Russians lose access to some banking services in Hong Kong due to Western sanctions over Ukraine

- HSBC sends out letter, seen by Post, saying lender unable to provide investment services to Russian nationals who are not European Union residents

- While HKMA notes local banks can ignore unilateral sanctions imposed by foreign governments, legal experts say most lenders will not take the risk

Russian businesspeople in Hong Kong have reported encountering difficulties carrying out banking due to Western sanctions over the Ukraine war, with at least one major lender suspending investment services to the nation’s residents based in the city, the Post has learned.

A source familiar with the Hongkong and Shanghai Banking Corporation (HSBC) confirmed the bank had sent a letter to most of its Russian clients in the city over the suspension of retail investment services because of sanctions enacted by the European Union.

But the suspension would not affect clients’ personal savings accounts or other personal banking needs, the insider said.

While the Hong Kong Monetary Authority (HKMA) said local financial institutions were not obliged to implement unilateral sanctions imposed by foreign governments, legal experts cautioned that banks in the city with a global presence could not risk losing major markets in the US and Europe by ignoring punitive measures they enacted.

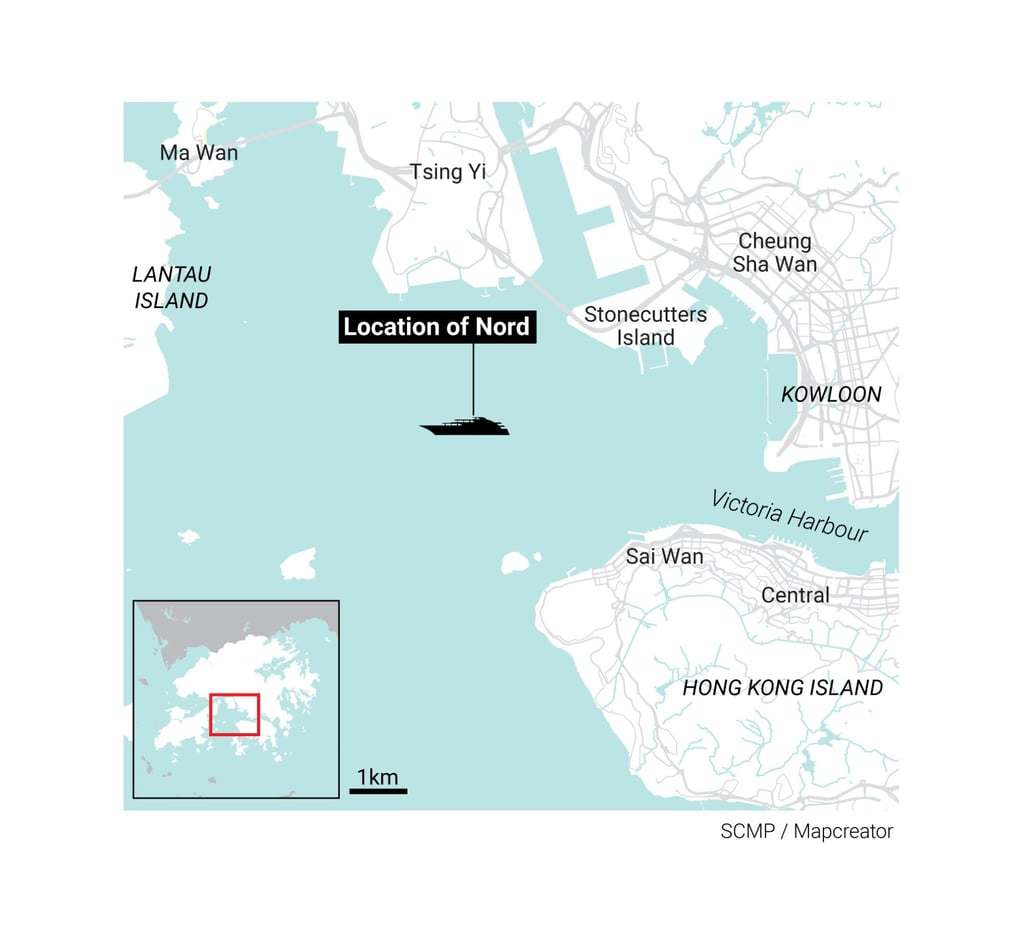

This past week, Hong Kong was caught in the middle of a diplomatic row when a HK$3.9 billion (US$497 million) superyacht believed to be owned by Alexei Mordashov, a steel and mining tycoon considered an ally of Russian president Vladimir Putin, was found docked in the city’s waters.

The United States warned that Hong Kong’s status as a premier international financial centre depended on its “adherence to international laws and standards”, after the city reiterated it would not implement unilateral sanctions imposed by other jurisdictions. Beijing accused the US of trying to “smear” the city’s business environment, saying its reputation as a banking hub was globally recognised and “brook no vilification”.

Igor Sagitov, Russia’s consul general in Hong Kong, said he had received reports of his fellow nationals facing difficulties with some financial transactions in the city.