Former clients of closed Hong Kong law firm demand the speedy return of HK$100 million frozen in its accounts

- Wong, Fung & Co was shut down by the Law Society after a clerk there was accused of misappropriating funds and other grievous breaches

- Now, scores of clients say they have been unable to complete the purchase of homes as their money, which had been deposited with the firm, has been frozen

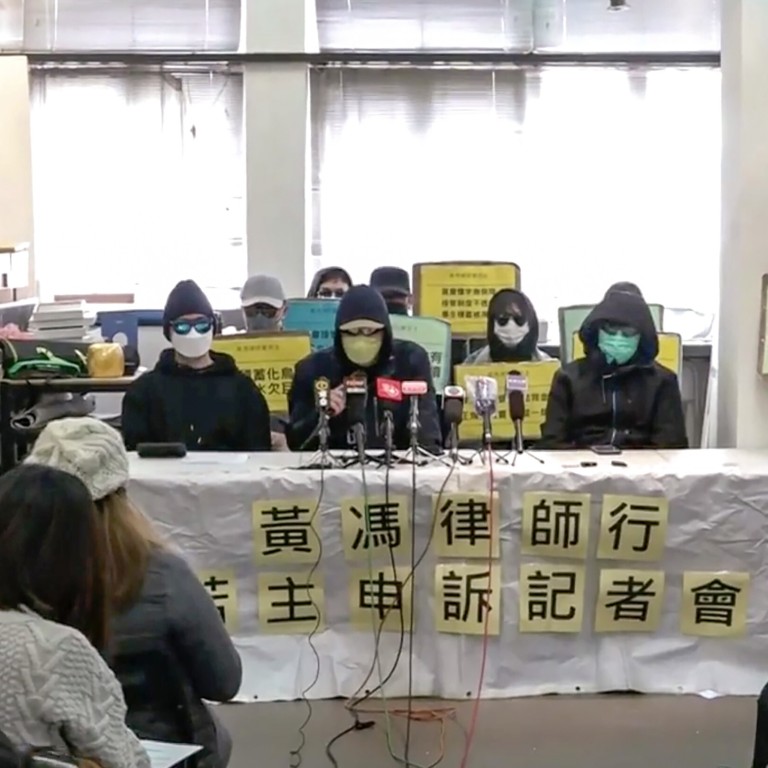

A group of victims affected by the closure of a major conveyancing firm that had misappropriated client funds has demanded the swift return of HK$100 million (US$12.9 million) belonging to at least 79 families hoping to buy new homes.

Last month, Wong, Fung & Co was shut down by the Law Society, which regulates the city’s 12,000 solicitors and some 900 law firms. It said a former clerk had misappropriated an unspecified sum of money from clients, and had committed other grievous breaches, such as overdrawing money from client accounts and allowing unqualified employees to sign off on client documents that required authorisation.

But on Sunday, a group of affected clients said they wanted the Law Society to release their funds, which had been frozen in the accounts of the law firm since its suspension, noting many of them had been unable to complete the purchases of new homes as they were unable to access their money or raise more.

Up to 10,000 clients affected as Law Society shuts down major conveyancing firm

“My deposit and stamp duty amounting up to HK$800,000 are now frozen in Wong, Fung & Co’s accounts. I had to borrow hundreds of thousands from my parents’ pension to pay for the house,” said a woman in her early 30s, who only wished to be identified by her surname, Chan. She had been planning to move into the house after marrying her boyfriend later this year.

“Everybody knows how hard it is for young people in Hong Kong to buy homes. I don’t know how many years it will take for me to get that money back now,” she said through tears at a press conference.

Another affected client said he hoped the government could intervene and prevent the other law firms that had taken over their cases from charging for their services.

The Law Society ordered the closure of the law firm on December 24, but did not disclose the exact number of clients affected or the amount of money involved, saying only that an investigation was under way. An insider had told the Post about 10,000 clients were affected.

The Law Society also did not reveal whether certain lawyers would be held accountable.

In a response to inquiries from the Post, the society said it had reported the freezing of the funds to the justice department, the Transport and Housing Bureau, the Stamp Office, the Monetary Authority and the Hong Kong Association of Banks.

“We called on them to do their utmost in helping the affected clients. There are now more than 100 law firms which are interested in helping those clients, and the Law Society will hold another press conference in the coming days to explain the latest situation,” the response read.

“As the regulatory body of Hong Kong lawyers, we hope that people understand that the law firm in question was involved in serious breaches of regulations and engaged in dishonest acts. The society must take swift action, and freeze the accounts. Delayed intervention would only cause more clients to suffer bigger losses.”

Among the 79 people, the single highest amount of funds frozen in the law firm’s accounts was some HK$10 million, though most families had deposited between HK$500,000 and HK$2 million with Wong, Fung & Co. More than half of the affected had funds for their deposits frozen, while a third were now unable to pay the remaining balance for homes they had bought.

The case has been reported to police and is being handled by the Commercial Crime Bureau.

In a previous statement on December 31, the Law Society had said it had appointed other law firms to help affected clients lodge claims for the return of money deposited with Wong, Fund & Co.

However, another affected client said he felt the whole process did not have clear enough guidelines, as questions still remained over whether the buyer or seller should be the one to claim back the frozen funds. “The biggest problem is there is no timetable for when all this can be settled,” said the man, who did not provide a name.

“I just want to know if the Law Society had taken into account the fallout from the suspension of Wong, Fung & Co,” he added.

The Post has reached out to the Stamp Office, under the Inland Revenue Department, for comment.