Eyeing a presidential run, Jeb Bush cuts some of his financial ties

With presidency in his sights, he hopes to avoid criticism that hit wealthy Mitt Romney

When Jeb Bush completed two terms as governor of the US state of Florida in 2007, he reported his net worth at US$1.3 million, about US$700,000 less than when he took office.

Today, nearly eight years later, he is a wealthier man. He has plunged into business and entrepreneurial ventures involving consulting, the paid lecture circuit and energy development. He has developed real estate, advised international investment banks and joined high-paying corporate boards.

But as he considers a run for president in 2016, Bush has begun to unwind some of his financial affairs, apparently to avoid the kind of criticism that hobbled fellow Republican Mitt Romney in his unsuccessful bid for the White House in 2012.

Bush is quitting Tenet Healthcare Corporation, a company that has profited from Obamacare - and is ending a consulting contract with Barclays Bank to focus on his political future.

Aides say he also has stopped giving highly paid speeches to focus on travelling around the United States, meeting with potential donors and testing what a friend calls a "visionary" brand of campaigning.

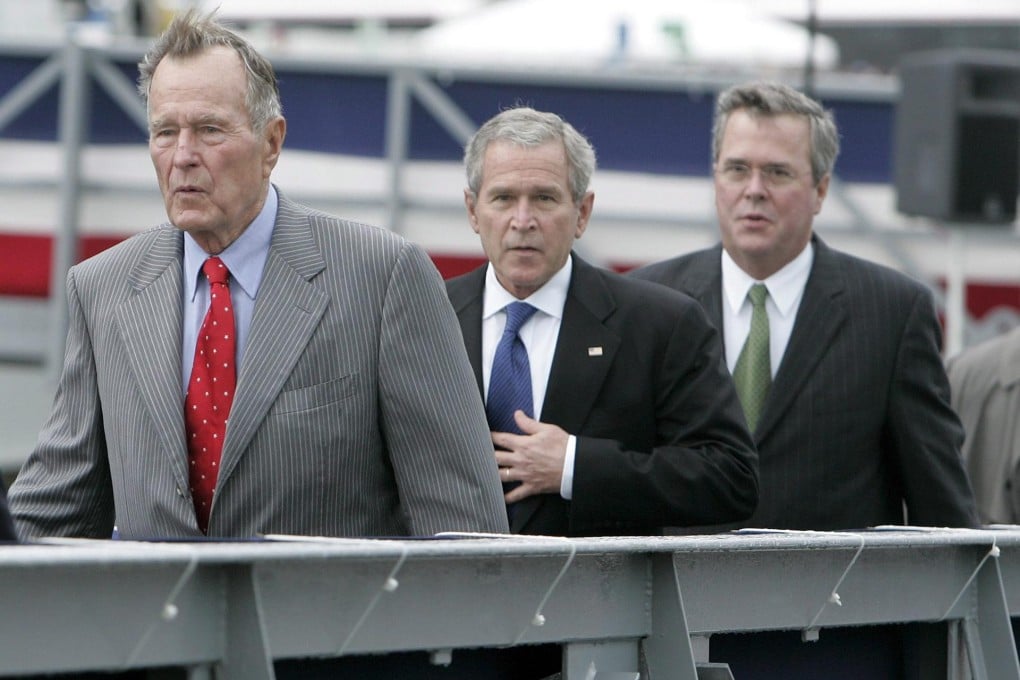

But Bush's business record, enmeshed in international finance and some troubled former ventures in south Florida, could end up complicating his return to politics and his hopes to follow his father, George H.W. Bush, and his older brother, George W. Bush, into the Oval Office. Last year, he took a step into the rarefied world of private equity and offshore investments, joining with former banking executives and a Chinese airline company to make bets on natural gas exploration and shipping. One of the funds was set up in the United Kingdom, a structure that allows the company to shield overseas investors from US taxes.

During the 2012 race, Romney drew ceaseless attacks from Democrats for his lucrative work at Bain Capital, a pioneering venture capital company that bought scores of troubled companies, took over their management and sometimes laid off employees while garnering huge fees and payouts.