China Southern Airlines to quit Skyteam alliance of carriers, with potential danger for Hong Kong’s Cathay Pacific

- Guangzhou-based carrier to leave in the new year, sparking talk it might join Oneworld

China’s biggest airline is leaving one of the world’s major aviation alliances, shaking up travellers’ options and possibly signalling a realignment that could have big implications for Hong Kong’s Cathay Pacific Airways.

Guangzhou-based China Southern Airlines, one of the world’s 10 biggest carriers, said on Thursday it would quit the Skyteam alliance on January 1, 2019.

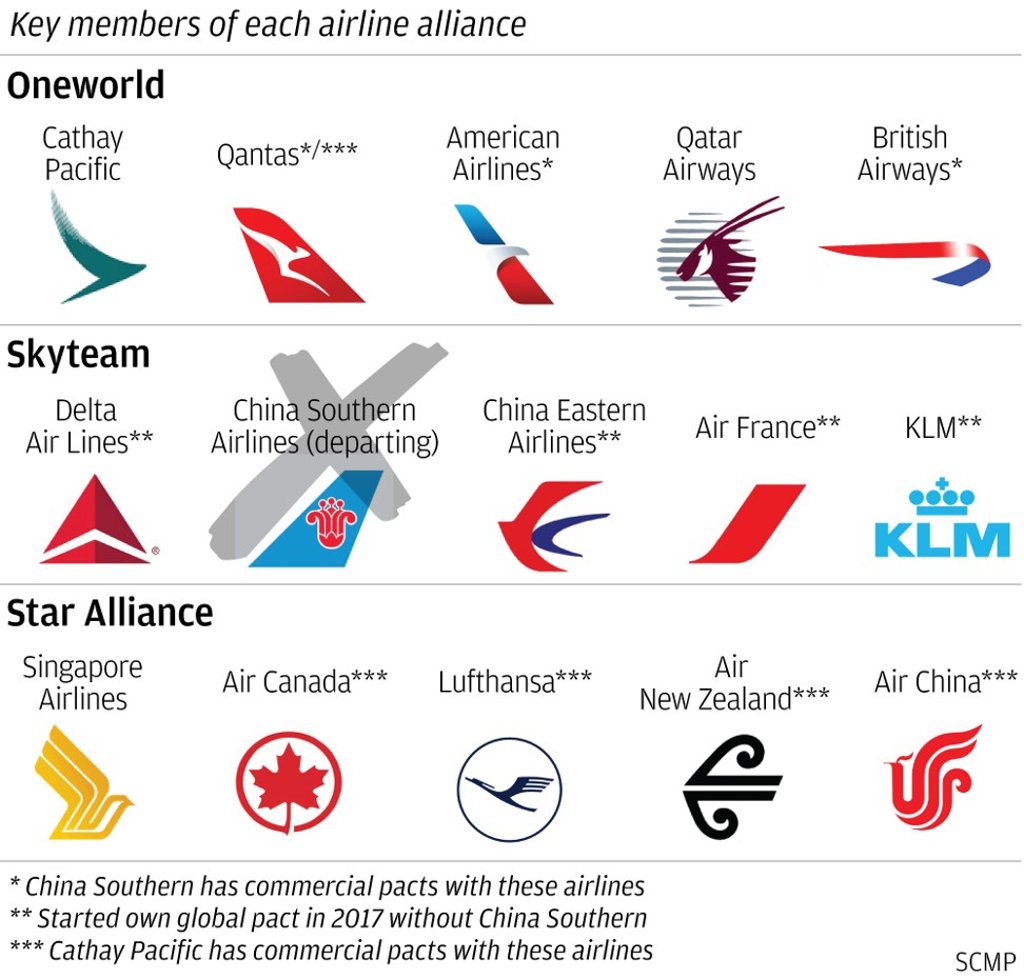

Major airlines are in one of three global airline clubs – Skyteam, Star Alliance and Oneworld, which counts Cathay Pacific as a key member. Airlines’ frequent flier members can use the points with their companies’ partners, and can benefit from a wider range of destinations on one booking. Code-share arrangements between the allies are common.

Announcing the split, the airline said: “The company will explore the possibility of establishing new partnerships with advanced airlines around the world, promote bilateral and multilateral cooperation and provide quality services to passengers around the world.”

Skyteam CEO Kristin Colvile said it respected the airline’s decision and wished it well.