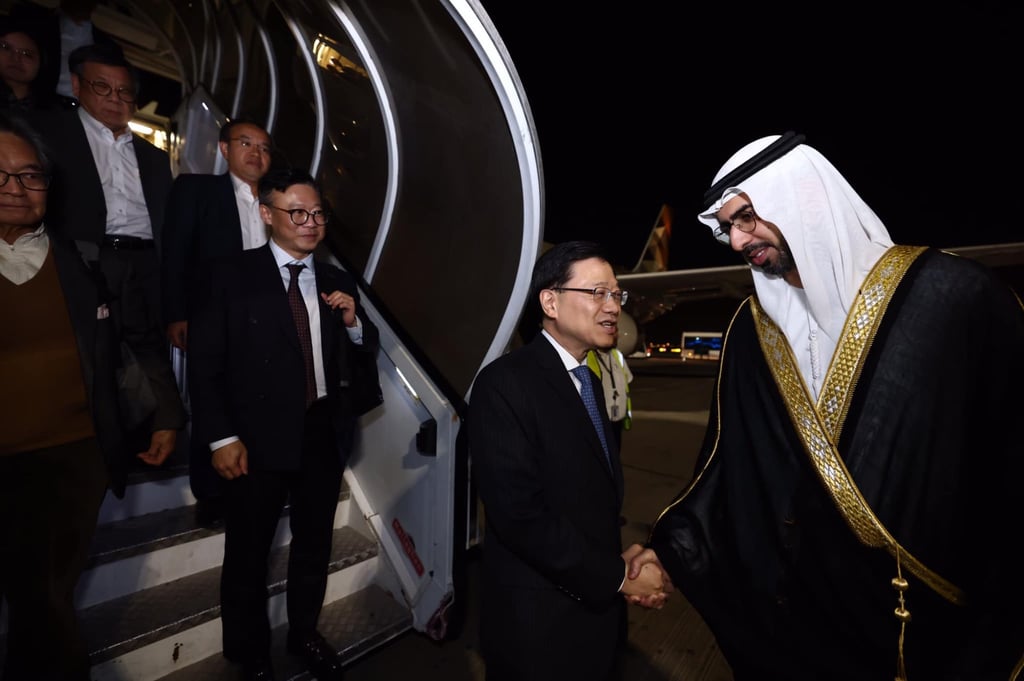

3 months after John Lee’s visit to Saudi Arabia, have Hong Kong firms made inroads? From pre-fab buildings to buses, businesses seek deals in region

- Hong Kong businesses reap benefits of city leader John Lee’s visit to Saudi Arabia and UAE in February

- As Gulf region attracts more foreign players, insider warns newcomers to be aware of ‘pro-local policies’

Managing director Ivy Lee Siu-wing told the Post the company had recently closed two deals on “multifaceted giga-projects” in Saudi Arabia and was in the final stages of concluding one in Qatar.

Leigh & Orange was among Hong Kong firms that rushed out Covid-19 isolation units during the pandemic by using the Modular Integrated Construction (MiC) method to build prefabricated parts, which were then assembled on site.

It also used the method to build InnoCell at the Hong Kong Science Park in 2021, assembling 418 prefabricated modules into a 17-storey dormitory in just 71 days, shortening the traditional building time by 40 per cent.

“Nowhere else other than mainland China has done projects of this sort of scale, at this speed. It’s a strong assurance that we are not selling dreams which may or may not work,” she said.

Lee, who was part of the Hong Kong delegation, said her firm followed up with their counterparts from the Gulf states, offering innovative solutions to development projects there.