S&P 500, Nasdaq hit record highs on renewed AI bets, rate-cut hopes

A US-brokered ceasefire between Israel and Iran that sparked higher crude prices also boosted market confidence

The S&P 500 and Nasdaq Composite hit all-time highs on Friday as megacap stocks surged on renewed AI enthusiasm and the prospect of a looser monetary policy, powering a recovery in US stocks from a months-long rout.

The benchmark index rose 0.2 per cent to 6,154.81 points, surpassing the previous peak of 6,147.43 on February 19, while the tech-heavy Nasdaq gained 0.3 per cent to 20,229.31 points, exceeding its record high of 20,204.58 on December 16.

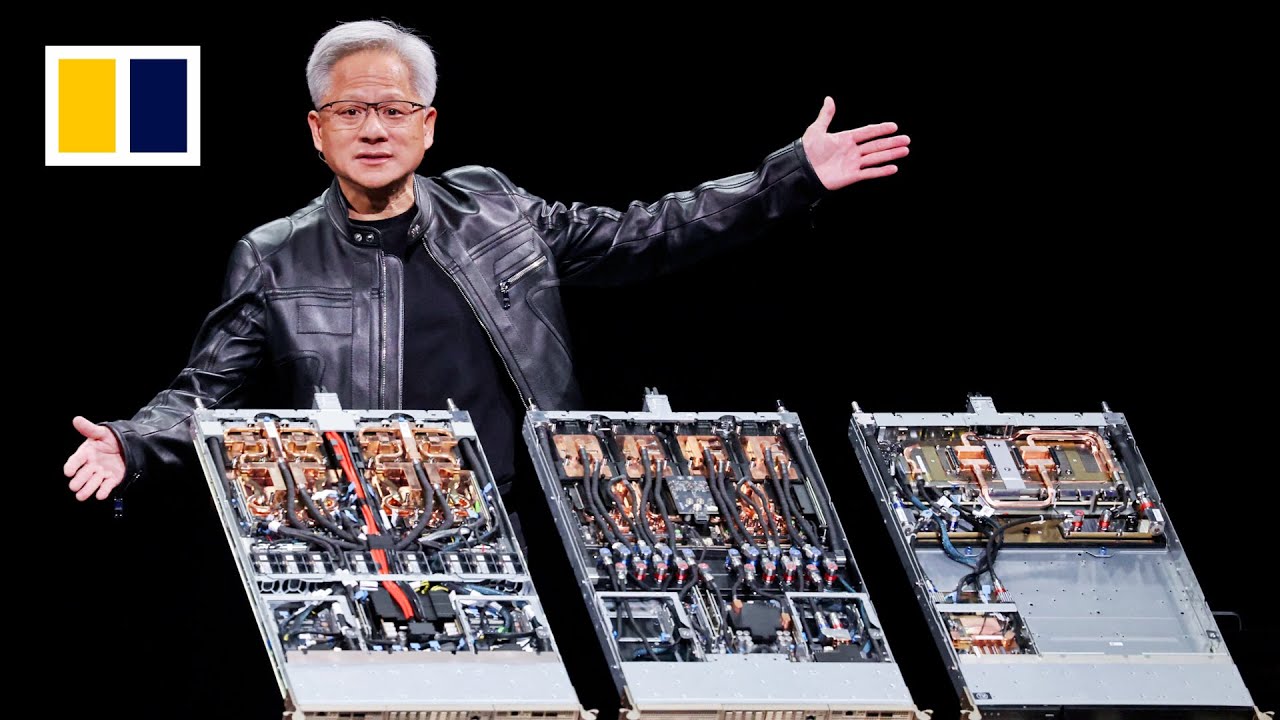

Markets rallied this week as an upbeat forecast from chipmaker Micron brought back investor confidence around artificial intelligence, while AI bellwether Nvidia hit a record high to reclaim its position as the world’s most valuable company.

Risk appetite also benefited from a US-brokered ceasefire to a 12-day air battle between Israel and Iran that sparked a jump in crude prices and raised worries of higher inflation.

Dovish remarks from Federal Reserve policymakers have also aided sentiment.

Trump’s April 2 “reciprocal tariffs” on major trading partners and their chaotic roll-out had put the S&P 500 within striking distance of confirming a bear market when it ended down 19 per cent from its February 19 record closing high.

The Nasdaq had tumbled 26.7 per cent from its previous peak, marking a bear market days after Trump’s “Liberation Day” on April 2.