Donald Trump lashes out at Harley-Davidson as EU trade war causes it to move manufacturing out of US

Harley-Davidson’s shares have dropped after it announced that the EU counter-tariffs, made after Donald Trump’s own taxes on European products, will cost the company up to US$100 million a year

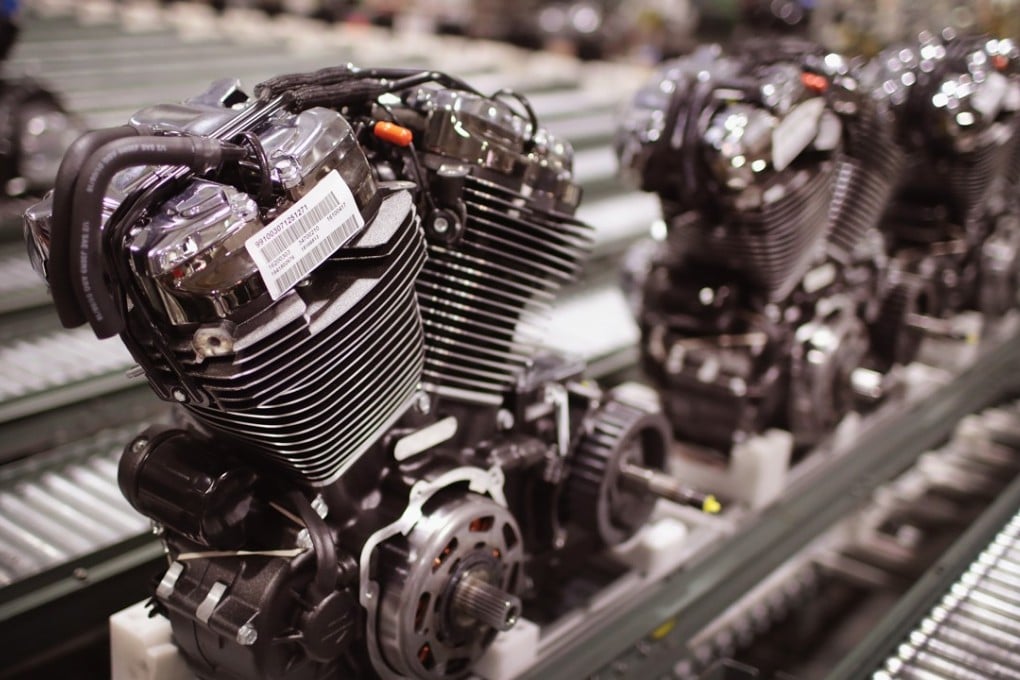

The trade wars started by US President Donald Trump have caused headaches for Harley-Davidson, which is moving production of its EU-bound motorcycles out of the US to avoid European counter-tariffs that it says will cost the company US$90 million to US$100 million a year.

The shift in production is an unintended consequence of Trump’s administration imposing tariffs on European steel and aluminium early this month, a move designed to protect US jobs.

It was met with anger by Trump himself, who lashed out at the company on Twitter, writing: “Surprised that Harley-Davidson, of all companies, would be the first to wave the White Flag. I fought hard for them and ultimately they will not pay tariffs selling into the E.U., which has hurt us badly on trade, down $151 Billion. Taxes just a Harley excuse - be patient! #MAGA”

In response to the US tariffs, the European Union began charging import duties of 25 per cent on a range of American products, including big motorcycles like Harley-Davidson’s, on June 22. Harley-Davidson shares sank more than 5 per cent in morning trading on Monday, its worst day in months.

In a regulatory filing, the Milwaukee, Wisconsin-based company said the retaliatory duties would result in an incremental cost of about US$2,200 per average motorcycle exported from the United States to the European Union, but did not provide more details on current motorcycle costs.

The company said it would not raise retail or wholesale prices for its dealers, and expects the tariffs to result in incremental costs of US$30 million to US$45 million for the rest of 2018.

“Harley-Davidson believes the tremendous cost increase, if passed onto its dealers and retail customers, would have an immediate and lasting detrimental impact to its business in the region,” the company said.

Trump vowed to make the iconic motorcycle maker great again when he took office last year. But since then the company has been counting the costs of his trade policy.