Hong Kong may record its second worst deficit at more than HK$100 billion amid ongoing coronavirus pandemic: Paul Chan

- Government’s financial reserves might further dip to around HK$800 billion, Chan reveals on blog

- ‘Amid the economic slump, the government’s revenue is not going to meet its expectation while its spending is going up,’ finance chief says

The government has projected a budget deficit exceeding HK$100 billion (US$12.7 billion) for Hong Kong’s current financial year, almost twice the amount forecast, as revenue from stamp duty and land sales is expected to fall far short of expectations.

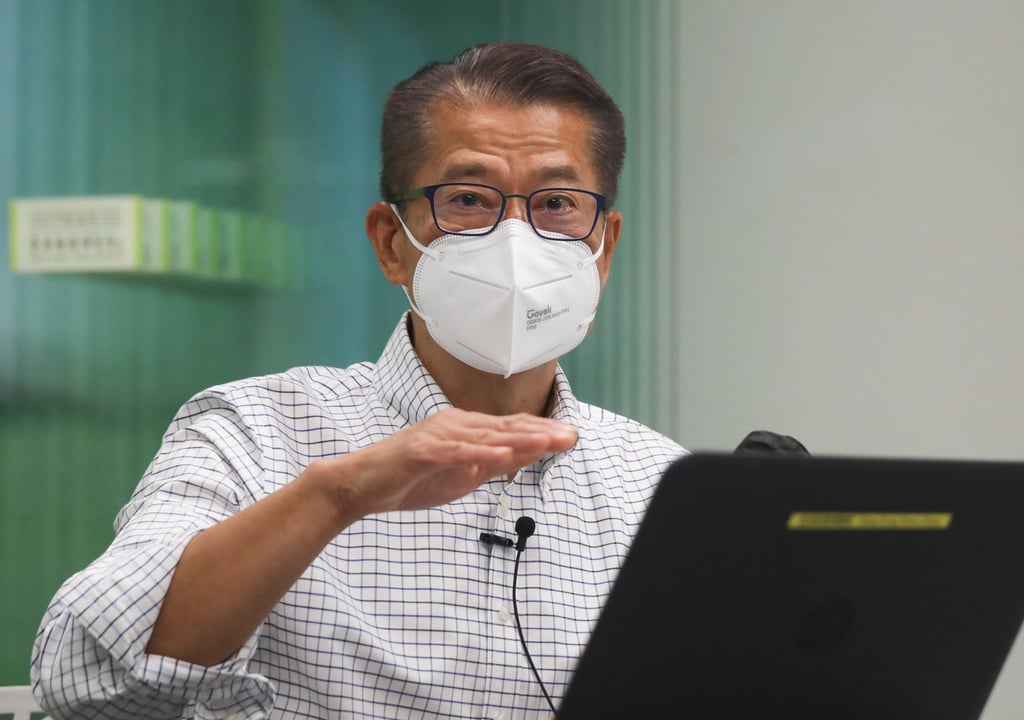

The deficit would be the second-largest after a shortfall of HK$232.5 billion was recorded in 2020, Financial Secretary Paul Chan Mo-po on Sunday said, noting growth had been sapped by the Covid-19 pandemic and a weak external economic environment. The government’s financial reserves could also further fall to about HK$800 billion, he warned.

“Amid the economic slump, the government’s revenue is not going to meet its expectation while its spending is going up. The financial situation of this year could be worse than expected under such circumstances,” he wrote on his weekly blog.

One expert argued that dropping the city’s requirement that arrivals quarantine in a hotel could help stimulate the economy and avoid the need for further government spending to offset the financial pain wrought by the pandemic.

Chan said the city might record a deficit of HK$100 billion this financial year, a significant increase from the HK$56.3 billion estimated in his budget speech in February.

“The deficit will be even more serious if we do not take the HK$35 billion gathered from the green bonds issued this year into account,” he said.

The pandemic and the tighter monetary policies of central banks had weakened economic momentum and affected Hong Kong’s growth, which was reflected in a drop in revenue from taxes, stamp duties and land sales, he said.

Revenue generated by stamp duties in the current financial year might be a third less than expected, Chan warned, given home purchases had dropped in the first four months by 37 per cent, while stock market deals between April and August had decreased by 26 per cent compared with the same period last year.