US bill to increase oversight on Chinese investment will be voted on in the Senate

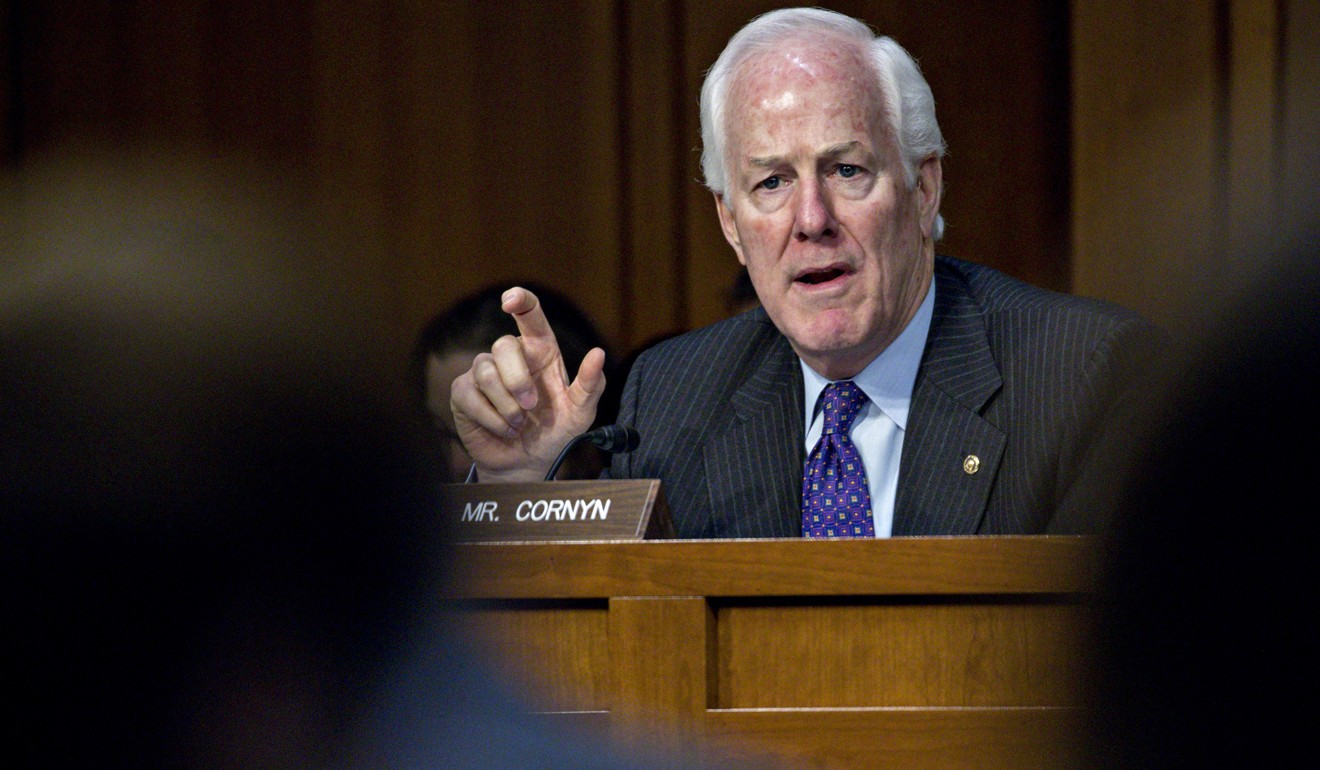

Senator John Cornyn, who introduced the bill, has said that China is using investment to extend its ‘tentacles’ into the US, creating a danger to the country’s security

A bill to tighten oversight of foreign investment in the United States that was inspired by concern over China’s acquisition of critical technology is headed for a vote this month in the US Senate Banking Committee, the panel said on Friday.

The committee also released draft proposals that will be voted on to amend the bill, which was introduced last November by Senator John Cornyn.

For Chinese investors obsessed with Warren Buffett, Nebraska is their Mecca

Proposed changes to the measure appear aimed largely at blunting opposition from high tech companies and investment firms, which had worried that even innocuous transactions would be subject to extended reviews by the Committee on Foreign Investment in the United States, or CFIUS.

CFIUS is an inter-agency panel led by the US Treasury Department that assesses potential foreign investment to ensure it does not harm national security.

The bill in the Senate, and a companion measure in the US House of Representatives, would broaden CFIUS’ reach in hopes of reining in China’s acquisition of US high tech knowledge even as China has sought to focus on production of higher-value goods, like robots, computers and telecommunications equipment.

The bipartisan legislation has the support of US President Donald Trump’s administration.

Chinese ambassador to US says a fairer trade balance will help China too

The new version eliminates a measure which some tech companies complained would force them to go to CFIUS to get approval for technology sales if they involved intellectual property licensing and support.

The draft also spells out that an investment can be deemed passive, and not subject to CFIUS oversight, if foreign investors have no access to non-public technical information or rights to be on the board of directors of a US critical infrastructure company.

The proposed changes include noting specifically that CFIUS could consider in its national security review if a deal would potentially expose sensitive data about US citizens, including genetic information.

Cornyn supports the proposed changes.

US and Taiwan hold first defence industry forum

“As China has increasingly weaponised investment, it’s a national security imperative to strengthen the inter-agency review process to safeguard military and dual-use technology and know-how,” he said in a statement that accompanied the release of the proposed changes.

The panel has killed a long list of deals, including a plan for Chinese conglomerate HNA Group to buy most of SkyBridge Capital, a hedge fund investment firm founded by Trump’s former aide, Anthony Scaramucci.