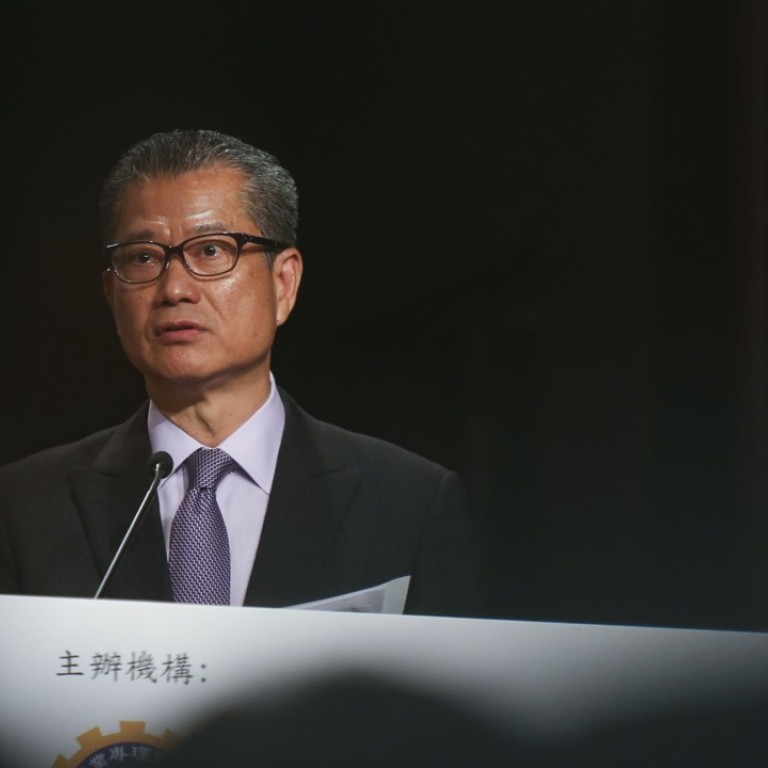

Hong Kong finance chief set to announce close to HK$50 billion in relief measures for city hospitals and taxpayers

Primary health care hubs planned for all 18 districts as Financial Secretary Paul Chan Mo-po’s budget theme stresses caring, sharing and diversifying

The package of relief measures would account for nearly 40 per cent of a HK$130 billion-plus surplus, more than the usual allocation of 30 per cent in previous years, according to a source familiar with the fiscal situation.

LATEST: Finance chief dishes out sweeteners worth billions to taxpayers

It is also understood that the three major themes of this year’s budget will be caring and sharing, diversifying the economy, and investing for the future.

While the relief measures are likely to include generous tax incentives for the middle class, a cash subsidy of HK$2,000 for students from poor families, a rates waiver, and more allowances for welfare recipients, including subsidies for the elderly, Financial Secretary Paul Chan Mo-po will also invest a substantial sum in innovation, covering biomedical technology and artificial intelligence, all aimed at broadening the city’s economic base.

Addressing the city’s ageing problems, which are pushing already overstretched public hospitals to breaking point with the increasing number of chronic disease patients, Chan is also expected to spend another substantial chunk of the surplus to set up a primary health care hub in all 18 districts in the long run.

Call to ease Hong Kong patient’s ‘living hell’ with drug subsidy to treat rare disease

Health minister Sophia Chan Siu-chee had a meeting with all district council representatives on Tuesday to examine parts of the city were ready to form the hub, which would offer community health care services to chronic disease patients and senior citizens through various satellite centres.

Lam announced the launch of a pilot project in Kwai Tsing district in her maiden policy address.

“The hub will serve three purposes: to prevent more people suffering from chronic diseases; to identify people with chronic diseases at an earlier stage; and to prevent their conditions from deteriorating rapidly,” said executive councillor Dr Lam Ching-choi, also chief executive officer of the Haven of Hope Christian Service.

Will Paul Chan dish out the sweeteners now or think long-term in Hong Kong budget?

Lam, without going into details of the budget, said the number of patients suffering from hypertension, diabetes, strokes and cardiovascular disease in Hong Kong would increase by at least 50 per cent over the next two decades.

A source close to the government said setting up these hubs would require considerable resources. Apart from identifying premises for health care centres, medical professionals such as nurses and therapists would need further training. The government would also need to pay NGOs and private operators for social and health services, which would involve Chinese medicine practitioners, dietitians and physical therapists among others.

Opinion: A few ‘selfish’ ideas for how to spend Hong Kong’s massive budget surplus

“It would take millions of dollars just to run one hub each year,” the source said.

Annual spending on all 18 districts would cost billions of dollars.

Chan is also expected to offer a more detailed tax break to encourage the public, especially the middle class, to join a voluntary health insurance scheme supervised by the government, a measure to divert more patients to private hospitals.

The annual subvention for the Hospital Authority could also see an increase of about 10 per cent to at least HK$60 billion this year, representing the biggest rise in the past five years. Last year, the increase was 7.4 per cent, after a record low of just 3.25 per cent rise in 2015-16.

Middle-class families to get ‘massive’ tax breaks in Hong Kong budget

Professor Peter Yuen Pok-man of Polytechnic University failed to see a comprehensive plan by the government to tackle the challenge of a rapidly ageing population and shrinking workforce.

He agreed that the city should focus on prevention more than cure, enhancing primary health care to reduce the number of patients developing acute conditions and requiring emergency treatment.

By doing so, Yuen suggested, the government would also strengthen the role of family doctors to boost long-term care for the elderly.

“Keeping on injecting money into public hospitals is not a cost-effective way as acute care is really costly. It should not be the way to handle the medical needs of an ageing population,” Yuen said.

“The biggest increase in subvention is good, but in the long term, it cannot increase unlimitedly as the city is seeing a shrinking workforce, which leads to a drop in the number of tax payers.”

Why history counts as much as balancing the books in Paul Chan’s budget for Hong Kong

As for a tax break incentive for the public to buy private insurance, Yuen said the returns would only amount to a few hundred dollars a year for those who paid thousands in tax – meaning it would not be attractive enough to make a difference to the current health care system.

“Young people are usually insured by their companies, and there is little incentive for them to buy another private scheme. As for the elderly middle class who are retired, they do not have to pay tax,” Yuen said.