Congress nearing short-term fix for US debt crisis

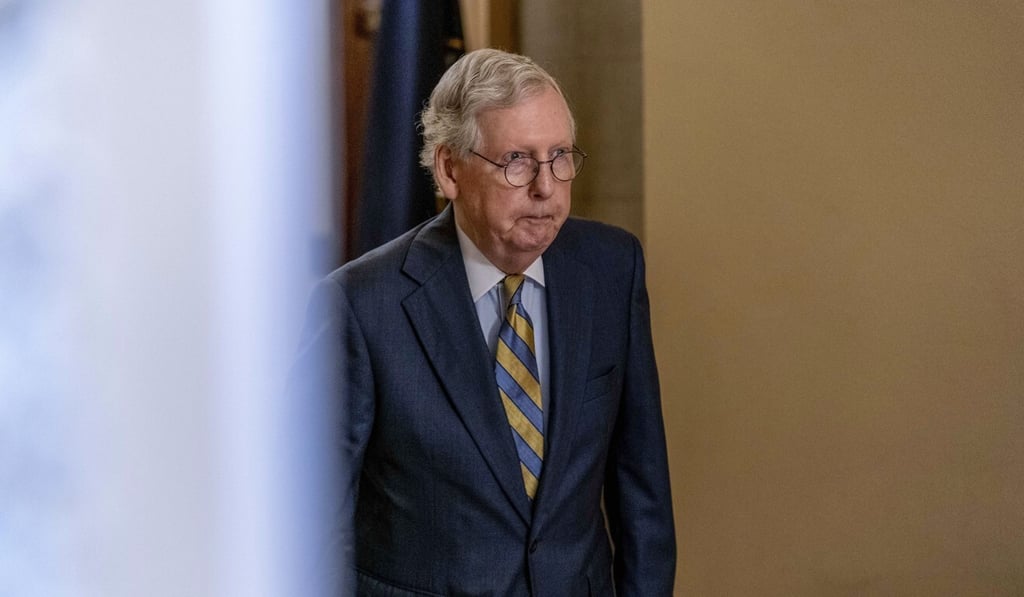

- Democrats signal they are receptive to offer from Senate Republican leader Mitch McConnell for an emergency extension into December

- Such an agreement would head off an unprecedented default on government payments, but sets the stage for a sequel to the debt drama in two months

Republican and Democratic leaders edged back Wednesday from a perilous stand-off over lifting the nation’s borrowing cap, with Democratic senators signalling they were receptive to an offer from Senate Republican leader Mitch McConnell that would allow an emergency extension into December.

The emerging agreement sets the stage for a sequel of sorts in December, when Congress will again face pressing deadlines to fund the government and raise the debt limit before heading home for the holidays.

A procedural vote – on the longer extension the Republicans were going to block – was abruptly delayed late Wednesday and the Senate recessed so lawmakers could discuss next steps. Democrats emerged from their meeting more optimistic that a crisis would be averted.

“Basically, I’m glad that Mitch McConnell finally saw the light,” said Senator Bernie Sanders, the independent senator from Vermont. The Republicans “have finally done the right thing and at least we now have another couple months in order to get a permanent solution”.