As trade tensions rise, Chinese investors move away from high-profile US properties to avoid Beijing’s wrath

Lesser known US assets that offer slow but steady returns – and are less likely to catch the eye of a vengeful Chinese government – are now more attractive to Chinese investors, analysts say

With Beijing clamping down on Chinese investment in the US amid threats of tit-for-tat trade sanctions, Chinese deal makers, once drawn to the glitziest real estate, have largely moved away from high-profile US properties.

Instead, they are turning to lesser-known assets that lack the glamour and possibility of fast profits, but offer slow and steady returns and are unlikely to draw Beijing’s attention.

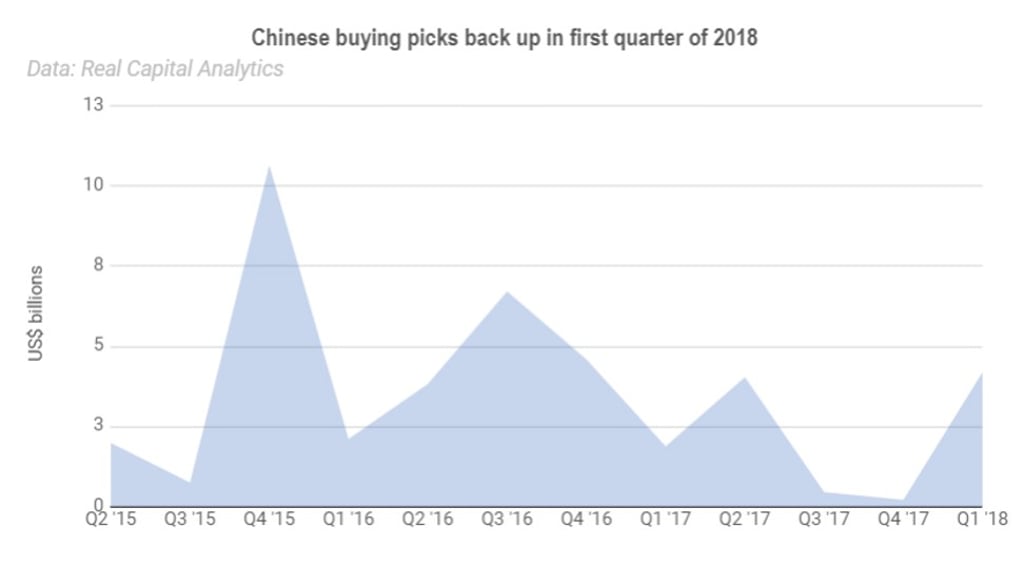

Deal volume in the most recent quarter jumped to the highest since the third quarter of 2016 after a lull. In the first three months of 2018, the amount of capital from China and Hong Kong deployed in the US commercial real estate rose to US$5.2 billion, nearly tripling the total amount in the entire year of 2017, according to Real Capital Analytics, a New York-based commercial real estate data provider.

“In contrast to the trophy assets Chinese investors tended to go for a few years ago, we now see Chinese buyers target deals that are much lower-profile,” said Richard Barkham, global chief economist at CBRE, a real estate service provider and investment firm based in Los Angeles.

“They are going for office buildings and multifamily properties that are less known.”

The largest deal in the quarter was the purchase of Global Logistic Properties (GLP), Asia’s largest warehouse operator, by a group of Chinese investors in January.