Failure to name China as focus of strengthened CFIUS investment panel ‘could lead to abuse and loss of money’

Failure to name China in legislation is faulted for its possible effect on acquisitions by companies from other nations

The US government was warned on Tuesday that its reticence to name China in foreign investment legislation could lead to “abuse” and a drop in money coming in from other countries.

Last week Congress moved to strengthen and expand the powers of the inter-agency Committee on Foreign Investment in the United States (CFIUS), a decades-old entity that reviews foreign corporations and their American investments for national security considerations, following concerns from lawmakers about the intentions of Chinese technology companies and the potential threat they posed.

But on Tuesday, numerous industry representatives and foreign-policy experts said that the vagueness of the legislation’s wording – and the failure to mention China as the target of increased scrutiny – could chill investment overall in the US, and not just from China.

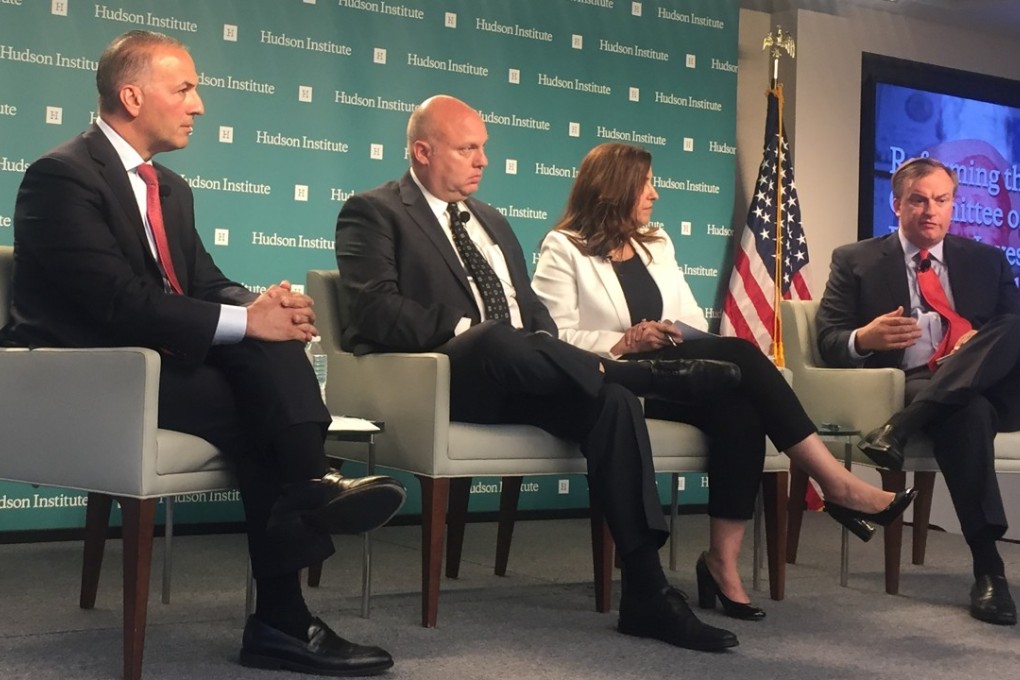

Speaking at a Hudson Institute forum, Mario Mancuso, the former undersecretary of commerce in the George W. Bush administration, said that not mentioning China in the CFIUS legislation might also disadvantage non-Chinese international investors bidding for businesses in the US.

“A seller of a US business – by virtue of the fact that you are foreign – may just decide not to sell to you because they don’t want to deal with the regulatory overhang,” said Mancuso, who now leads the international trade and national security practice at Kirkland & Ellis.

Changes to CFIUS, as laid out in the Foreign Investment Risk Review Modernisation Act, expands the reach of the committee’s scrutiny from merely direct foreign investment for controlling interest in a US company to include joint ventures and foreign investments that result in any level of control.