Hong Kong finance chief Paul Chan dials down budget relief measures after smaller surplus

- Minister offers taxpayers HK$33.9 billion in rates and tax concessions, nearly HK$10 billion less than last year’s package

Hong Kong finance chief Paul Chan Mo-po scaled back the usual sweeteners in this year’s budget, given projections of slower economic growth and a smaller fiscal surplus.

He offered taxpayers HK$33.9 billion (US$4.3 billion) in rates and tax concessions, nearly HK$10 billion less than last year’s HK$43.3 billion package.

Individual earners will again enjoy a 75 per cent reduction in salaries tax for 2018-19 but subject to a lower ceiling of HK$20,000, compared to last year’s HK$30,000. The concession affects about 1.91 million taxpayers and will cost the government HK$17 billion in forgone revenue.

For businesses, taxes on profits will again be slashed by 75 per cent subject to a ceiling of HK$20,000, down from last year’s HK$30,000. It will benefit 145,000 taxpayers and cost the government HK$1.9 billion. Business registration fees will also be waived.

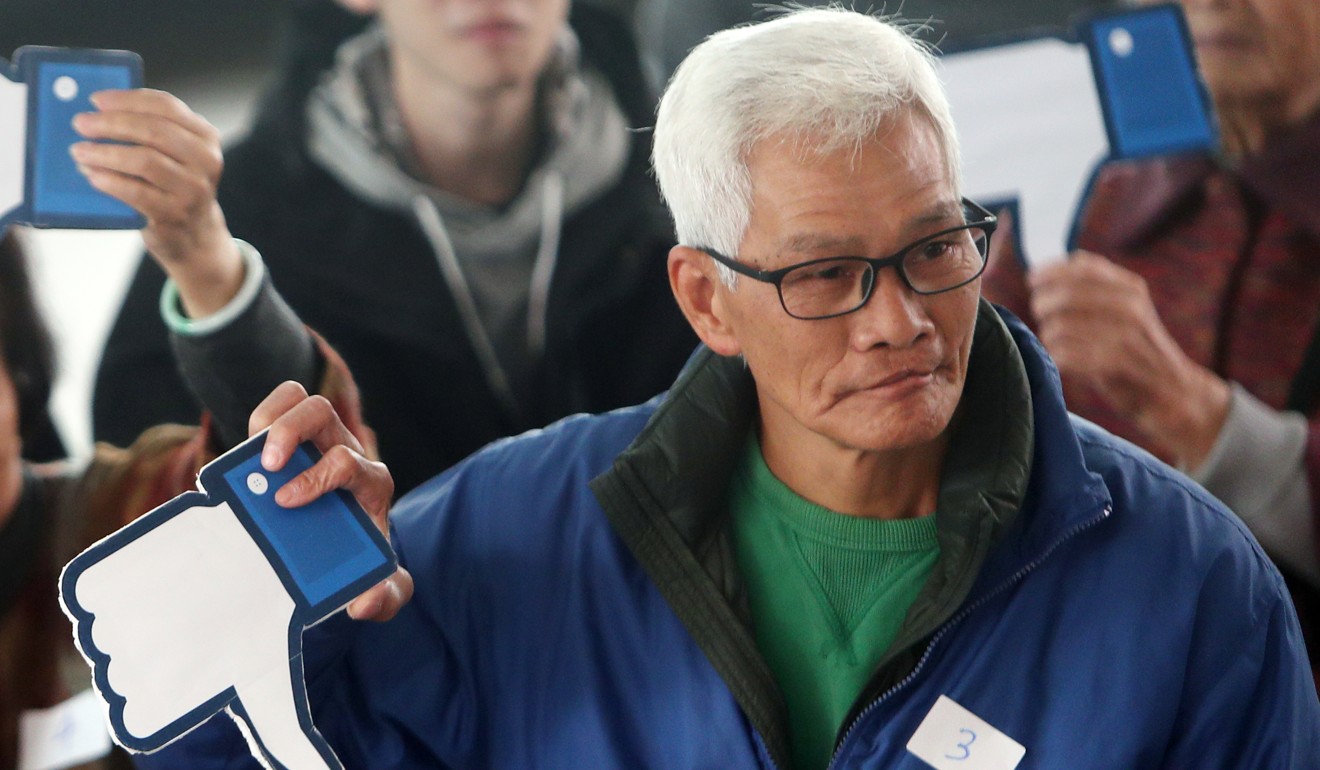

Economists said the less generous budget was reasonable in light of the smaller surplus, but lawmakers from across the political spectrum gave the thumbs down, with one saying the sweeteners were “as plain as water”.

As part of the administration’s bid to ramp up the city’s high-value-added maritime services industry and win back market share from competitors such as Singapore, Chan announced a 50 per cent profits tax concession for firms in marine insurance.

Property owners will continue to have their rates waived for all four quarters of the 2019-20 financial year but subject to a cap of HK$1,500 per quarter per rateable property, down from last year’s limit of HK$2,500. The owners of about 3.29 million properties will benefit.

Hong Kong budget 2019: six key takeaways, from tax relief to help for struggling businesses

Recipients of Comprehensive Social Security Assistance, old-age allowances and disability allowance who received two extra months’ worth last year will get only one this year. The same goes for those drawing the working family allowance and work incentive transport subsidy.

Needy students from the primary to tertiary levels of education will get a one-off grant of HK$2,500 – HK$500 more than last year – for learning support. And those sitting the Diploma of Secondary Education (DSE) examinations in 2020 will take them for free.

Chan said in his two-hour budget speech on Wednesday that government revenues were forecast to hit HK$626.1 billion in 2019-20 and operating expenditure HK$501.5 billion.

Against the backdrop of global economic uncertainties and threats such as a hard Brexit and the US-China trade war, the city’s economy grew by just 3 per cent last year, which he said was at the lower end of projections made in the previous budget.

Hong Kong’s ailing public hospitals to get HK$5 billion injection in Financial Secretary Paul Chan’s budget for investing in advanced equipment

The fiscal surplus for 2018-19 was estimated to be just HK$58.7 billion, a sharp drop from the record HK$138 billion in the last financial year.

Government revenue estimates had been adjusted to HK$596.4 billion, about 1.3 per cent lower than originally projected, owing to lower than expected revenues from land premiums and stamp duties, Chan said.

Dr Paul Luk Sheung-kan, an assistant professor at Baptist University’s department of economics, said: “The relief measures cannot be described as generous, but with the shrinking surplus and in the face of some structural problems such as the ageing population, it is understandable the government would take a more careful approach.”

But Yu Chu-pak, 62, who lives on welfare payments of about HK$3,800 a month, said the financial secretary was making his life more difficult.

“Last year, we had an extra two months’ worth of allowances, but this year only one. The difference is huge. With less in allowances, food becomes more expensive,” he said.

Yu appreciated the need to invest in the future, but added: “The government needs to take care of and address the current social issues.”

Chan told a press conference on Wednesday afternoon that he had taken into account the estimated surplus when planning his sweeteners. He said last year’s generous offering was unusual after a bumper surplus of HK$140 billion.

A government source said a waiver on rents rolled out last year for public housing tenants had been a one-off, and a more balanced approach was needed this year.

Unionist legislator Alice Mak Mei-kuen, of the pro-government Federation of Trade Unions, called Chan’s sweeteners “as plain as water”. She said student subsidies should have been offered to all.

Meanwhile, the Democratic Party accused the government of failing to help those not on welfare and also not benefiting from tax relief.

“The government should be fair and help all residents,” party chairman Wu Chi-wai said. He called on officials to continue last year’s practice of dishing out a HK$4,000 cash handout to each eligible permanent resident, but reduce the amount to HK$3,000.

Lawmaker Jeffrey Lam Kin-fung, of the Business and Professionals Alliance for Hong Kong, said the middle-class had been hard hit by the scaled-back relief measures.

“The middle-class are pillars of the city. They have paid a large amount of tax but enjoyed little in welfare benefits,” he said.

The Liberal Party’s Felix Chung Kwok-pan said Chan had not done enough to help small and medium-sized enterprises.

“The government has recorded a fiscal surplus of more than HK$50 billion in six of the past 10 years. This year’s HK$58.7 billion is not small at all,” Chung said. “We are a bit disappointed – the finance chief could do much more.”

And Labour Party lawmaker Fernando Cheung Chiu-hung said the budget placed too much emphasis on economic development at the expense of people’s livelihoods. The sweeteners mainly favoured the middle class and would worsen income inequality, he added. An analysis by his party had showed that for every HK$1 given to the poor, HK$4.70 would be allocated to the city’s middle and upper classes.