Police smash Hong Kong fraud syndicate with arrest of 11 over romance, investment scams totalling HK$4 million

- Cases stretched over 18 months with at least 24 victims, most of whom are under 30

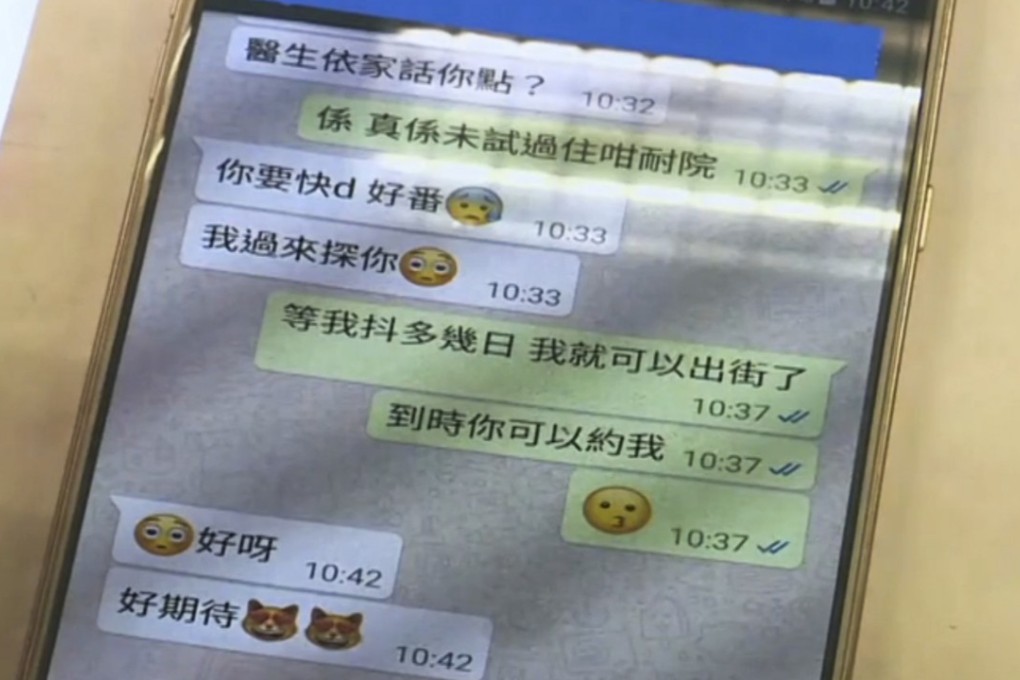

- Women in the racket believed to have supplied voices for fake social media accounts luring men

Eleven members of a Hong Kong fraud syndicate were arrested in an undercover police operation last week after victims lost about HK$4 million in online romance and investment scams stretching back to last year.

The month-long police operation, called “Jetblast”, led to the arrests of seven men and four women, aged 19 to 56. On Friday, officers seized HK$1.4 million worth of items ranging from cars and phones to luxury clothes and handbags.

Police said they believed they had shut down the organisation, which has duped at least 24 victims. “We have successfully dissolved an online investment fraud syndicate,” Acting Chief Inspector Billy Ho Yiu-chung of the New Territories North Region squad said.

“Police arrested four ringleaders including two involved in romance scams, two in charge of investment frauds, two bank account holders and others.”

The group, which started its operations 1½ years ago, was believed to have split into two branches, targeting distinct victim types.