Chinese police thwart online fraudsters about to nab US$3.7 million from woman’s bank account

- A fake caller who said they were from a school in which the potential victim’s child had actually enrolled was offering a refund of fees

- An anti-fraud app the woman had the presence of mind to download after the call allowed police to step in

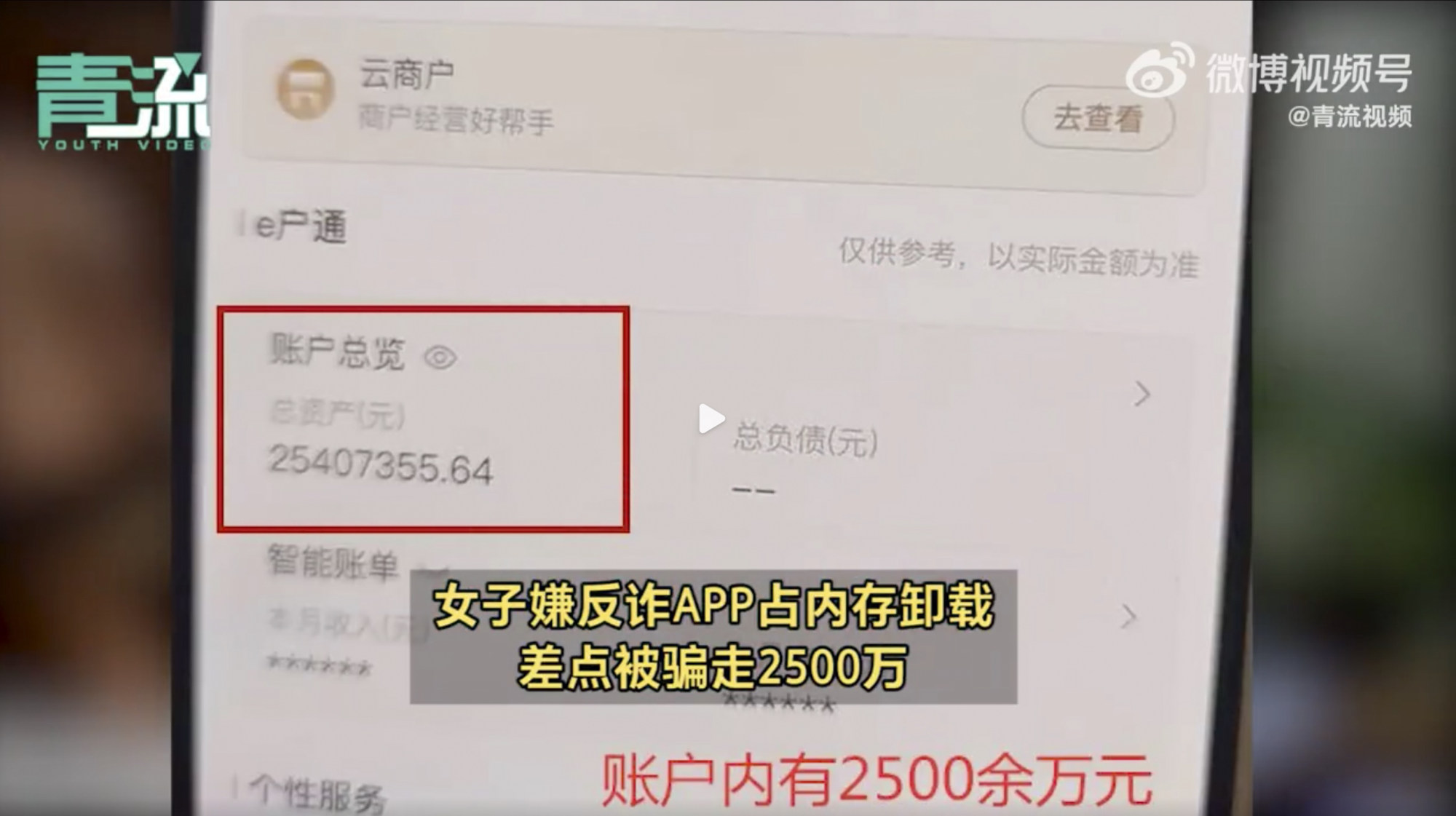

Online fraudsters shaping to make off with the 25 million yuan (US$3.7 million) savings of a woman in eastern China were thwarted when local police called the would-be victim to warn her.

The Hangzhou woman, surnamed Sun, almost had her bank account emptied after she received a call from someone pretending to be a member of staff from a training school her child had attended. The fake staff member offered her a refund of fees, claiming the school could do so due to its improved financial situation.

The June 1 call – which came from a number starting with double zero – purported to come from the customer hotline of the training school at which her child had, in actual fact, enrolled. This fact meant Sun let her guard down and believed the call to be genuine, according to Chinese video news platform Youth Video.

Sun listen carefully to the details of the offer – that she would receive a refund of more than 7,000 yuan (US$1,040) from the school that had been in financial turmoil and disappeared.

However, the potential victim was not fully persuaded that the offer was genuine and decided to download an anti-fraud app to her phone.

Next, Sun joined a Tencent QQ group that claimed to have been set up to facilitate the return of tuition fees to enrolled students. A service coordinator guided Sun to make an account, after which Sun handed over private details such as her bank account and Chinese ID numbers.

A short time later, her phone rang again and this time the caller said they were from the local police. Sun was dubious, despite the police warning her she was encountering a scam. It took the police turning up in person at her home soon after to convince her they were genuine.

‘An Adam’s apple?’ scammer in make-up cons man out of US$8,700 over 6 months

“I chose to believe it (the initial call) because I had paid tuition fees to the school on my child’s study, otherwise I wouldn’t trust it,” Sun told the police.

After ensuring Sun’s bank account was safe, the police convinced her to use an anti-fraud app developed by the criminal investigation department of the ministry of public security.

Sun said: “I did use the app, but I deleted it on my phone as I thought it took up space. Now I will remember.”

News of her experience went viral on Chinese social media and while many people thought the app did help protect her, a few argued it could compromise her privacy.

Many Weibo users quipped: “Mrs Sun, couldn’t you afford to buy a phone with a larger memory?” One asked: “How did the swindlers precisely find the wealthy group?”

Another said: “I must make sure I have the app on my phone.” But someone else questioned: “I knew the app would help, but would we be at risk of being tracked?”

In response to a huge rise in online scams in China, in March last year the ministry of public security launched a national anti-fraud app as a tool to identify fraud accurately.

Officials said that in 2021 the app has prevented more than 320 billion yuan (US$48 billion) from being scammed, and it has protected the bank accounts of more than 28 million people.

However, according to Chinese state-backed news outlet the Global Times last year, the popular app was slammed by Western countries as a tool to track access to overseas financial news sites.

.JPG?itok=NUwH9YK3&v=1713190226)