Hong Kong travel agents fear cash squeeze as Cathay Pacific targets tickets sales in money-saving move

- Industry group fears commission earnings could take a hit and accuses airline of trying to undercut its members

- Airline says city’s travel agents have to ‘embrace change’ and adapt to a new reality

The airline is reportedly considering changes to how its tickets are sold, and wants the industry to get on board as it looks to save money, and reduce the cost of selling a seat.

For travel agents, that could mean losing the commission they earn when they sell a flight, and for passengers it could mean the end of cheaper air fares.

The Society of IATA Passenger Agents (SIPA), a coalition of the largest travel agents in Hong Kong, is afraid the airline plans to undercut its members and wants to lure more passengers to book directly with them.

03:43

Cathay Pacific Airways announces its largest job cuts in history

“Airlines around the world have been looking for more cost-efficient ways to distribute their products and Cathay Pacific is no exception,” a company spokeswoman said.

“Hong Kong’s principal airline has a duty to the community, and the travel industry that provides tens of thousands of jobs,” Tam said.

“This predatory pricing putting profit before the welfare of the trade is shabby thanks for all the taxpayer-funded support they have received.”

Hong Kong Airlines cautious on expansion in wake of Cathay Dragon shutdown

Highlighting the struggles for the sector, Travel Industry Council executive director Alice Chan Cheung Lok-yee told the Post that 73 travel agents had gone bust between the start of the pandemic and the end of September. Most employed between five and six staff, while some larger ones had 10 to 15 employees.

The society’s concerns stem from a private meeting in early September involving Larry Lo, one of its board members, and Cathay senior manager Patton Chan.

Sources said during the meeting, the society was warned of forthcoming changes to the way the airline would do business with travel agents.

In a subsequent letter to Cathay Pacific executive director Ronald Lam Siu-por last month, Tam wrote: “Cathay naturally employ direct channels to further bolster your business and these should be complementary and not compete directly with the very travel agency customers who generate the bulk of your load factors.”

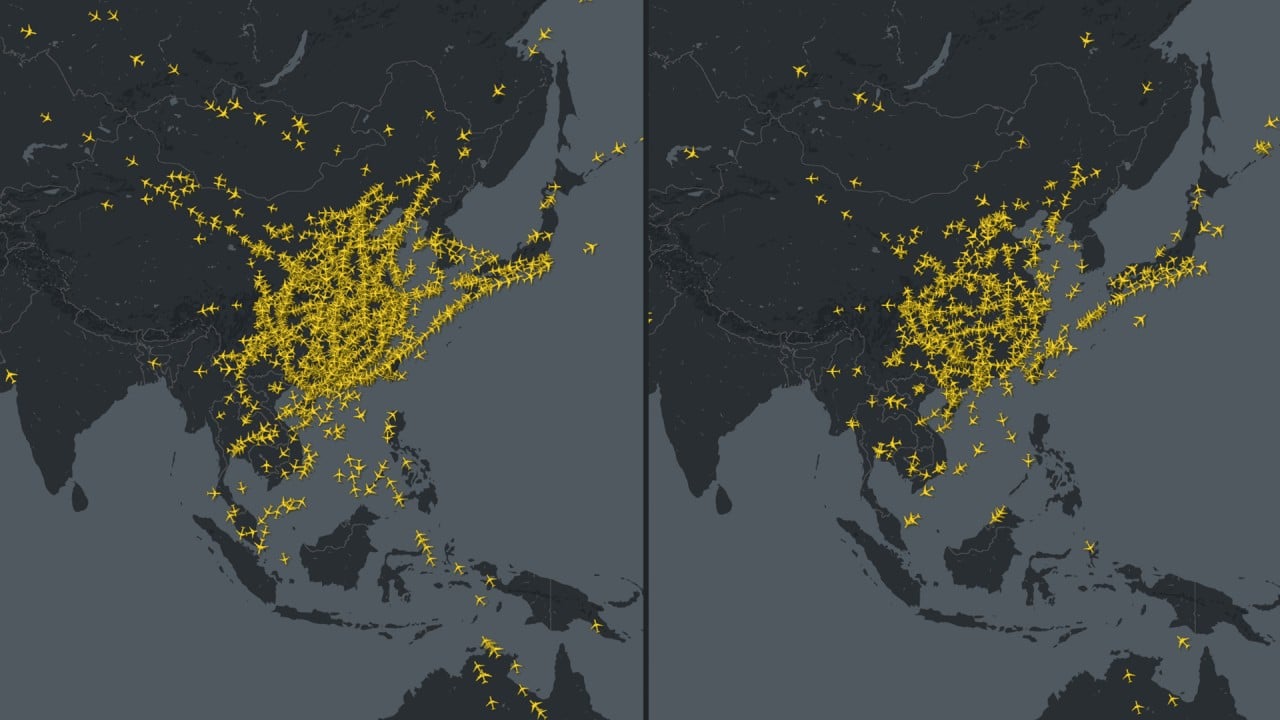

03:51

Tracking the massive impact of the Covid-19 pandemic on the world’s airline industry in early 2020

The society said agents sold fares at a discount of 1 to 3 per cent compared to Cathay’s, enough to allow members to compete fairly and remain in business.

Airlines globally have sought to slash distribution costs by charging travel agents a surcharge per ticket sold. Among them are British Airways at £8 (HK$81), Lufthansa at US$21 (HK$163) and Singapore Airlines at US$12 (HK$88), which have done so to encourage agents to boost revenue. Cathay does not disclose distribution costs clearly in its financial reports.

Singapore, Germany agree on ‘green lane’ for business travellers

Lo, a former SIPA chairman and Asia CEO of Westminster Travel, said once air travel came back, the society’s members should consider whether to work with Cathay at all.

“Once air travel recovers, SIPA will explore all avenues to support airlines … but Cathay may not be one of them,” he said.

Transport analyst Luya You, of Bocom International, said distribution costs had been falling over the years, and said airlines’ “biggest gripe” with travel agents was they did not have as much power over marketing-added services.

“These products are increasingly important since margins on fares have become razor thin, so the move towards direct sales is also a push for more control over product marketing, rather than purely a cost-saving tactic,” she said.

“I don’t think Cathay could generate significant cost savings from this at once, but it’s still a worthy goal over time.”