As Hong Kong shoppers flock to Shenzhen’s megastores for bulk-buy bargains, can city retailers fight back?

- Membership warehouse retailers draw city shoppers by the busload, strong Hong Kong dollar helps too

- High rent and labour costs make it hard for megastores to set up in Hong Kong without government help

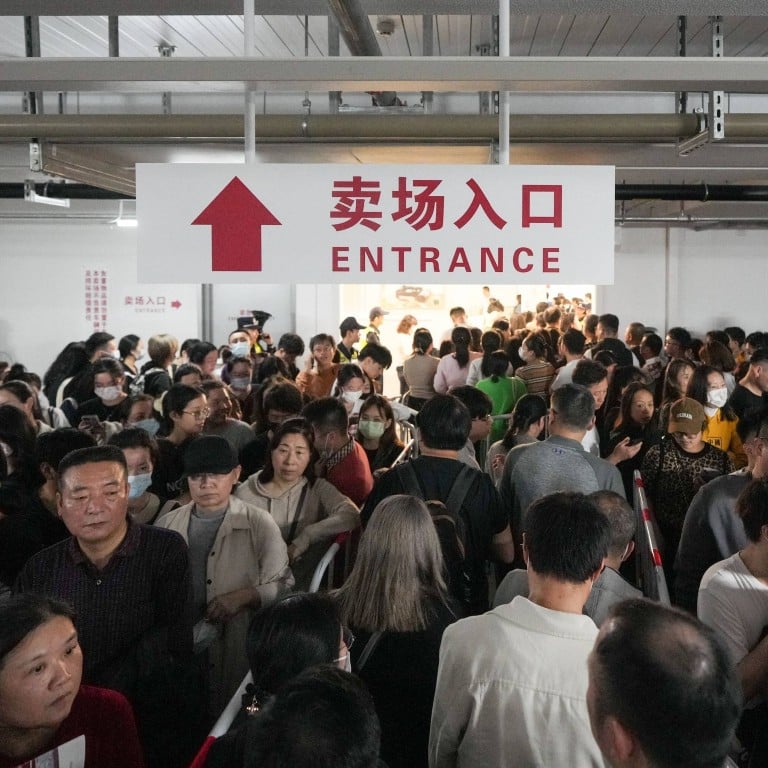

Hongkongers have taken to bulk-buying everything from tissue paper to snacks and electrical appliances in mainland China, lured by cheap deals at massive members-only megastores offering a wide variety of products.

Retail sector observers urged Hong Kong authorities to offer incentives to attract megastores to set up in the city or risk losing out to Shenzhen.

Google Trends showed that online searches from Hong Kong for Sam’s Club – an American membership warehouse retailer that opened its first mainland outlet in Shenzhen more than 27 years ago and now has four megastores there – began surging two months ago and peaked over the New Year weekend.

Costco Wholesale’s new store, which opened in Shenzhen’s Longhua district on Friday, fuelled Hongkongers’ bulk buying frenzy, with Google online searches for it outstripping those for Sam’s Club last week.

The stronger Hong Kong dollar against the yuan has also helped make shopping across the border more attractive.

IT worker Stephen Yu Kam-fung, 36, said he visited Sam’s Club outlets about six times in recent months to snap up bargains.

He said he made significant savings on his most recent shopping spree last week, when he filled two large trolleys with bulk-bought tissue, four bath towels, three jars of laundry detergent pods and delicacies such as roast chicken.

Baniel Cheung Tin-sau, an adjunct assistant professor at the University of Hong Kong’s business school, said: “Hongkongers like to chase bargains and the cheap deals available through warehouse shopping are definitely a lure. The goods in Sam’s Club are on average over 10 per cent cheaper than in Hong Kong with some even cheaper by half.”

Hongkongers flock to Shenzhen where their dollar takes them further

Having visited Sam’s Club in Shenzhen and some Costco stores in Japan, he added: “The megastores provide massive shopping space not seen in Hong Kong. Hongkongers like new experiences and easily fall for trends. All these have contributed to this growing phenomenon.”

Cheung said Hong Kong’s sky-high rents made it hard to woo such megastores to the city without government incentives, including land and transport infrastructure.

Agreeing, economist Simon Lee Siu-po said the mainland megastores could offer bargains because of the low rent and cheaper labour costs there.

“Megastores are unlikely to set up shop in Hong Kong due to the high operating cost, while the city’s market has been dominated by two supermarket chains, ParknShop and Wellcome,” said the honorary fellow at Chinese University’s Asia-Pacific Institute of Business.

“The idea of importing their success model simply won’t work in Hong Kong unless the government is willing to offer incentives such as rent relief or land.”

Megastores have operated in Hong Kong in the past.

GrandMart Warehouse Club, the city’s first discount warehouse-style membership store, opened in 1993 and expanded quickly to have seven branches, but folded suddenly in 1998.

The first outlet shopping centre, San Tin Shopping City, operated near the Shenzhen border for more than three years before it also closed. Lee said its sprawling site could be suitable for a new megastore.

Wholesale and retail sector lawmaker Peter Shiu Ka-fai said the new shopping craze was the result of the megastores’ bargain offerings.

“But this model is not suitable for Hong Kong due to its high rent and labour cost,” he said.

Mainland Chinese tourists drop shopping and chase Hong Kong’s ‘trending’ side

Instead, he urged the government to import more foreign labour to reduce the city’s labour costs and resume the multiple-entry visa scheme for mainlanders to visit Hong Kong.

“Hong Kong still has its own attractiveness such as its genuine goods with copyright protection and duty free products. The issue now is that we don’t have enough people coming to the city,” he said.

Tour operator Steve Huen Kwok-chuen, whose EGL Tours takes two to three busloads of Hongkongers a day to popular megastores in Shenzhen, said they eyed items not found at home, such as microwaveable burgers, snacks such as Mexican rolls, crab roe noodles and electrical appliances.

“On average, Hong Kong travellers spend over HK$1,000 each at Sam’s Club,” he said.

The tours, costing HK$459 to HK$559 per person, are fully booked for the rest of January. “The response has been overwhelming,” he said.

Huen said Hong Kong could not offer Shenzhen’s low prices, but it had to reshape its reputation as a shopping and a gourmet paradise by promoting its unique East-West mix.

“Hong Kong can still enhance its uniqueness and strength to attract visitors to spend on high-end products and services,” he said.

Summer slump bites hard for Hong Kong restaurants as locals, tourists change habits

Timothy Chui Ting-pong, executive director of the Hong Kong Tourism Association, said the city had to improve its service quality to make visitors feel that shopping and dining in Hong Kong was value for money.

“Hong Kong can never beat Shenzhen in the price war. The only way to beat Shenzhen is to raise its service quality so visitors will feel things are value for money here,” he said.

“Just like in Japan, tourists never complain about its higher prices because they are happy with its service quality. This is the only way to retain customers.”

Additional reporting by Willa Wu