HSBC Innovation Banking steps up support for innovation businesses

- HSBC has been supporting its clients’ international growth for more than 150 years

- Portfolio company coverage team and a global fund banking team established under the specialised proposition

[Sponsored article]

Hong Kong’s position as a thriving innovation hub continues to gain momentum, attracting significant numbers of start-ups and investors. With a growing financial ecosystem and an increased focus on the innovation economy, new initiatives are emerging to support businesses and drive economic growth.

HSBC has been supporting the local innovation economy in Hong Kong for decades. As part of that drive, it recently introduced HSBC Innovation Banking, a globally connected, specialised banking proposition that aims to support innovation businesses and their investors.

High-growth start-ups often need assistance to seize opportunities and navigate the challenges of expanding globally. Together with its innovation hubs in the United Kingdom, the United States and Israel, the new proposition enables HSBC to step up its support for businesses with venture capital or private equity investor backing – helping them and their investors achieve their international growth ambitions.

As part of the launch, the bank, which has been supporting its clients’ international growth for more than 150 years, has established two dedicated teams of specialist bankers: a portfolio company coverage team, and a global fund banking team. The teams serve the distinctive needs of venture capital and private equity firms, as well as venture-backed businesses in cutting-edge sectors such as tech and life science across Hong Kong and mainland China. Backed by its financial strength and global network of hubs in the US, the UK and Israel, HSBC Innovation Banking will offer customers customised financing solutions, banking services and business strategy support.

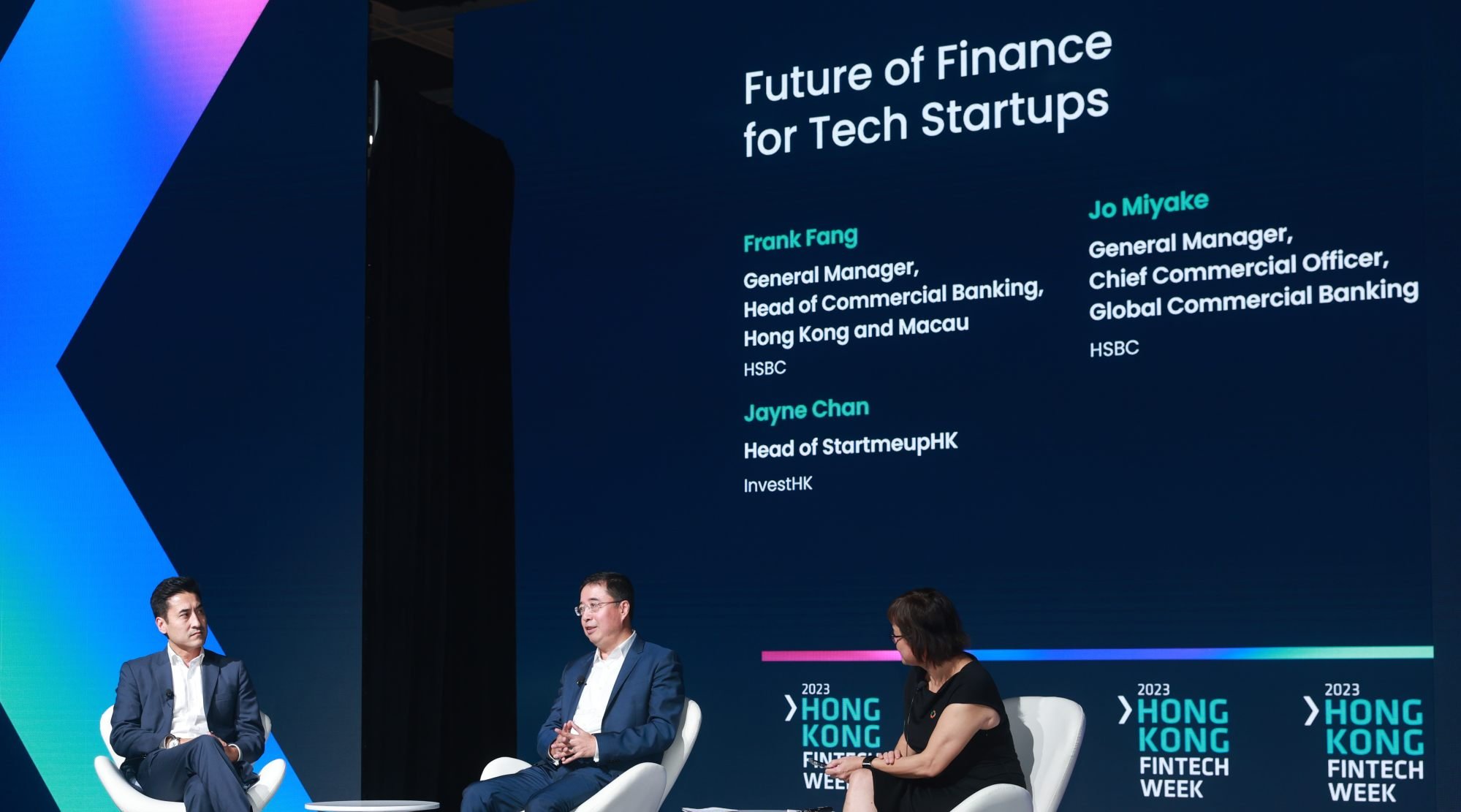

“For generations, HSBC has been proud to support entrepreneurs who have played a pivotal role in shaping our present and future,” says Frank Fang, general manager and head of commercial banking, Hong Kong and Macau, HSBC. “We are excited to bring our sector expertise and extensive global network to Hong Kong’s vibrant innovation landscape. With the launch of HSBC Innovation Banking in Hong Kong, we reaffirm our commitment to supporting customers across the innovation economy with a holistic ecosystem approach.”

The start-up ecosystem in Hong Kong has experienced significant growth. According to InvestHK’s 2022 Startup Survey, the number of start-ups in Hong Kong is now close to 4,000 (up 52 per cent from 2018), employing 14,932 staff across 132 co-workspaces, incubators and accelerators. These figures reflect Hong Kong’s ability to attract global talent, which contributes to its status as an international innovation hub.

Further support for the new economy comes in the form of HSBC’s recently introduced debt financing scheme, which is tailor-made for start-ups. It provides an aggregate debt funding of US$3 billion as the bank widens its support for innovation businesses and investors in Hong Kong and mainland China.

The HSBC New Economy Fund will support start-ups and tech-led businesses in the climate tech, industrial and consumer sectors, while retaining its existing focus on technology, healthcare and life sciences.

“Structural shifts driven by imperatives such as the transition to net zero, the fourth industrial revolution and Web3 are redefining businesses, regardless of their industry and size,” Fang says. “New-economy companies are set to play a more pivotal role in stimulating economic growth. With ever-growing links with mainland China, Hong Kong will continue to be the preferred gateway, bridging global capital to China’s growth story.”

Funding support to drive innovation

With Hong Kong gaining momentum in becoming a leading innovation hub, it has the potential to lead the Greater Bay Area (GBA) in the ideation stage of innovation. The city’s strategic location places it in a favourable position to become a financing centre for innovative industries across the Asia-Pacific region.

Under the HSBC New Economy Fund, the bank is introducing venture debt as part of its financing solutions. This capability will provide early-stage businesses with bespoke debt financing options, including equity warrant instruments within the lending structures.

In July, HSBC arranged the inaugural venture debt facility of OneDegree Group, which features equity warrants and a borrowing base concept, as part of the group’s Series B fundraising round to accelerate its global business expansion.

From Series A stage and beyond, the bank will continue to offer working capital, capital expenditure facilities, treasury management and corporate finance solutions to innovation companies as their growth life cycles expand.

“This is yet another demonstration of HSBC’s support for the innovation economy in Hong Kong and beyond,” Fang says.

The new funding initiative has arisen from HSBC’s debt financing schemes for entrepreneurs and innovation companies, which have provided US$1.8 billion in funding to technology and healthcare ventures in the GBA since they were introduced in 2019. These two financing schemes have now merged to form the HSBC New Economy Fund.

Shaping the innovation ecosystem

In addition to its banking services, HSBC offers beyond-banking solutions through its digital platform, HSBC Business Go. This platform provides innovative tools and resources to support start-ups. It enables them to access a wide range of services beyond traditional banking, including digital banking services, business analytics and various other resources tailored to their needs.

The bank is also collaborating with key players in the ecosystem, aiming to create a supportive environment for start-ups and facilitate their growth.

Notable recent partnerships include the sponsorship of the Jumpstarter 2023 Global Pitch Competition organised by the Alibaba Entrepreneur Fund, and support for the inaugural Hong Kong Innopreneur Awards in conjunction with the Federation of Hong Kong Industries.

Disclaimers from HSBC:

HSBC Innovation Banking refers to HSBC’s worldwide innovation banking business and is not indicative of any legal entity or relationship.

Reminder: “To borrow or not to borrow? Borrow only if you can repay!”