Biden team weighs fully cutting off Huawei from US suppliers

- Sales from US firms to the Chinese tech giant have been limited for years, but some officials are pushing for a complete ban, insiders say

- Biden is under pressure from Republicans controlling the House to continue squeezing China, particularly to limit the country’s technological advances

The Biden administration is considering cutting off Huawei Technologies Co from all of its American suppliers, including Intel Corp and Qualcomm, as the US government intensifies a crackdown on the Chinese technology sector.

Sales from US firms to Huawei have been limited for four years, since former president Donald Trump added the Shenzhen-based company to the US trade blacklist, called the Entity List, out of national security concerns. US suppliers have since required government approval to sell to the telecommunications equipment giant.

Now, some officials in the Biden administration are advocating for banning all sales to Huawei – long suspected of ties to the Beijing government and Chinese military – as the administration debates whether and how to adjust its licensing policy, according to people familiar with the matter.

The people asked not to be identified because a decision has not been made.

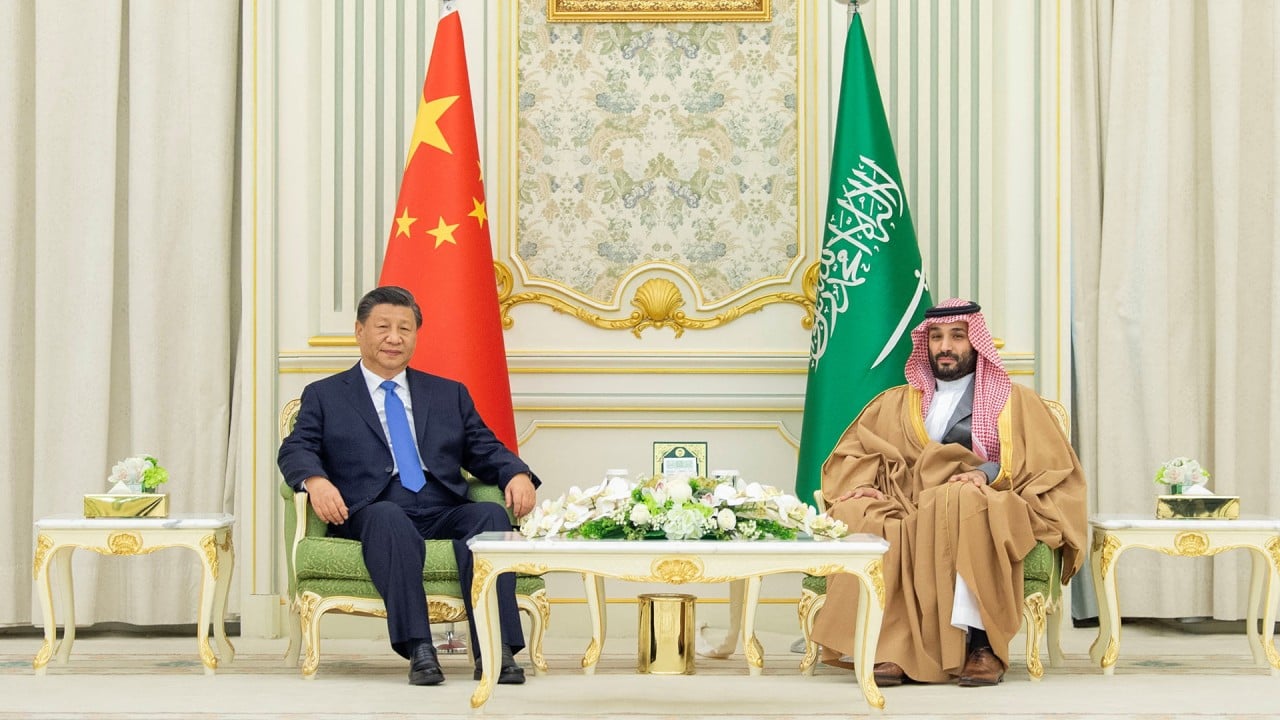

Tensions with China have been rising throughout Joe Biden’s presidency, and he is under pressure from Republicans controlling the House to continue squeezing Beijing, particularly to limit the country’s technological advances.

Last week, the Biden administration persuaded the Netherlands and Japan to join with the US in restricting exports of advanced semiconductor manufacturing machinery to China.

Huawei was once one of the world’s largest buyers of electronic components and a hugely important part of the supply chain because of its position in the smartphone and telecoms networking equipment industries. Trump’s ban on certain sales wiped out huge amounts of revenue for companies including Broadcom.

But the Commerce Department continued to allow some other products to be supplied to Huawei. Under the new policy some officials advocate, all licence requests to supply the company would be denied.

Huawei has staunched the bleeding but can it regain overseas traction with digital drive?

Intel and Advanced Micro Devices (AMD) provide Huawei with processors it uses in its Mate range of laptops, while Qualcomm sells the Chinese firm processors and modems for its diminished range of smartphones.

Representatives of the National Security Council and the Commerce Department did not immediately respond to requests for comment. Representatives for Intel, Qualcomm and AMD declined to comment.

It is not clear how soon the Biden administration will act on a policy change, the people familiar with the matter said.

They cautioned that discussions are at an early stage, and some of them said timing for a decision could coincide with the four-year anniversary of Huawei’s addition to the US Entity List in May.

Shutting off sales to Huawei would not be as devastating for US companies as it once was.

The Chinese company has already spun off its budget smartphone business Honor, while offering only lower-bandwidth 4G smartphones under its own name. Its brand has also been damaged by the US campaign against it.

Underlining the decline in its importance, Huawei represents less than one per cent of revenue for Qualcomm, Intel and AMD, according to Bloomberg supply chain analysis.