non-intervention in the stock and futures markets remains unchanged,” Mr Tsang said.

“No intervention may take place unless a sufficiently clear linkage exists between the currency play and the stock and futures markets play. I must make clear that we are not against the shorting [short selling] of Hang Seng Index futures by hedge funds. But we do not tolerate attempts by speculators to manipulate our interest rates so that they can benefit from the short positions they have built up in Hang Seng Index futures.”

The share buying, which saw some stocks rise by up to 16 per cent, encompassed all 33 members of the Hang Seng Index.

Although the Monetary Authority is the regulator of the local banking sectors, Mr Yam said there would be no conflict of interest for the Exchange Fund to buy banking stocks.

The Citizens Party condemned the intervention last night, criticising the use of taxpayers’ money without Legco approval.