‘Cathay Pacific should have alerted shareholders earlier about massive data leak’: calls for Hong Kong stocks regulator to probe matter

- Airline only reported case to stock exchange as ‘inside information’ when approached by the Post

- Disclosure questioned under Securities and Futures Ordinance, especially since announcement was made after Cathay’s interim results in August

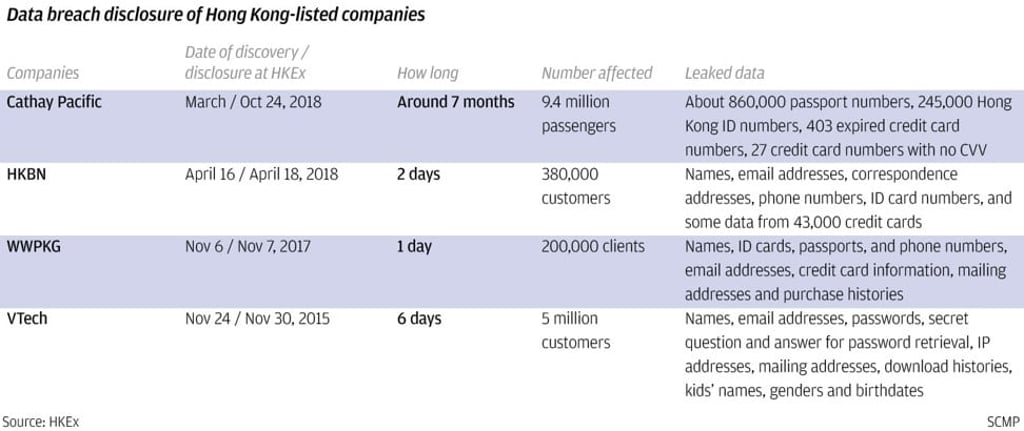

The five-month delay by Cathay Pacific Airways in notifying 9.4 million passengers about a data leak has sparked questions over whether the airline should have alerted its shareholders more promptly.

Legal experts said news of the breach in May could affect the company’s share prices and urged regulators to look into why it took so long for Hong Kong’s flag carrier to come clean.

One senior lawyer involved with public bodies overseeing financial policies and regulations noted that Cathay Pacific’s announcement on the night of October 24 was filed as “inside information”.

“The announcement showed the airline was treating the incident as inside information, as opposed to a voluntary disclosure, so it’s only a matter of when Cathay made that call,” said the legal source who did not wish to be named.

This was echoed by shareholder advocate David Webb: “From what is publicly known, it appears the board and senior management knew, or should have known, about the data breach by May 2018.