Growing global links mean Turkey’s lira crisis poses risk to world economy

Turkish government has so far refused to employ the traditional remedy of sharply raising interest rates

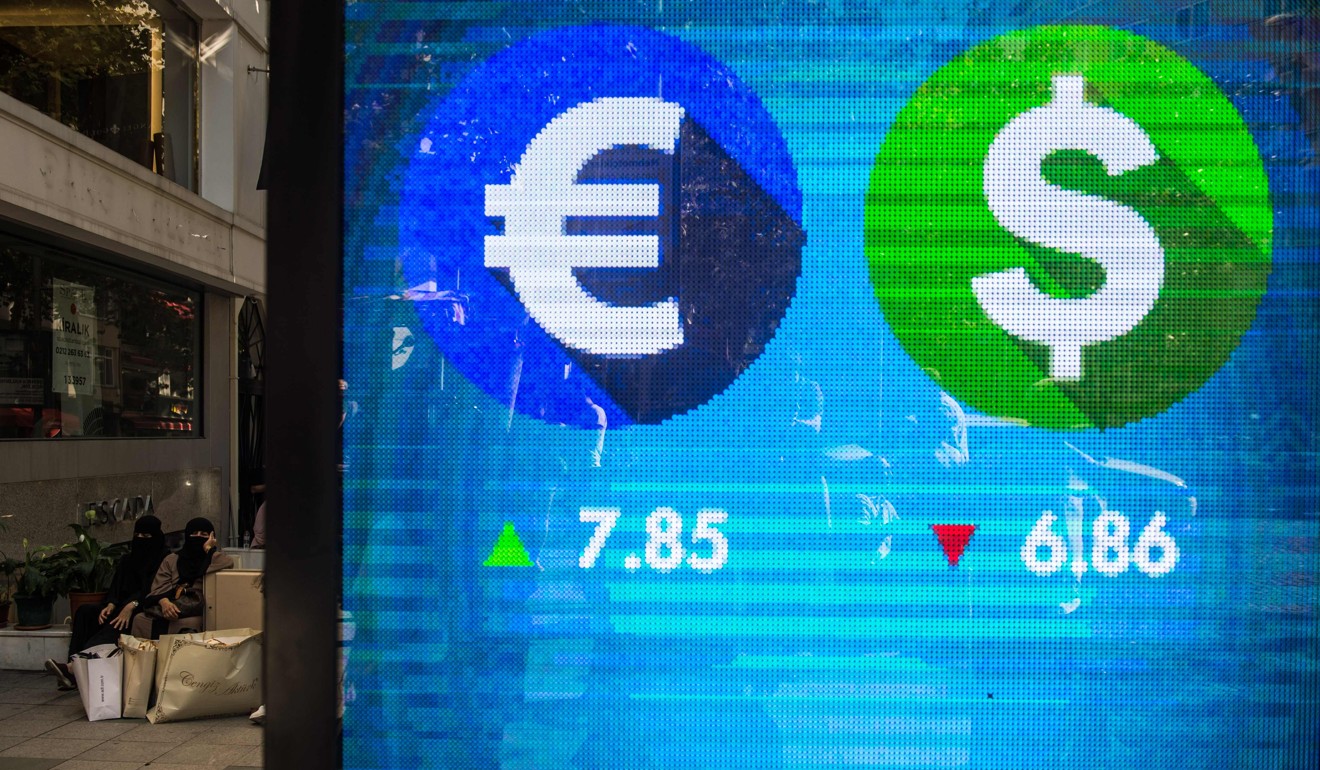

The escalating political dispute between the United States and Turkey, along with the sharp drop in the value of the Turkish currency, the lira, have captured front-page headlines in recent days. The political dispute threatens to realign major alliances while the drop in the lira threatens to undermine the global economy if it continues.

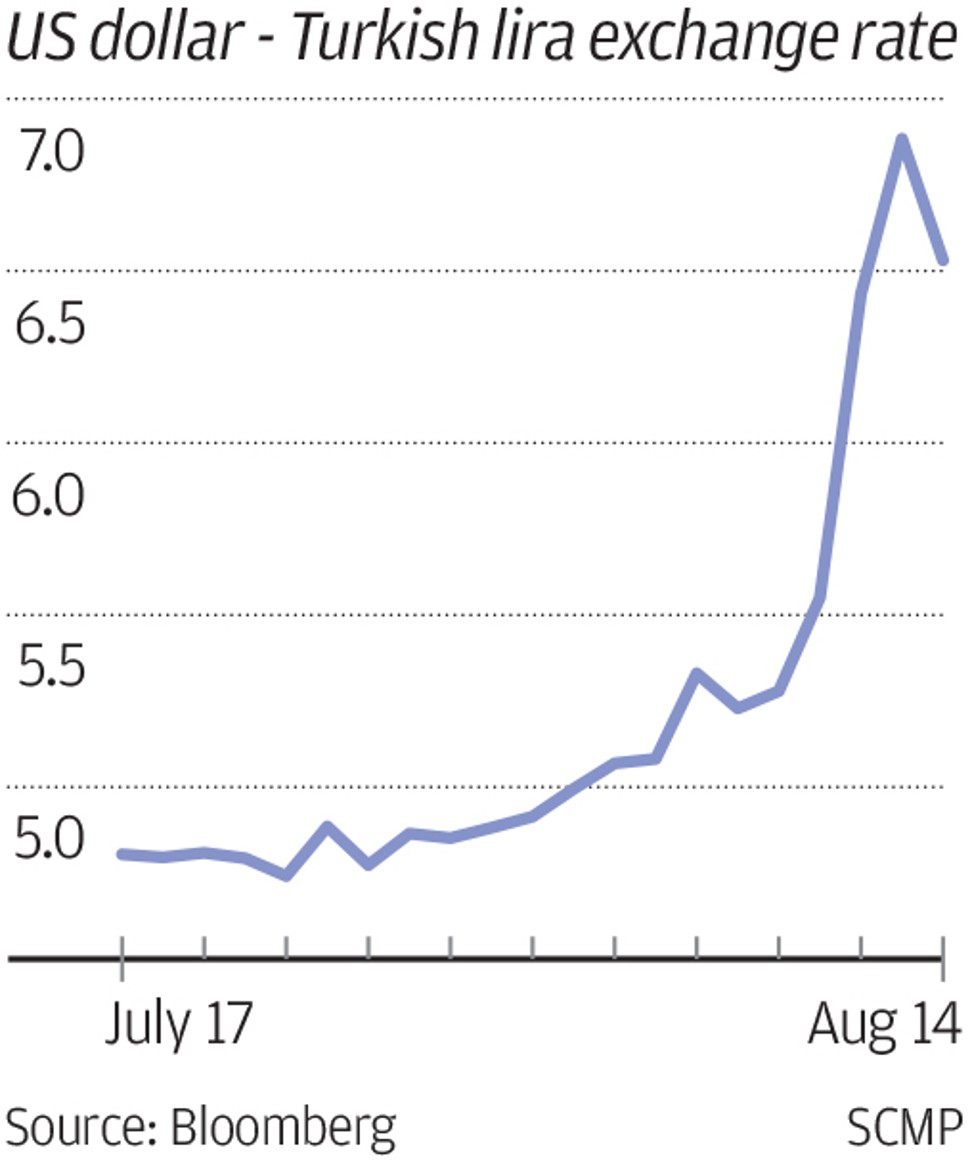

The lira stabilised against the US dollar on Tuesday just above the all-time low posted early Monday, but most analysts believe the crisis is not yet over.

1. What impact could the drop in the lira have on consumers in Hong Kong and New York?

The Turkish economy is relatively small – only about 1 per cent of global gross domestic product. But thanks to the globalisation of financial markets, decisions in Ankara can affect jobs in the rest of the world.

The growing interconnectedness of the world economy means that the recent sharp decline in the value of the lira poses risks for other fragile emerging market economies, which in turn pose risks for the developed world.

2. What caused the current crisis for the Turkish lira?

The root causes of the current crisis are economic and predate the political conflict between the US and Turkish governments.

In essence, investors have lost faith in the current economic policies of the Turkish government, worried that a continued weakening of the economy will cause Turkish borrowers to struggle to repay their foreign debts.

Real and financial investments in Turkey have been scaled back or abandoned, pushing down the exchange rate and increasing pressure on the economy.

Speculators, sensing an opportunity to make a quick profit, have piled into the market, “shorting” the lira and the Turkish stock market, that is, betting that they will fall further. So far, they have been handsomely rewarded, with the currency down nearly 30 per cent over the last month and the stock market down 4.9 per cent since August 9.

3. How is the lira crisis affecting the Turkish economy?

By pushing down the value of the lira, investors have exacerbated Turkey’s economic problems:

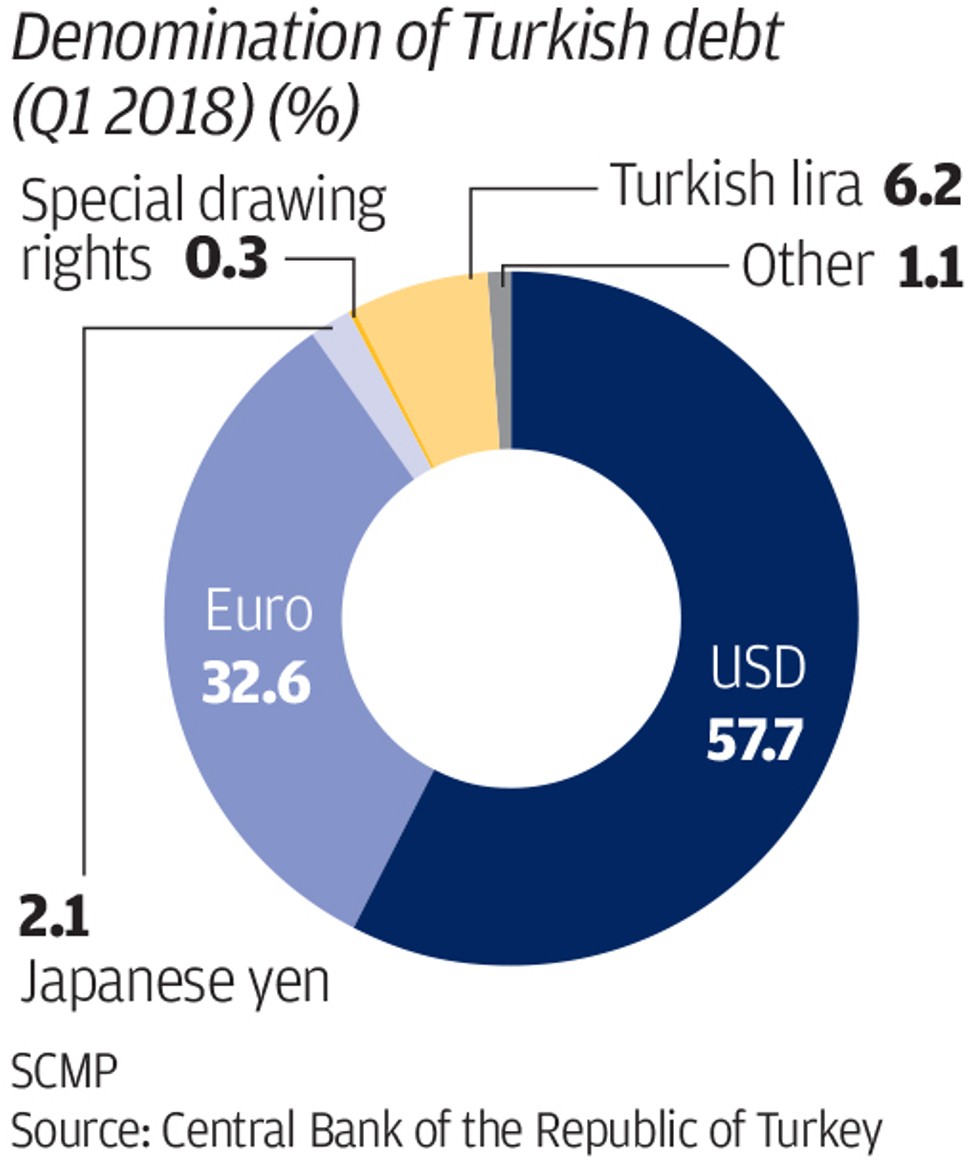

- Debt denominated in foreign currencies becomes more expensive to repay;

- Key imports, like oil, that are denominated in dollars and other foreign currencies become more expensive to buy;

- This boosts domestic inflation and reduces the purchasing power of both Turkish consumers and businesses; and

- Turkish consumer and businesses, increasingly worried about the future, rein in their spending and investment plans.

4. What is the Turkish government doing to solve the problem?

The government of President Recep Tayyip Erdogan has so far refused to employ the traditional remedy of sharply raising interest rates to defend the currency, given the damage this would do to the domestic economy – and his political support. He has also refused to turn to the International Monetary Fund for a financial rescue, instead blaming a foreign “operation” and economic “traitors” for precipitating the currency crisis.

On Monday, the Turkish central bank introduced several measures to help, including cutting the reserves that banks are required to hold at the central bank, thereby freeing up money for lending. It also indicated it would lend money at interest rates above prevailing market rates, an effective tightening of monetary policy.

For the moment, these measures have succeeded in stabilising the lira just above the all-time low it posted early Monday.

However, in the minds of many investors, the Turkish government’s efforts to control the downward spiral have, so far, been inadequate, keeping the crisis alive. Unless and until the government takes more stringent actions, they expect the lira to resume its decline in the near future.

5. How is the lira crisis affecting the world economy?

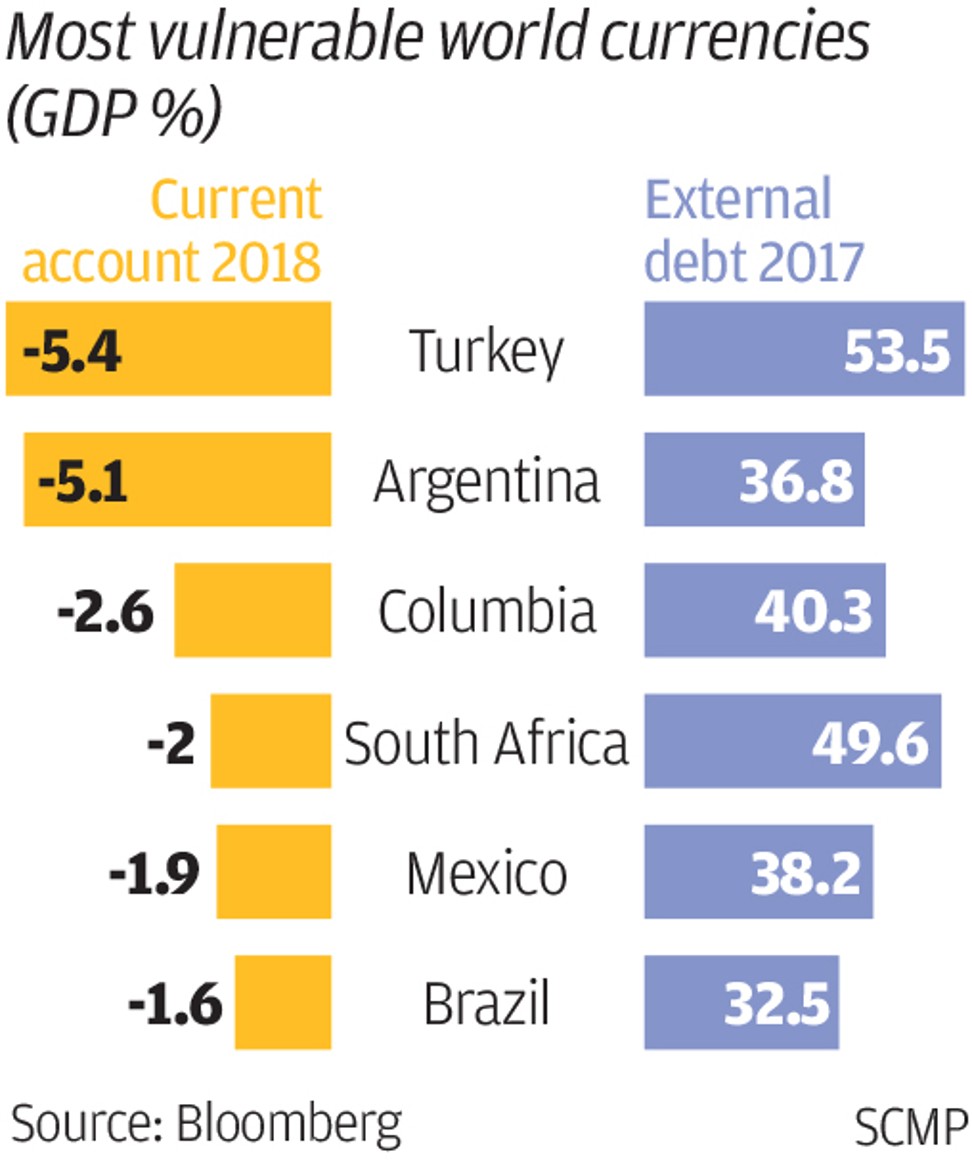

Turkey’s mounting problems have put pressure on the currencies of other developing economies, particularly those that, like Turkey, have weak economies and owe large amounts to foreign debt:

- The South African rand fell 6.1 per cent in the last month;

- The Argentine central bank was forced to raise interest rates on Monday to defend its currency, a move that will only worsen its domestic economic problems;

- The Brazilian real and the Mexican peso have also fallen sharply, with knock-on effects for their stock markets and economies; and

- The Turkish crisis hit the Chinese yuan, already under pressure from the on-going trade war between China and the US.

Developed countries have not been immune to the contagion. Share prices of major European and US banks have fallen, given the risks that their outstanding loans to Turkey won’t be repaid.

The euro exchange rate has weakened due to concern about the broad exposure of European businesses to the deteriorating economy in Turkey. Investors seeking safe havens for their money have pushed up the value of the Japanese yen and the Swiss franc, putting downward pressure on these export-dependent economies.

6. What will happen next?

If the lira’s bleeding is staunched – either as a result of concrete steps introduced by the Turkish government or because investors come to believe that Turkish assets have become cheap enough to be worth buying again – then the economic fallout will ease and the global economy will move forward, albeit in a weakened state.

But if the political conflict between the US and Turkey worsens, or if the Turkish government refuses to take sufficient steps to end of the crisis, then the fallout will increase. The longer the Turkish problems last, the greater the chance that they will create a broader crisis among developing countries, which would have negative consequences for the entire global economy.