The Hongcouver | Canada tax chiefs knew foreign money’s big role in Vancouver housing market 20 years ago, leaked documents show, but they ‘ignored’ auditors’ warning

Team of investigators tried to raise alert about tax cheating after 1996 analysis found rich new immigrants dominated luxury property market, buying 93 per cent of homes in two cities, while declaring extremely low incomes

Leaked documents have revealed that Canada’s tax department was warned 20 years ago about the impact of millionaire migration on greater Vancouver, by a team of auditors who discovered the influx was playing a huge role in the luxury housing market and suspected the buyers were engaged in widespread tax cheating.

But the “alarming” results of the auditors’ investigation were “ignored” by Canada Revenue Agency bosses who failed to commit the resources needed to tackle the issue, and just “wanted the problem to go away”, one of the auditors, now retired, told the South China Morning Post.

Instead, Vancouver went on to become one of the world’s most unaffordable housing markets, with rich mainland Chinese flocking to the city in recent years under the same wealth-migration model that raised the auditors’ concern two decades ago.

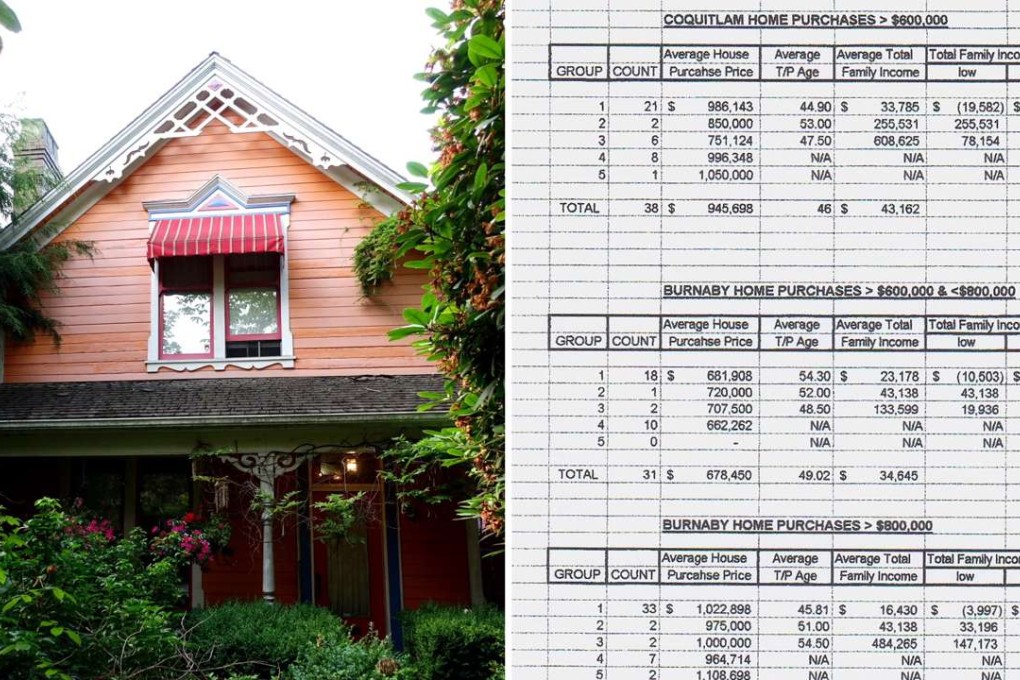

The 1996 investigation, described in interviews, leaked memos and a spreadsheet obtained by the SCMP, compared luxury home sales in two regional cities against buyers’ social insurance numbers and tax records, amid the arrival in Vancouver of thousands of rich immigrants from Hong Kong and Taiwan. It showed that recent immigrants made up more than 90 per cent of top-end, C$600,000-plus purchases in which buyers were identifiable.

The existence of the CRA team’s 1996 analysis has never before been publicly revealed. It was conducted by CRA’s Underground Economy Workload Development Unit in the Burnaby-Fraser tax office, which had been tasked with identifying potential audit targets.