US, Canada and EU to offer ‘robust alternative’ to state-led development finance, as belt and road increases reach

- The new Overseas Private Investment Corporation alliance is its second, following one last year with Japan and Australia

- OPIC head David Bohigian says, ‘We’re trying to hold up an example ... of the way that development finance should work’

A development financing arm of the United States government entered into a trilateral agreement with Canada and the European Union on Thursday, part of a US-led bid to offer emerging economies a development alternative to state-led models such as China’s “Belt and Road Initiative”.

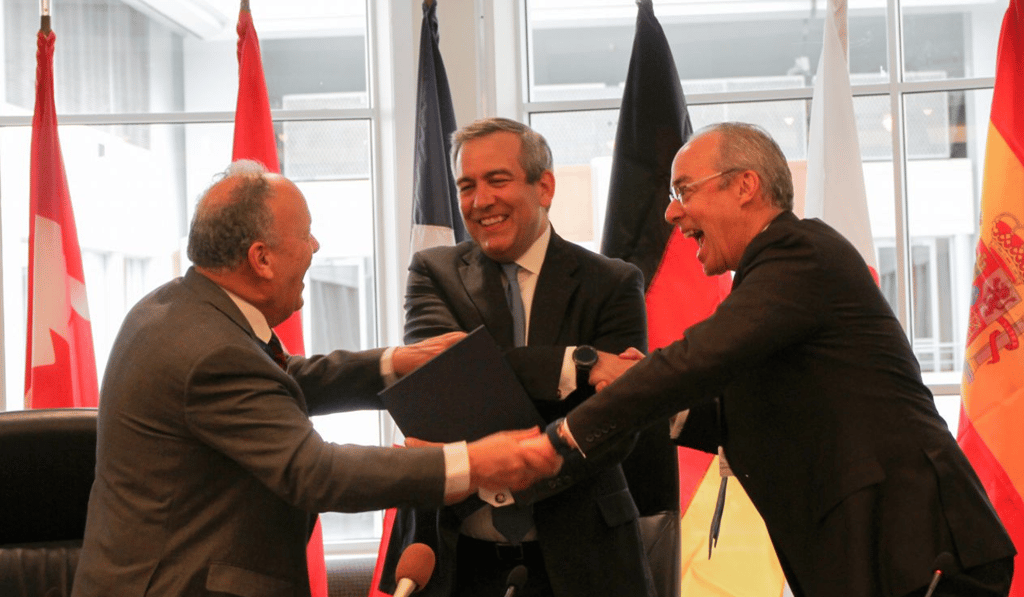

Representatives of the Overseas Private Investment Corporation (OPIC), a US federal agency that connects private American lenders with governments and developers in developing countries, and its Canadian and EU counterparts announced the new alliance in the form of a memorandum of understanding, signed into effect at a ceremony at OPIC’s Washington headquarters.

The pact was signed by OPIC’s acting president and chief executive David Bohigian, Nanno Kleiterp of the 15-member European Development Finance Institutions (EDFI) and Paul Lamontagne of FinDev Canada.

It will enhance cooperation “to advance shared development objectives and underscore the participants’ commitment to providing a robust alternative to unsustainable state-led models”, a statement from OPIC said.

The agreement is the second of its kind brokered by OPIC, which entered into a similar partnership with Japan and Australia late last year as part of a whole-of-government push to protect the economic and sovereign rights of countries in the Indo-Pacific region. Since that agreement, OPIC has posted an official in Tokyo to facilitate coordination on projects in the region.