Opinion | Hong Kong must stop loan sharks from preying on the vulnerable

Consultation must result in reforms that better protect the public and ensure city’s notorious loan sharks are not able to prosper

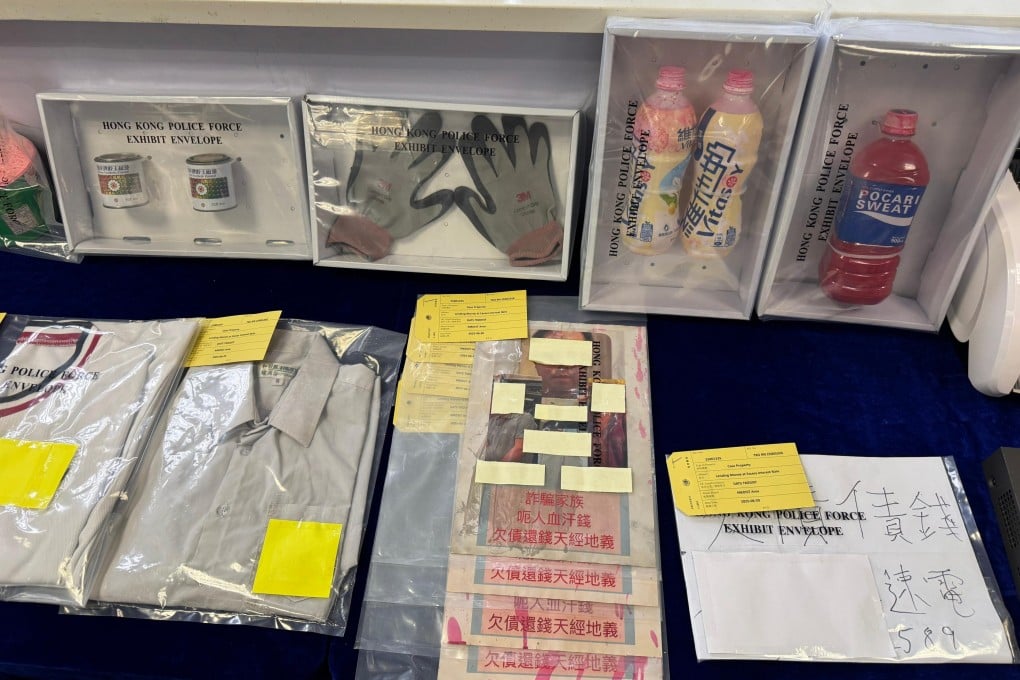

The misery inflicted on desperate debtors by Hong Kong’s predatory loan sharks is well known and has persisted despite laws intended to combat the problem. Victims face crippling rates of interest, exceeding the legal limit, and are often sucked into a spiral of debt. Those who fall behind with payments are often intimidated and their family members and employers harassed.

Money lenders are already required to obtain a licence. The permitted interest rate is capped at 48 per cent. It was cut from an eye-watering 60 per cent in 2022, but remains high. Lenders often charge debtors extortionate handling fees, sometimes a third of the sum borrowed, which effectively raises the interest rate way beyond the legal level. This needs to be tackled.

The government’s proposals are a step forward. A balance must be struck between ensuring sufficient access to credit and preventing abuse. But there is room for more to be done. Lawmakers have called for tougher measures. Their suggestions and others raised during the consultation must be carefully considered.