Donald Trump poised to hit China with trade penalties soon, as he toughens ‘America First’ stance in 2018

‘We want China to stop stealing our stuff, live up to its commitment, and don’t distort the international trading system’: White House official

The Trump administration is setting the stage to unveil tough new trade penalties against China early next year, moving closer to an oft-promised crackdown that some US business executives fear will ignite a costly battle.

Several corporate officials and analysts closely tracking trade policy said that President Donald Trump was expected to take concrete actions on a range of disputes involving China within weeks.

Trump is due by the end of January to render his first decision in response to petitions from US companies seeking tariffs or import quotas on Chinese solar panels and washing machines manufactured in China and its neighbours.

Trump could also order new limits on Chinese investment in the United States or raise tariffs unilaterally - a likely violation of US commitments to the World Trade Organisation - pending the outcome of a broader investigation into Beijing’s alleged failure to protect foreign companies’ intellectual property rights, analysts say.

So far, it’s been the Teddy Roosevelt philosophy turned on its head: Speak loudly and carry a small stick

And White House action is due on a separate Commerce Department probe triggered by worries about the national security impact of rising imports of Chinese steel and aluminium.

“Their intent is to bring shock and awe,” said Scott Kennedy, an expert on Chinese trade at the Centre for Strategic and International Studies.

“They’re not kidding around.”

On December 6, Robert Lighthizer, the president’s chief trade negotiator, had a contentious discussion of administration trade policy with members of the US-China Business Council’s board of directors, which includes the chief executives of companies such as Chubb Insurance and General Motors, according to three executives familiar with the session who asked for anonymity to describe a confidential meeting.

During the closed-door Washington briefing for chief executives with business in China, Lighthizer said that US complaints about Chinese trade practices could not be resolved simply by additional talks with Beijing, and he appeared indifferent to concerns that the administration’s hard line risked rupturing a US$600 billion annual trade relationship.

“It did not go well,” said one person familiar with the exchange.

It’s not yet clear how extensive the administration actions will be.

Trump’s repeated campaign vows to retaliate against China for policies that he says contributed to the loss of millions of US jobs have yet to translate into concrete action.

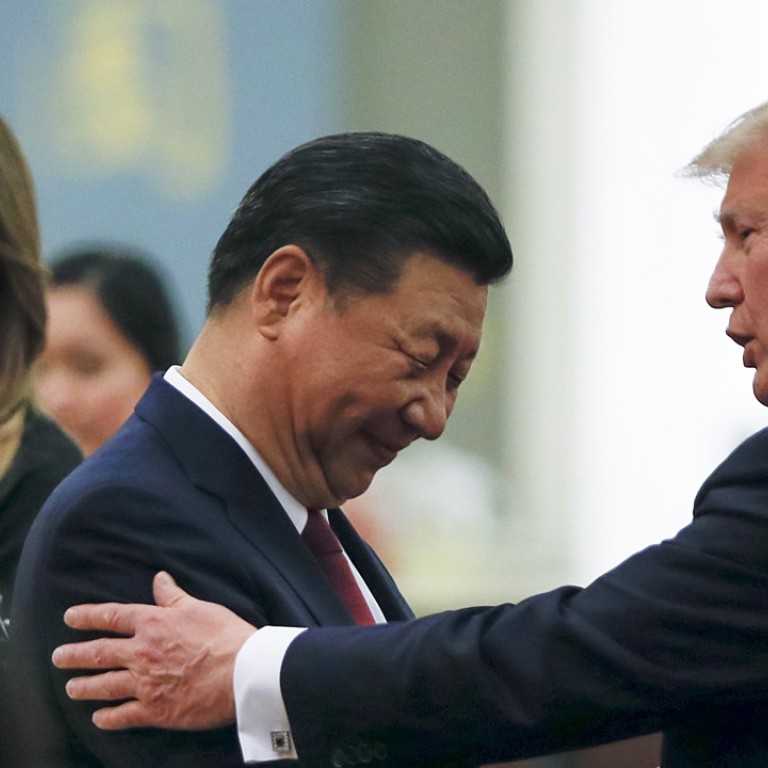

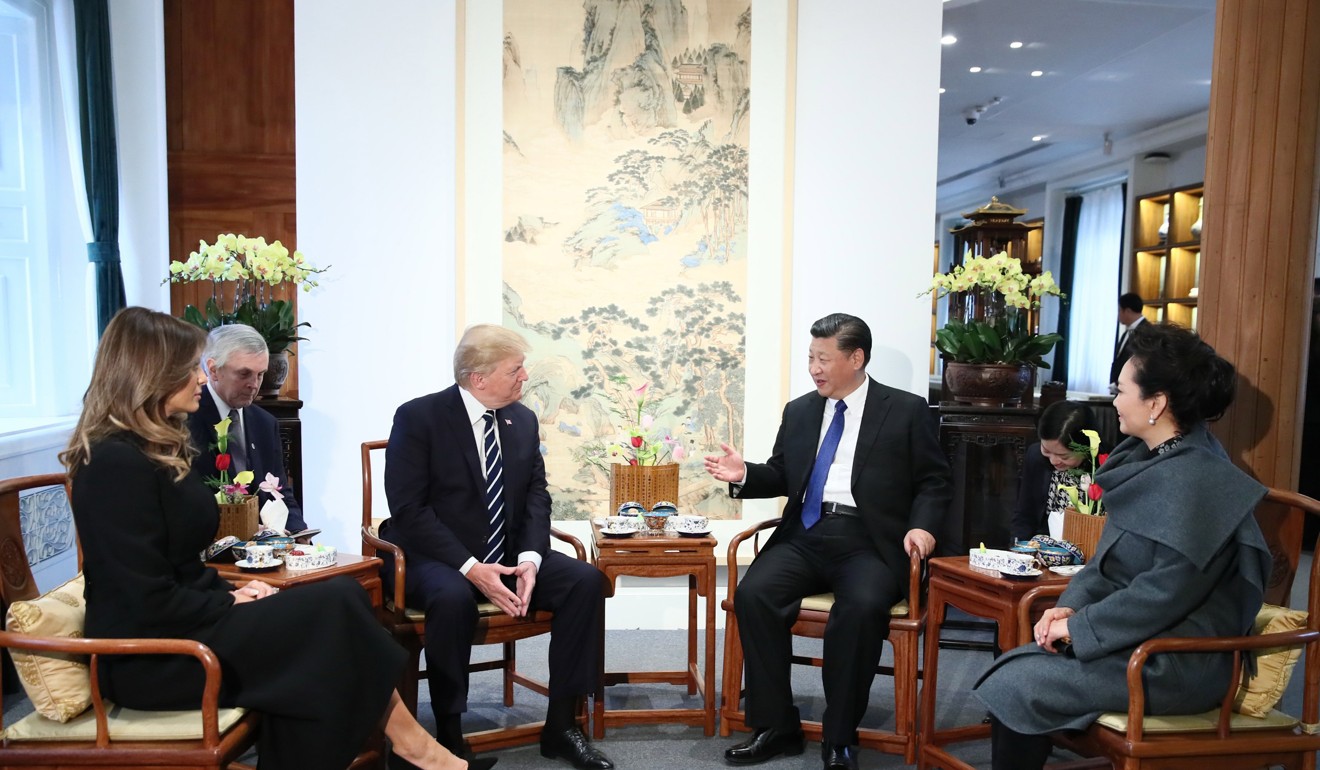

During a visit to Beijing last month, the president blamed his White House predecessors rather than Chinese President Xi Jinping for the yawning bilateral trade deficit.

That gap has only grown since Trump became president, despite his “America First” rhetoric. Through the first 10 months of this year, the United States incurred a US$309 billion trade deficit with China, up from US$289 billion during the same period one year earlier.

“So far, it’s been the Teddy Roosevelt philosophy turned on its head: Speak loudly and carry a small stick,” said Scott Paul, president of the Alliance for American Manufacturing, a non-profit established by the United Steelworkers union and major steelmakers.

Still, in recent weeks, there have been mounting signs of the president’s intention to act. In a new national security strategy, the president earlier this month described China as a strategic competitor and said that when it comes to trade, the United States “will no longer turn a blind eye to violations, cheating or economic aggression”.

The US president also previewed the tougher line in a speech last month in Danang, Vietnam, saying that the US now expects its trade “partners will faithfully follow the rules just like we do”.

Administration officials say that China has not lived up to the bargain struck at the time of its accession to the WTO.

In a US-China Business Council survey, 57 per cent of US companies operating in China say they have yet to see any impact from a sweeping package of economic reforms Xi unveiled four years ago.

The trade decisions facing Trump in the next several weeks encompass a range of US complaints: the dumping in US markets of Chinese products such as solar panels, the theft of intellectual property and trade secrets, and economic damage caused by excess Chinese production in key commodities such as steel.

“There needs to be a fundamental, systemic change and a real commitment to market opening by China,” said one senior administration official.

“We want China to stop stealing our stuff, live up to its commitment, and don’t distort the international trading system.”

China is sure to respond to any significant move by the United States with measures designed for political impact - such as reversing the recent opening of its markets to US beef exports, Kennedy said.

That would hit states such as Montana that backed Trump last year.

US multinationals operating in China also would be likely to suffer. Some companies might receive unexpected visits from government inspectors or encounter difficulties obtaining permits or licenses. Others could be hit with tax audits or antitrust investigations.

Chinese officials could “make American companies wear small shoes,” said Kennedy, alluding to a traditional Chinese saying that means causing pain or difficulty for another party.

For now, US business leaders are bracing for impact. Though uncertain as to exactly what the president will do, they anticipate a difficult year ahead.

“Our sense,” said Jeremie Waterman, vice-president for Greater China at the US Chamber of Commerce, “is that everything is on the table.”