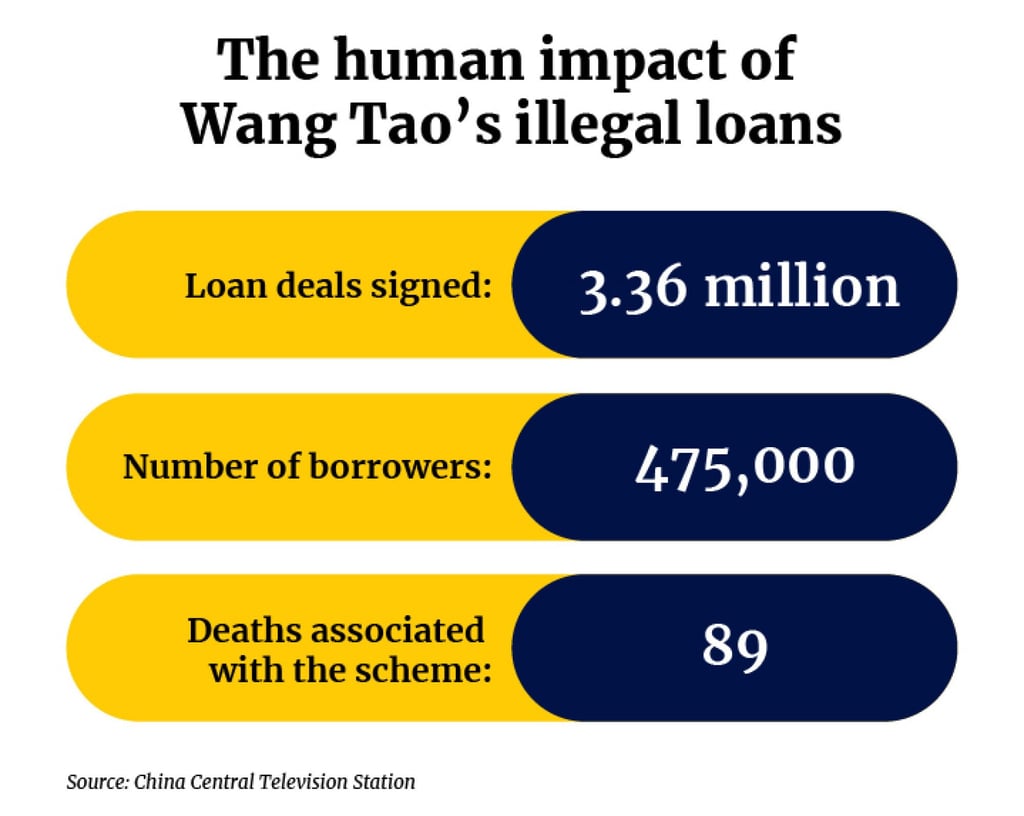

A multi-billion dollar criminal lending scheme resulted in 89 deaths in China: CCTV

- The scheme would trap people in illegal loan contracts that resulted in annual compound interests as high as 5,214 per cent.

- One man borrowed 2,000 yuan (US$305) before eventually owing 700,000 yuan (US$107,000) in a vicious cycle of predatory lending.

The gang implemented aggressive collection tactics blended with vicious interest rate schemes, believed to have contributed to the suicides of 89 people in China.

Wang’s illegal enterprise lured unsuspecting borrowers with enticing terms such as “interest-free for seven days” or “low threshold, fast loans” in contracts that often resulted in annual interest rates of between 1,303 per cent to 5,214 per cent if the borrower could not pay off their debt quickly. According to Experian, a credit rating agency, the average interest rate for an above-board personal loan is 9.4 per cent.

The crime ring, which had no lending license, would also issue what police call “trap loans,” which did not include terms for defaulting, which sometimes resulted in borrowers selling their properties to pay off debts.

The documentary said, “The fundamentals of the loan, also known as a trap loan, is you can not pay it off at all even though you go bankrupt. Under the disguise of a legal loan, every loan is a debt stained with blood.”