Hong Kong subsidised flat buyers earned ‘more than HK$2.5 million each’ in quick resales, concern group calls for speculation curbs

- Federation of Public Housing Estates flags profiteering practice in which buyers resold properties three to five years after purchase, at double the original tag

- Housing Authority adviser says it will look into restrictions, though minister had earlier pointed out such transactions accounted for only 1.6 per cent of secondary market

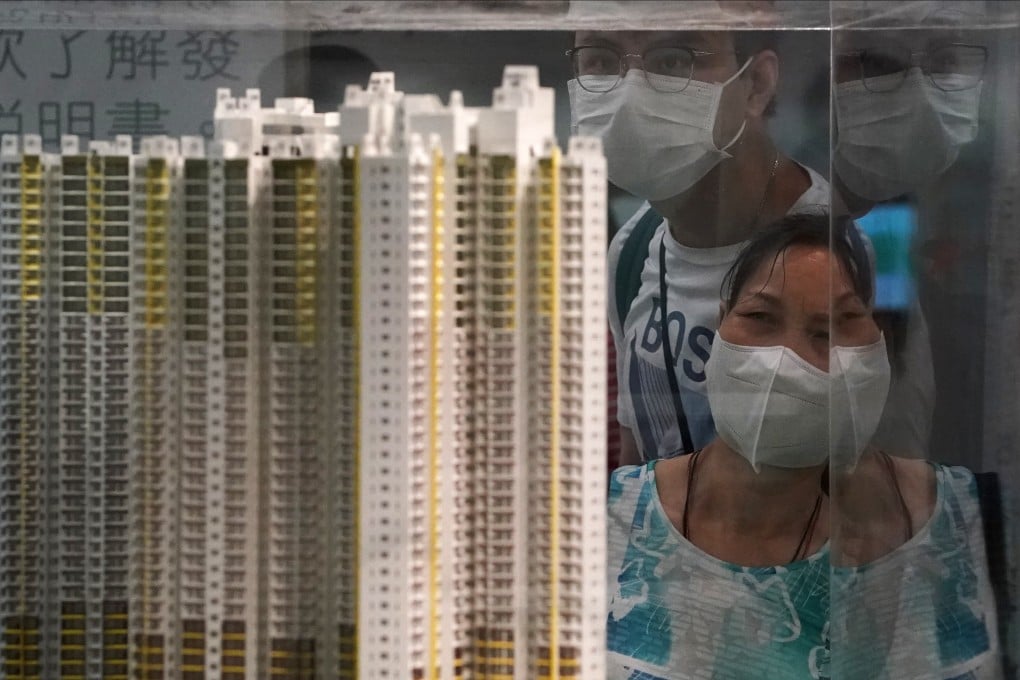

More than 160 buyers of new government-subsidised flats in Hong Kong have on average earned HK$2.53 million (US$324,43o) each by quickly reselling the properties at double the purchase price, a concern group has found.

The Federation of Public Housing Estates, an alliance, said on Wednesday such homes had become commodities for profiteering, with a leading adviser for the Housing Authority adding it would look into setting up more restrictions against speculation.

The concern group found a total of 167 buyers of new flats built under the authority’s Home Ownership Scheme (HOS) had resold their flats within three to five years after purchase. The flats are located in 11 HOS estates constructed from 2014 onwards.

On average, these homeowners resold their properties at a price higher than the original by 101.8 per cent.

The HOS targets low- to middle-income households, with prices set according to their affordability.

Currently, owners of the subsidised homes can only resell the flats at the original price within the first two years of purchase. From the third year, the price can be freely negotiated in a so-called secondary market, where buyers are either tenants of public rental housing, or those on the waiting list for such homes.

Sellers are not required to pay back the premium – the discount first enjoyed when the flat was bought from the authority.